(written down by Black Swan)

The real Aussie way

Big Picture

What a week. I don’t know where to start.

The great thing about this Blog is that many readers are now sharing some great articles on various topics. Keep it up.

So there has been much reading to do. It is uncommon though to have such a diverse spread of thoughts. For example, many articles justify why the equities market (here and abroad) can keep running higher for months. There are as many, if not more, that proffer the argument that economic Armageddon is knocking on our door.

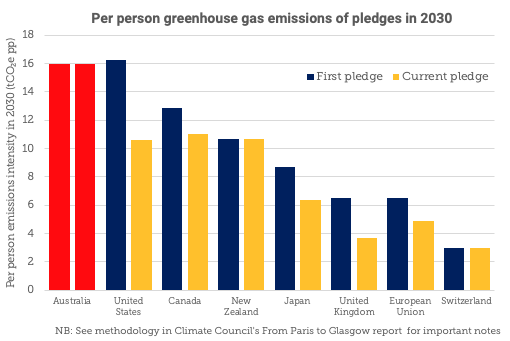

Then there is the carbon and energy story which has dominated our media for the last fortnight.

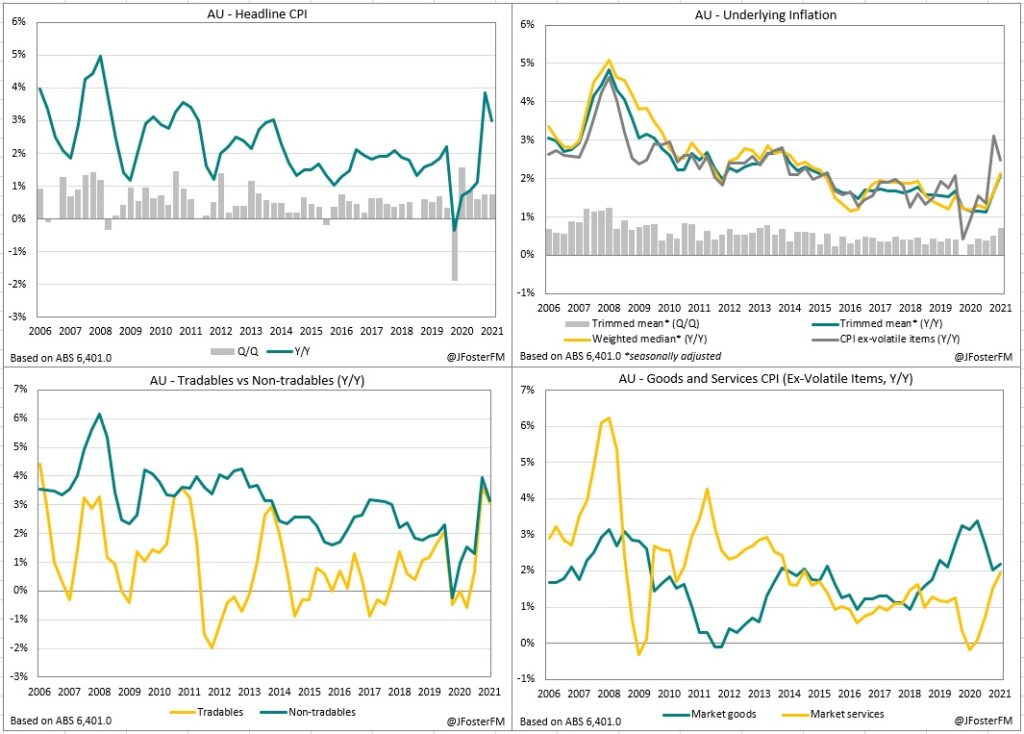

But the big picture, of course, is the fixed interest bond rout of the week. It all started when Australian CPI data came out last week. It was actually very close to general market consensus so there was little reason to panic.

RBA’s preferred measure of inflation is now running at an annual rate of 2.1%. Given RBA try to keep inflation between a 2% and 3% band, and have been criticised for some years for not getting inflation high enough, you would think this is a great result.

Tradeable inflation (energy, metals, livestock, and agriculture) spiked higher (petrol and gas?) and the housing component spiked higher too – see Housing commentary below.

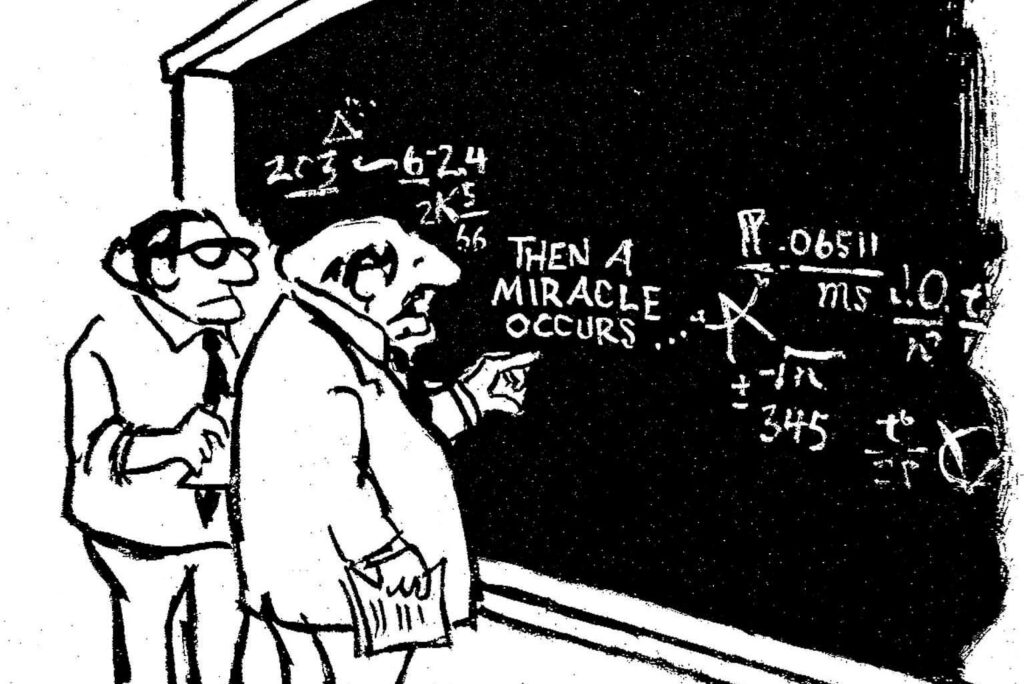

As we know, RBA committed very early on the Covid journey to keep 3-year government bonds down to circa 0.10%; the same level as the official cash rate. After the inflation data, it would appear that a cohort of bond traders worked to test the RBA resolve on that commitment – not for the first time. Previously, RBA had worked to get the 3-year yield back down. But late last week, it looked like RBA put the white flag up. RBA had a Baldrick Plan

So, 3-year bonds went from circa 20 bps to 106 bps very quickly.

Jonathan Pain (above) highlighted the “pain”.

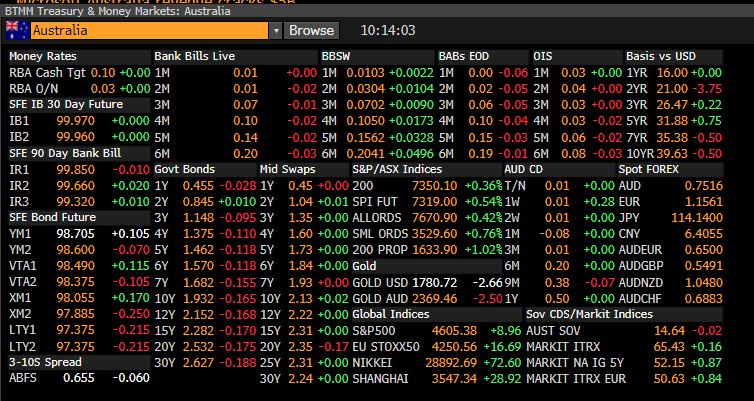

A mate in funds management was pulling his hair out. He shared the following snippet:

So why does a sudden lift in Australian Government Bonds affect you and I?

Government bonds are the bedrock (known as risk free) of fixed funding, and, to some degree, can reverse engineer cash rates.

Banks hold government bonds as security but trade between each other at what are known as swap rates. Swap rates are derived from bond rates, plus a margin for additional risk (banks versus government).

Banks will charge fixed home borrowers and fixed business loans at a higher rate once that level rises. Banks also may raise some of their capital funding at a fixed swap rate which rolls into their bucket of “cost of funds” that all borrowers (fixed or floating) pay. So, ultimately all of us with a loan will potentially see higher interest rates ahead.

RBA have stuck steadfastly to their mantra of ‘no cash rate hikes till 2024’. If you have sold your three year investment at 1.06% to sit on your cash, it makes no sense to then earn a meagre 0.10% in a floating deposit rate. These punters are backing the horse that says RBA cash rate will AVERAGE over 1% from now until 2024. To do that, they are saying RBA will most likely start the tightening cycle as early as next year.

At the RBA November meeting, they confirmed they will allow the 3-year bond to go where the market takes it.

When cash rates will move higher, they do not see any 2022 change. They previously highlighted they wanted inflation to be sustainably in the 2-3% band and unemployment lower. They did deviate a little with a somewhat new addition of wage growth. A bit like vaccination rates, it seems to be a moving target. They acknowledged that other countries were moving already… but we are different.

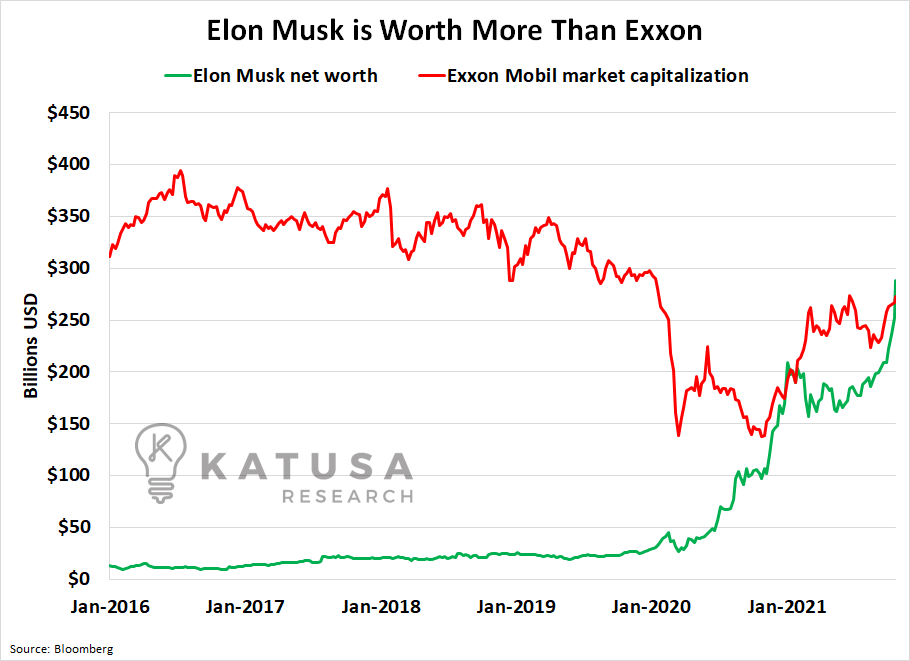

Tesla shares are having a good run. Charts show their share price remains horribly out of whack with their revenue growth, but that does not seem to matter.

Elon, himself, is now worth more than Exxon.

Banks

Westpac shares got hammered this week. Profit results released.

Massive share buy backs usually see prices up, and their cash profit was not too bad. They failed on the expense line though, and analysts think that whilst they may have kept a tight handle on their customers purse strings, they can not keep their own spending in check (cheque?). Issues then compounded with an interpretation that they have tried to buy market share back at a cost to their bottom line via NIM (net interest margin).

Shares off some 8% on the week. At $23, they might actually start to look valuable given most brokers have them at $26+ over the next 12 months.

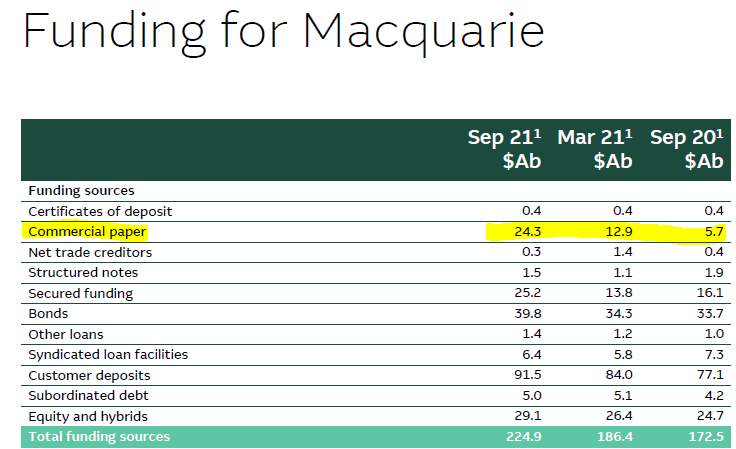

Macquarie Bank on the other hand had a cracker profit result report card. They do benefit massively from offshore economic activity and merger and acquisition mandates – both going well. Shares up and up. If you remember way back to the 2007/08 financial crisis, one thing that really kicked banks in the arse was funding short and lending long. In other words, raising money for the here and now, and getting it out the door for repayment dates unclear.

The table below shows they have increased their funding via commercial paper (maximum tenor 180 days by definition) by 5 fold over the last year from $5.7 billion to $24.3 billion. Should that mystical Black Swan event happen in the near future, this could be a big liquidity trap. Maq Bank lose their funding but get those funds back from borrowers quickly.

The Aussie Dollar and Commodities:

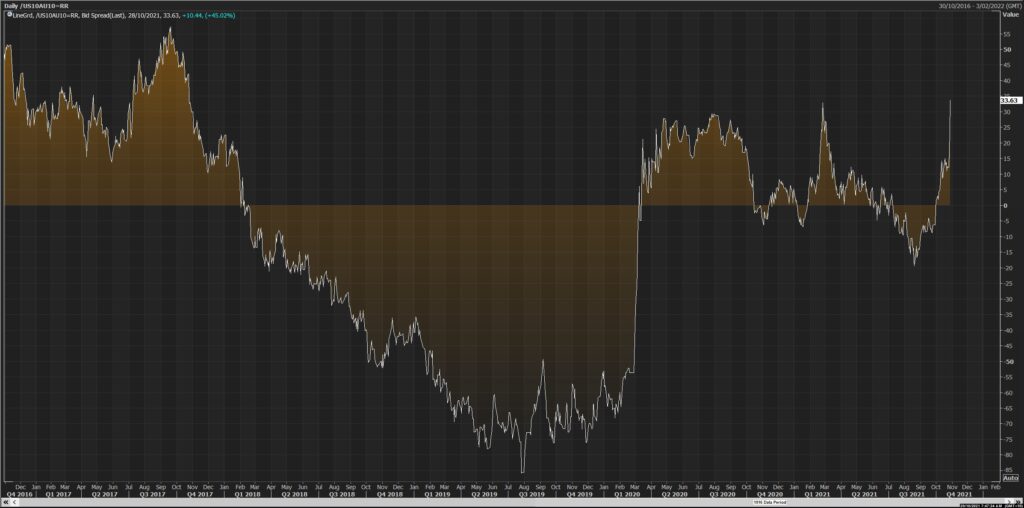

Not the clearest of charts below, but it measures when Aussie 10-year yields are higher or lower than the US equivalent. As an ‘importer of money’, it was usual that we paid a premium over the US equivalent to entice investors to give us cash. It went an inverse in 2018/19 for a few weird reasons, but is back to normal and rising.

So what? The situation is important for the AUD. Interest rates strongly influence a currency: higher rates = higher currency.

I make this point to explain why my comments last week were so wrong – for now at least. The AUD has pushed higher into 75 cents.

Like a broken clock… we will be right eventually.

US rates, in my opinion, will still rise earlier and potentially further than ours. As this approaches, you would expect the AUD to reverse recent movements. One large caveat to all that is that the RBA and the FOMC behave like normal central banks and will not overtly overheat their economies to appease housing and share market’s lust for even everlasting all time highs.

Data this week (Monday):

Politics

Another target-rich week.

Rome and Glasgow were ‘the’ thing.

Fair to say even my most ardent Coalition supporters agree it has not been our finest hour/week.

So many memes…

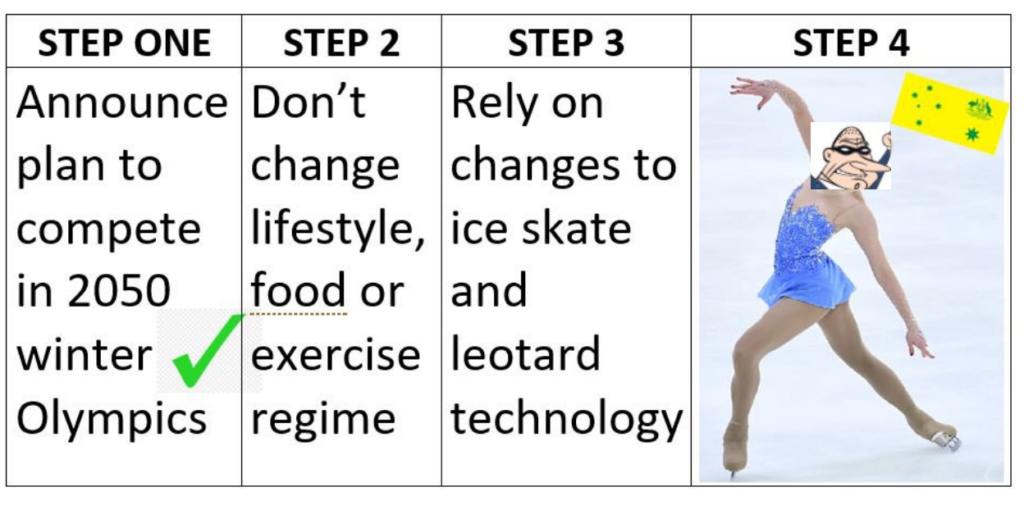

Perhaps “The Australian Plan” can best be described similar in style/approach and most probably outcome as my plan…

But ScoMo had his best people on it…

And it went down an absolute treat – an iron ore balloon.

No usually I would get all patriotic when the uppity French call our main man a liar.

Except of course most of us (including other world leaders given crickets from them) think that Macron is right on the money.

The vague text ‘leaked’ from the PMO’s Office proved nothing and only further highlighted what a dick our man is.

We have joined a new coalition of India/Russia/China/Australia that voted against recognising coal mining must (eventually) stop. As Mama Swan would often say to me on the pond – you are judged by the company you keep.

Matias Corman was walking the floor espousing the virtues of a price on carbon when, as a senior member of the Liberals, he actively joined in the destruction of a perfectly working system for such here. How do these people sleep at night?

Twiggy Forrest presented his Green Hydrogen solution like a martyr riding in on his white horse. No self interest at all I’m sure, and I’m no scientist. But there are articles out in the WebSphere (or is that Meta now) that state that it solves the CO2 issue but only via emissions of the worse methane. I’ll keep my tinfoil hat off, but note the US Hydrogen Council includes BP, Total and Shell as members.

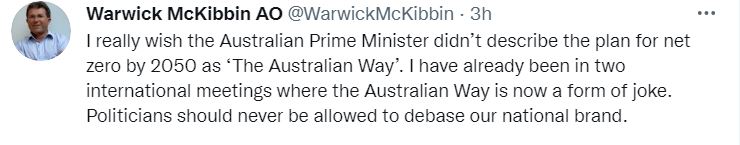

My tweet of the week:

But to be fair my nomination would have been ‘Cock’.

Finally, the media and Federal Coalition ‘outrage’ at the defamation of Saint Gladys at the hands of those ruthless ICAC thugs has gone very quiet.

Perhaps like me, they recognise either:

- She is lying to the inquiry and is not fit for office

- Is as naïve and dumb as her ex-boyfriend and such a poor judge of character that she is not fit for office

It is not okay to say pork barrelling has been done for years by both sides. It is taxpayers money – and must stop.

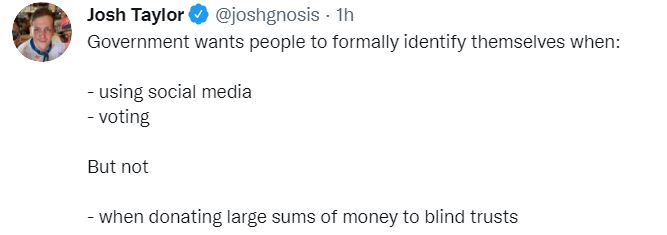

As a late side issue, the Coalition presented a left field solution to a problem that does not even exist – voter fraud in Australia.

Clearly taken straight from the Trump playbook. It may massively increase sales of BBQ sausages as we wait in line for much longer, but it will at least stop the 9 dodgy votes from the last election – from 14 million votes cast. #Idiots.

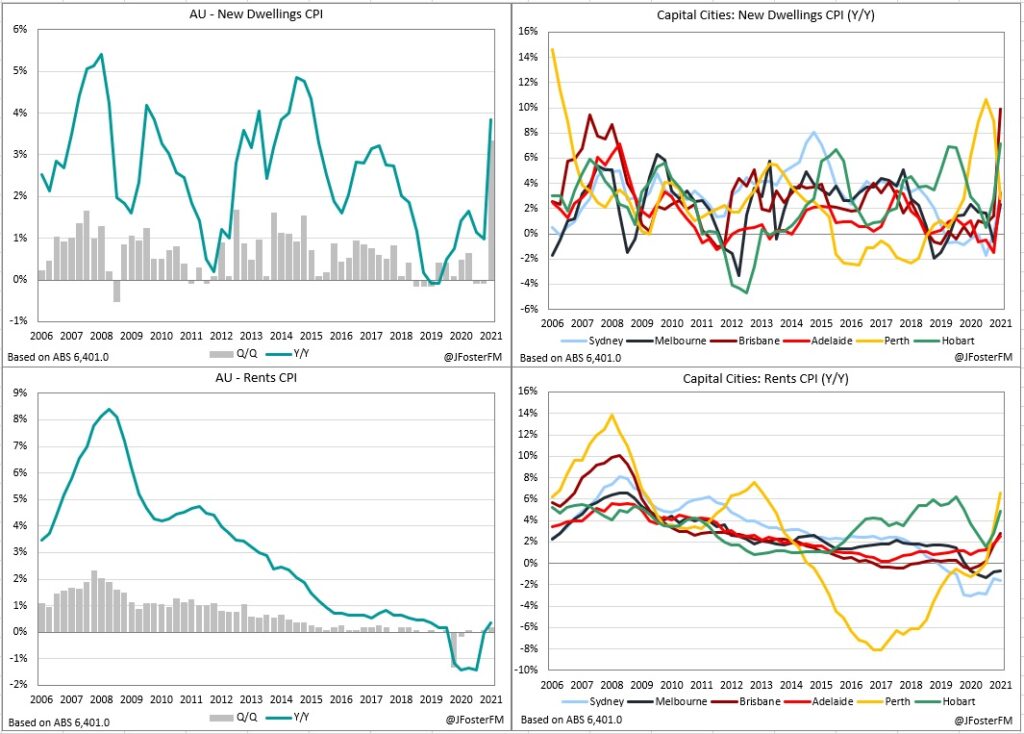

Housing

Last week’s inflation data showed what we can all see day to day; the cost to put a roof over your head as a buyer or renter is rising sharply.

ABC Four Corners did a exposé on housing this week – maybe a sign that the top has been reached.

Whilst we all bemoan the difficulties for our cygnets to buy their first home, or battlers to find appropriate rentals, no politician appears at all engaged enough to challenge either negative gearing or capital gains tax. How many home owners or investors are happy to ‘donate’ 10% or 20% of their real estate gains via legislative changes? Not many votes in that.

So, if demand can not be controlled (except by maybe higher interest rates ahead), then supply must be the other lever. I did agree with the point that the massive land and building developers play a negative role here too. They buy large tracks of dirt to add to their ‘land bank’ for future development. They could fast track a number of these, but to do so would work against the end sale price and their margins, so instead they leak them out slowly.

Like some hairstyles, that is rubbish.

Crypto and Gold Land

My frustration on XRP/Ripple remains. To me (as a virgin crypto investor) it seems like the other crypto is going backwards. However, it should be considered more a cryogenic than a crypto. It has gone largely to sleep awaiting a US court ruling that now appears to be delayed to end of Q1 2022. Unlike most crypto investors, I am a patient player and will hold.

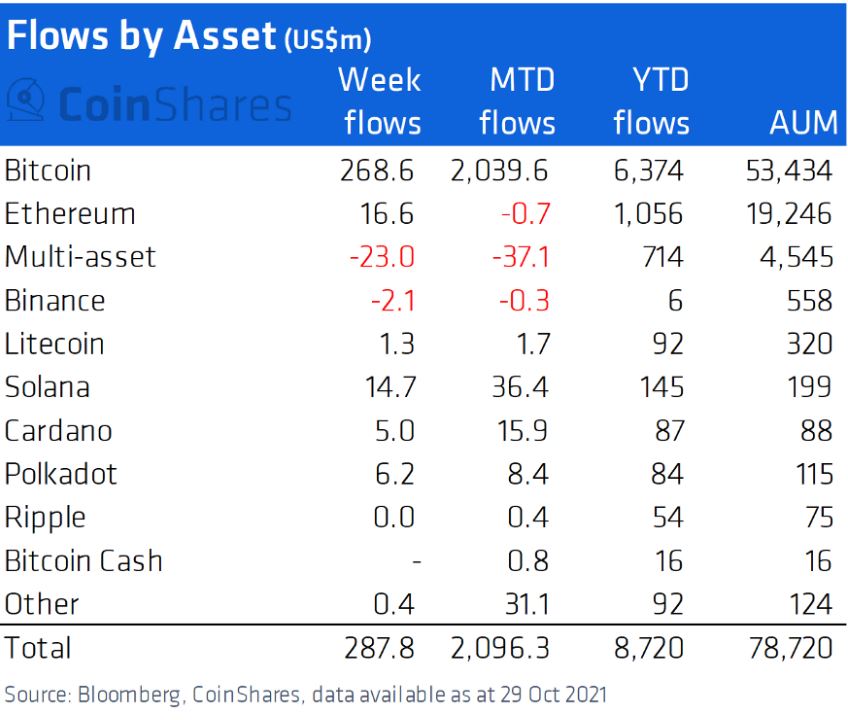

A reader also expressed an opinion that it is getting ignored for two other reasons. Firstly, it is shunned as it is seen as a legislated/controlled/centralised ‘currency’ – the very thing that appeals to old swans like I. Secondly, it is suffering from being a second class citizen to Bitcoin. Chart below shows the flows of funds into BTC as punters prepared for a price hike on the back of the release of a crypto EFT Fund. That did happen, but the price rise in anticipation was self-fulfilling.

The mad Crypto punter that has shared his portfolio before has updated me again. To use his terms, he has gone deeper down the rabbit hole than ever before.

His words:

Having done fairly well on larger cap tokens during 2020 and 2021 (up circa 570%), I was satisfied with how my Crypto portfolio had performed, but I had steered clear of tokens like Doge and Shiba Inu as I couldn’t wrap my head around the value proposition. Some of these tokens that I have avoided have MASSIVELY out-performed.

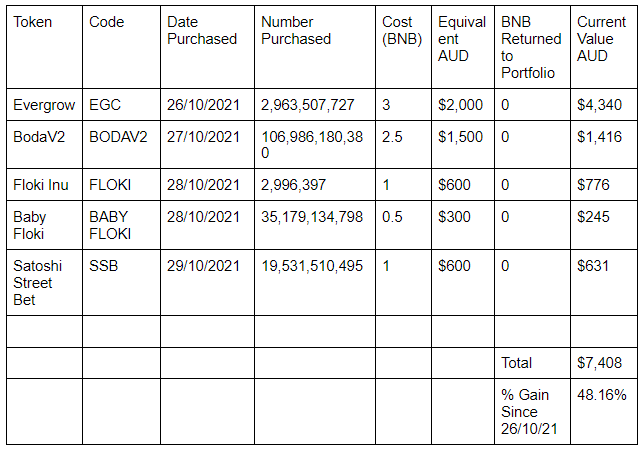

As a result we decided to set up a small cap crypto portfolio ($5k initial investment). The idea was to purchase tokens that we wouldn’t normally have considered based on a low market cap and rising interest on social media, i.e., follow the money!

Given that many of these tokens aren’t available through more traditional crypto exchanges I had to work out how to swap BNB token for the tokens that I was chasing on decentralised exchanges.

Assuming the tokens that we acquire appreciate in value, I plan to then swap some of these small cap tokens for BNB to replenish my supply of BNB to continue to acquire other small caps and let the rest ride!

His update from 6 days later:

Update – I may be going too far down the rabbit hole with this stuff to be able to be succinct in my thoughts/progress regularly.

6 Days in and the $5k has grown to $20k and I have bought two Taxi NFTs (for the price of 1 ETH each) for a digital world (Polka City) that are going to (in theory) pay me a ridiculous yield (circa $400 per week convertible to AUD)…

Not sure which way is up, but this shit is fascinating…

Good luck to our punter I say. Clearly, he is better at this stuff than horse racing. I look forward to his updates.

One thing he did say was that transaction fees were higher for some of these tokens – but you get a fee rebate when new players come on. To me, that can be best broken down to P O N Z I. This old dog (swan) is struggling to keep up.

Gold up on the week by nowhere near as much as it traditionally should given current inflation fears.

Thought of the week – no time

Drinking favourite…

Long lunch – big fat steak.

A Mollydooker shiraz is not bad as a partner. 15.5% has a kick, as I found out this morning

Not overly expensive.

Fellow drinker described it as an adequate table quaffer with little special about it.

I think he was a harsh judge.

7.5/10

Listening to…

Spotify threw up a few Raconteurs songs into my playlist this week.

Seemed very White Stripes to me – until I read that Jack White heads them up.

Not a song for a hangover.

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

Cheers, BS