(written down by Black Swan)

Big Picture

Wow – long time between drinks. With so much happening it was hard to know when to hit the restart button. Then again, if I won an award for laziness, I would probably get someone else to collect the trophy for me.

Most of the stuff that we had discussed or predicted has gone to ‘plan’ – but the scale and timing is always hard to predict. I am always surprised when the market is ‘surprised’ by crap that has been building for months or years. For the ‘smartest guys in the room’ equity guys can be pretty stupid.

US equity market is in official correction territory. The more interest sensitive Nasdaq dropped by 20% odd. The S&P dropped by significantly less, but by more than our All-ORD’s. Then again, we didn’t get the most of last year’s USA frothy rise either. In fact, you may be surprised that even after the last few higher days, the ALL-ORDS is only 4% higher now than this time last year.

After so many countries crying out for inflation (and many stated fears of stagflation), the old adage of ‘be careful of what you wish’ seems to be true yet again.

The USA inflation numbers are actually quite scary as the chart below shows. Even with oil, supply chain and transitory bullshit claims, this is nasty.

I get the feeling that price rises globally are all but baked into the pie. Ikea announced on New Years Eve (probably had to wait until Santa was on leave) that it was raising its global prices by just over 9% immediately. When I told one of my nobby mates, he said “who cares” – it is just Ikea. Well nobby – global sales of Ikea are over $60 Billion. That means your kid’s next flat bed will cost an extra $5.5 billion or so.

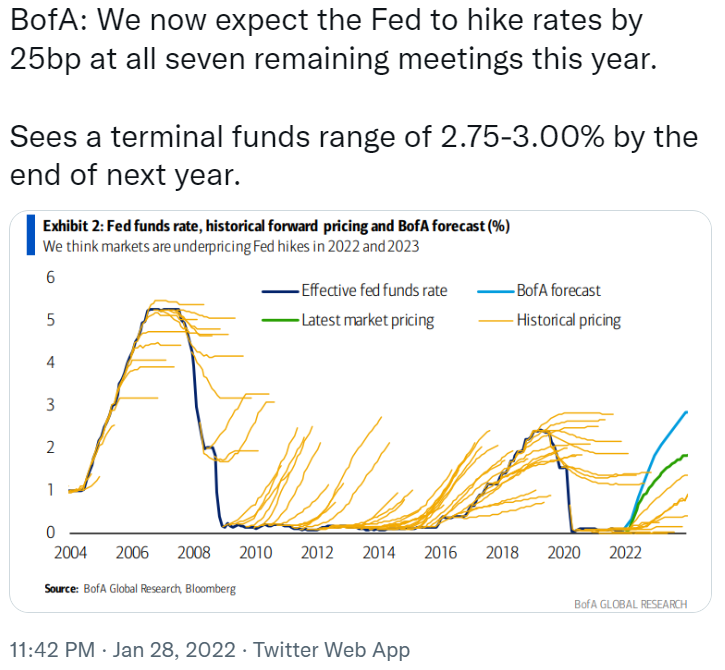

The US Federal Reserve seem to have got the message that they are chasing the tail now. The market is expecting a very sharp increase in official cash rates, starting next month (could even be a 50 bps kick off). Bank of America is even more dramatic as seen in the blue line below.

Thus, little wonder that bond markets have had another hissy fit.

So, is it hard hat time, and the last few days is just the last dead cat bounce before the inevitable collapse? I don’t think so.

You could argue that we remain within a four decade downtrend on yields. Given the chart below, that would be a fair technical analysis – although at effective negative yields in real terms, I am firmly of the belief that a break out to the topside is only a timing issue.

Someone sent in a few pertinent comments around a matter that we have also covered before. Plans to address the disaster may in themselves be enough to avert the disaster, without full implementation.

Particularly in the US, but here as well, we have seen 2-year bond yields rise sharply in response to growing belief that the FOMC and RBA will hike. But the 10-year and 30-year bonds have risen much less so. Thus, the curve (sorry Casey Briggs… not that curve) has flattened. Why? Because market players see the higher rates in 2022/23 will in themselves let the air out of the balloon adequately to stop the need for prolonged hikes into 2024 and beyond. I’m on that horse – especially given segments of high leverage debt that will be hurt by even modest rises.

In summary, I don’t think this bloke needs to worry that much.

The US public debt issue on the other hand is less clear. It has just topped $30 trillion USD for the first time ever – and added the last trillion in 46 days. Back in 1980, debt measured at 30% of US GDP. It is now at 125%.

And that is at a time of historical low rates – what happens when servicing costs rise.

A lot of Modern Monetary Theorists say, “who cares”? It doesn’t matter. I’m still getting my head around the whole MMT conundrum.

Serious question: if debt doesn’t matter, why do we have income (or any) taxes at all?

Domestic Duties

RBA Governor How Lowe spoke this week on the year ahead. His mantra seems to be to release the doves on every occasion. RBA internal forecasts are that inflation will run in the high 2’s this year and next, whilst unemployment figures will start with a big figure 3 by year’s end. Yet he states that RBA is in no hurry to raise rates, and inflation is not yet certain to be sustainable. Me thinks he is feeding the chooks.

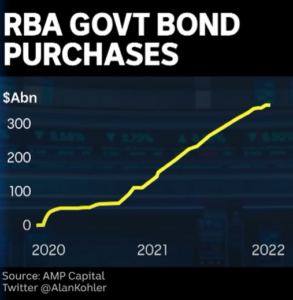

That said, RBA have committed to cease bond purchases – aka QE.

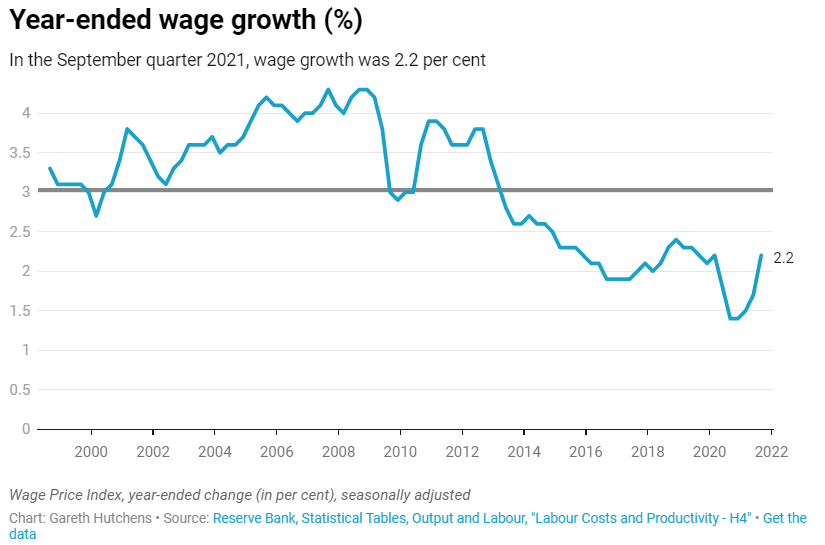

The missing piece remains wage growth. This is where we seem to be different from the USA where wage pressures are becoming clear.

Even at 2.2%, it means in real (inflation adjusted) terms, workers are going backwards in spending power… government hand outs aside.

Can someone please explain why labour shortages feature every night on the news, yet wages are not rising? Economics 101 seems broken.

I am certain the minute Lowe and RBA see wages growing at 3% or above, then their higher rate pudding will be cooked.

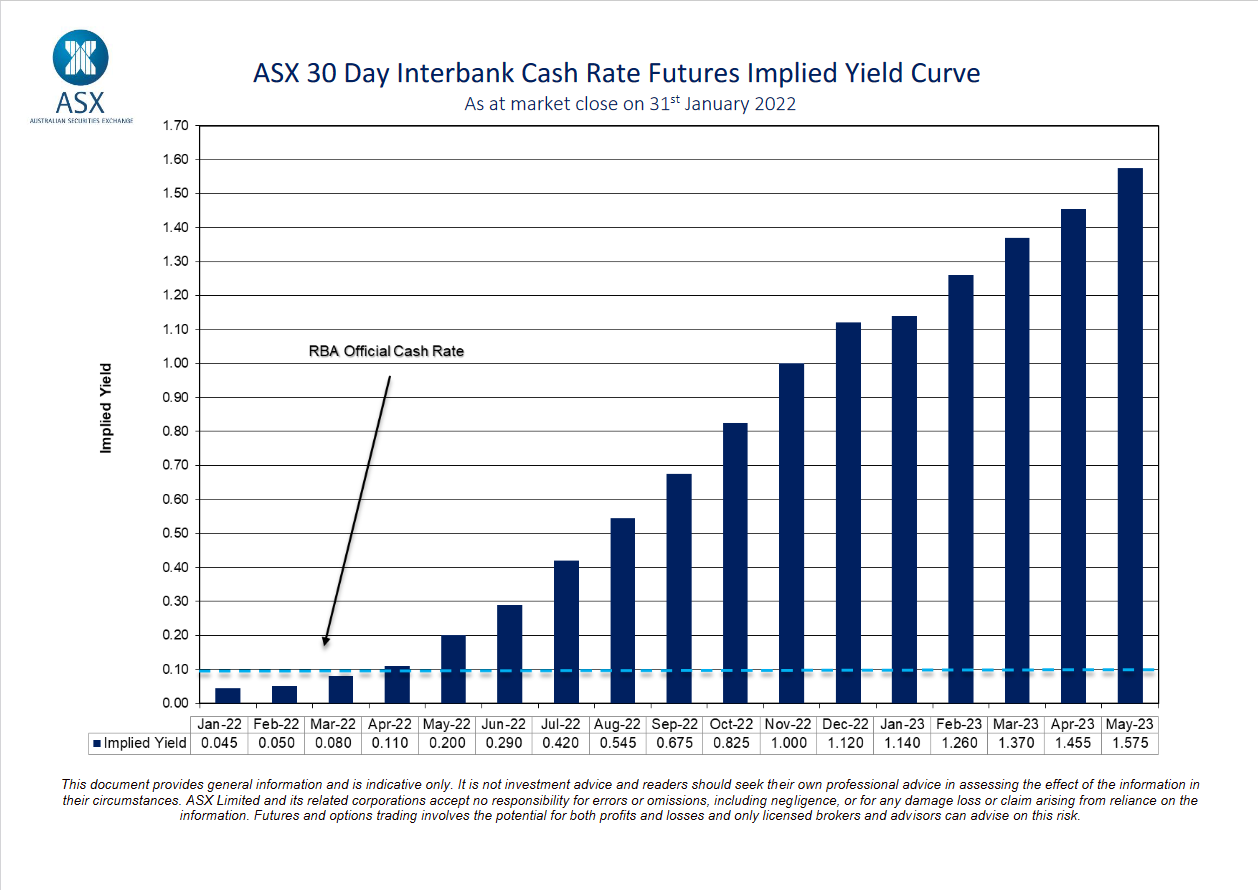

The market is seeing the chance of rate rises much earlier than RBA are saying, despite all the above. Kick off later this year.

Westpac are calling for SIX rate hikes by March 2024 – to 1.75%.

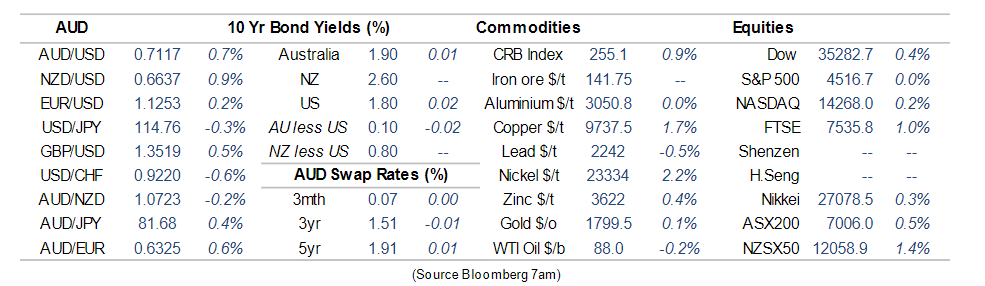

CBA data:

Banks

Macquarie Bank equities did a recent report on Aussie banks.

From a share price perspective, amongst the majors, they see it as ANZ, NAB, WBC and last of all, CBA.

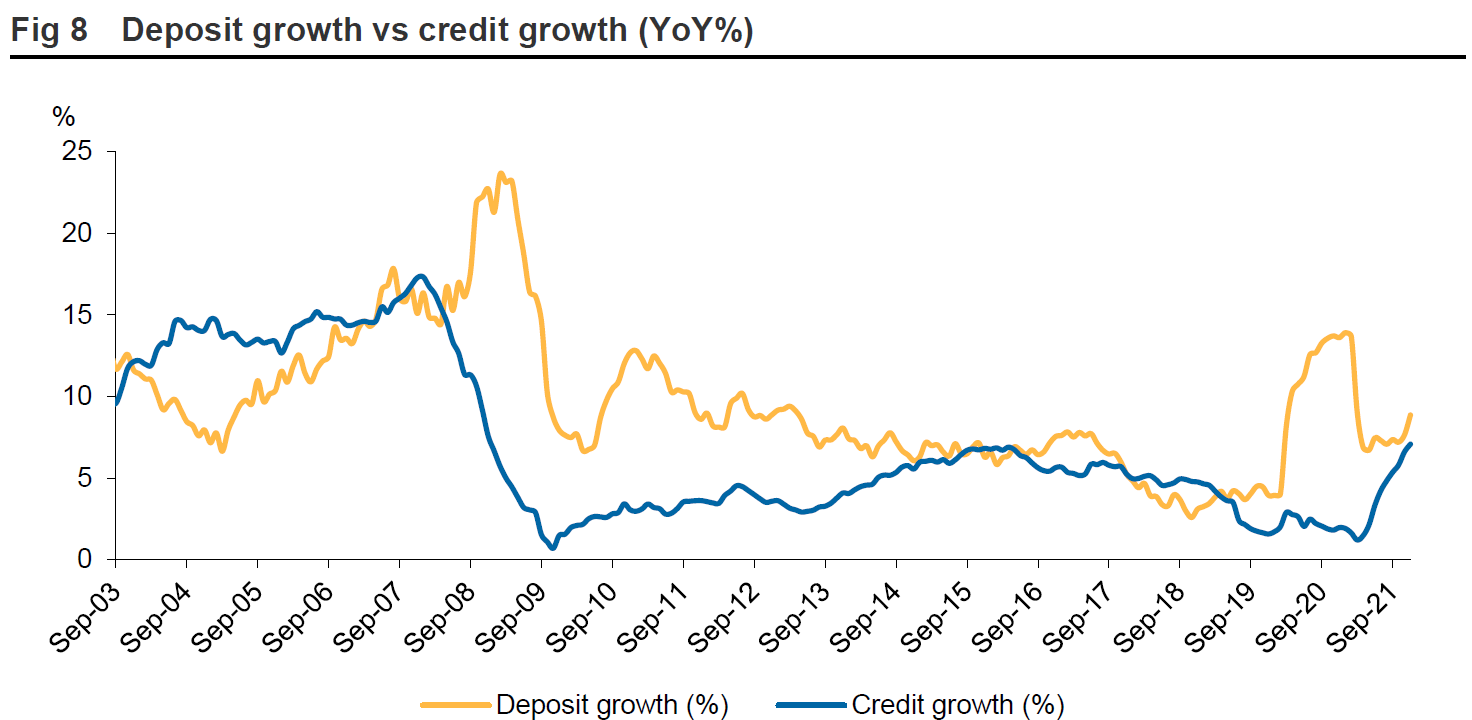

Chart below is a positive for banks. Credit growth (lending) is outpacing deposits. Banks only make real returns when they lend.

Some big variances amongst the players, though. Between them, ANZ and WBC increased deposits by $44B over the last 12 months, whilst Macquarie lent $13B more than it took in. We have mentioned previously that Maq Bank seem very reliant on short term wholesale funding. We hope whoever runs their liquidity book knows what risk that adds.

Given the recent push higher in fixed home loan rates, there is a sway back towards variable loans at present as borrowers chase a home loan below 2%, which is getting harder to find.

The Aussie Dollar and Commodities

Commodities first.

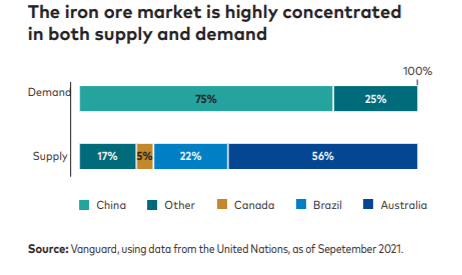

We all know this stuff, but if you are like me and only ‘get it’ with pictures, then this is an enlightening graph.

75% of global iron ore demand is from China. Australia supplies 56% of global iron ore demand (almost exclusively to China).

That would be good if you had faith that China will remain strong for long. It looks like even the PBOC has lost a little of that faith when it cut rates in January for the first time in two years. This is amongst other official measures to encourage banks to lend more for new homes in what is seen as a semi desperate measure to support a rapidly slowing construction sector.

At present ‘we’ are buying the China story and ore prices up strongly in January as are thermal coal prices.

Oil prices remain high and most forecasters see it staying high for some time.

Low inventories, low investment, and low spare capacity has Morgan Stanley expecting barrel prices to rise from current $90 a barrel to $100+ by September. So don’t expect any imminent relief.

I asked Mrs. Swan where she wanted to spend NYE. She said she didn’t care as long as it was expensive.

LNG prices are also rising in step with the Ukraine vs Russia tension. Russia is a major supplier of gas to Europe. If things turn nasty, the pipe might be turned off.

The Aussie dollar has been pretty range bound since our last report in mid Dec. It has dipped just below 70 cents last week, and as high as 73 cents in mid January. Right in its comfort zone for now at .7135.

Not much impetuous to see it much higher in the short term.

Politics

The great New Year reset plan from SloMo has failed spectacularly.

Not just him, but his entire Cabinet is covered in this meme:

A few readers told me they totally back the journalists’ ‘take’ on Grace Tame’s famous Australia Day side-eye. Immature and disrespectful. The leader of the pack PVO says:

Then at the Press Club, the same journalist disrespects the same office better than Tame ever could.

Which Cabinet member called the Prime Minister an absolute pyscho? The PM says anonymous leaked text messages should be ignored (unless he is leaking one about a French Prime Minister).

I had my money on Christian Porter, but his buddy PVO says no. Marise Payne was a short priced favourite but it seems to be narrowed down to a ‘he’.

That leaves me to think Mr. Potato Head may be the culprit. He has unfettered ambitions for the top job and proven history of being capable of any deceptive means to an end. The way the message relates to 2019 and yet comes out after a stinker of a political poll that predicts a LNP wipe-out could help explain.

Like Boland, they can all get Rooted.

Housing

House prices rose again in January.

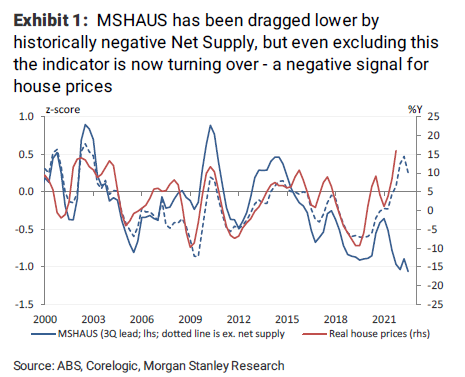

Morgan Stanley have an in-house measure that looks 9 months forward.

The dipping blue line below predicts house prices will fall by 5% nationally by year end.

They attribute this (rightly) to higher rates, and tighter credit and serviceability assessments by banks looking to get tougher for easy money lending.

That said, I’m watching closely a few mortgage applications that I have an interest in. Borrowers would say that banks are already b@stards to deal with for loan assessments. How harder can it get?

Crypto and Gold Land

I got a little excited when gold got a wriggle in January.

The rally has stalled for now, but the chart below (gold in AUD terms) shows that technically it seems to be in good shape.

Still holding a fair chunk of Perth Mint EFT gold. Sold some penny dreadful Aussie gold mining stocks in January to buy some penny dreadful offshore gold mining stocks.

Crypto:

Our Ponzi Pumping Program remains on hold – interesting it was our purchase that sent the market into free fall.

Ripple XRP holdings are down some 40% (see above).

Bitcoin is down 20% in the last month. Again, funny how the believers spruiked the idea that crypto was a store of wealth against ‘fiat’ money and protection against inflation. Bullshit I say. It is purely a momentum trade.

No momentum evident. Bitcoin as at last report was circa $50k USD. Now $36k.

The beast is wounded but not dead. NFT’s might be the last great hope.

Fallen idol, Lance Armstrong has hopped into NFT’s. It has not gone that well.

He was also at pains to make it clear it was a leopard, not a cheater (sic).

Regulation from central authorities has been flagged here before as the greatest challenge to blockchain technology.

The Johnny’s ‘come-lately’ believe it will just push on past that – much like the internet did. But this is different.

The Bank of Russia came out in January and banned all crypto mining and trade.

Not a killer blow, but just another handicap to get over.

Is it just me that thinks the old guard may just pinch the theory and technology for themselves?

Or listen to master spruiker Matt Damon. Back in 2010, Damon was the narrator for a film on the financial crisis, Inside Job. He closes it with the following on financiers:

“They will spend billions fighting reform. It won’t be easy. But some things are worth fighting for.”

With crypto companies spending increasing amounts of money on lobbying, these words seem pertinent now.

ESG and Carbon

Nothing to report this week.

Thought of the week: Ukraine revisited

We took a look at the concept of military action back in our April 2021 edition.

It is holding up well and worth a re-visit:

China – Xi Jinping

He became President in 2013.

He believes that the Chinese form of government to be imminently superior to democracy. He also believes his key role and mandate/legacy is to ‘reunify’ China… specifically get Taiwan back into China. Hong Kong already achieved. Indian border pressure is building.

We all know about the South China Sea ‘islands’ that China built and then claimed sovereignty over. Chinese military incursions over Taiwan airspace are becoming regular. As you can imagine, Taiwan is concerned.

Aussie analyst, Jonathan Pain, proffers the following as a possibility (not a prediction):

China invade Taiwan.

USA and its allies (Australia) need to respond. If they fight a conventional war, China would win. If they go nuclear, then no need for any of us to worry about economic consequences – game over. On the side lines is another nutter Kim Jong-un who has nuclear ability and would rather a fight than a feed.

The USA is busy fighting internal pain, and is not looking for a stoush – as verified by its withdrawal from Afghanistan.

He thus expects the USA may do lots of posturing but ultimately allow that to happen. If you think there was trade tensions now, imagine if that scenario plays out? I know a couple of Taiwanese business people, and they see catastrophic outcomes.

At least the Chinese own the Darwin port if they decide to continue to move southward…

Russia – Vlad Putin

Vlad: former KGB spy. He believes the USA destroyed the Soviet Union – and wants payback.

Recently declared he is President until 2036 (mind you ScoMo would love that bit). Believes he is the old school Emperor. But at 68 he needs to get moving. He has no qualms in using violence to get outcomes.

So what might be possible in his game plan? You see Joe Biden coming out this week pretty much telling Putin to cool his heels. I see that as a waste of the few breaths Joe has left.

Russell Warren believes he will soon move on Ukraine, and then tackle Turkey. Why Turkey? To give access for the Russian navy to a warm water port – something that has held their military ambitions back for centuries.

A bit like China, Putin is gambling that the USA is a weakened beast that will not get involved in a Ukrainian tussle. That may be so, but if he also moves on Turkey, then as a NATO country with ‘close’ ties to the USA, then expect fireworks.

Wildcard event on top of both scenarios is that the two nations coordinate the timing for the incursions to further add complexity to any response.

Outside of military impacts (and possible nuclear wipe-out) expect a stronger USD, and oil and gold to rise. Or Bitcoin, if that is your thing.

Feb 2022 update:

It looks ever more likely a big stink will happen in Ukraine.

How will the market react? As above, but add in gas prices.

I did read (and it makes sense to me) that Putin may have taken a call from China’s Xi asking him to delay sending in troops until after the Winter Olympics. Hate to spoil the party.

Drinking favourite…

Wine, like many things taste better with good people around. Had a few bottles of this outdoors at a pub in January with good mates.

Dan Murphy says:

“Barbera can be a bit of a chameleon, so let’s set the record straight immediately; this wine falls into the pure-fruited, punchy, lighter bodied, good-times category. Pure, black cherry, raspberry, nettle and anise aromas and flavours – perfumed and engaging – it has both sweet and savoury notes and more than enough structure to keep the palate fresh.”

It is supposed to match with lamb, but we swilled it down easily with duck cassoulet which was also spectacular.

Dan’s have it for $45

9/10

Listening to…

Would be appropriate to go with Meatloaf (or Glen Wheatley) – it’s because I love you… But not after the MCG debacle.

Instead it is the below. A good song and dedicated to Grace “Tame the Impaler”.

As an aside, I backed The Wiggles with the bookies for the Triple J Hottest 100 and got a collect.

Sorry for long edition.

Anyway I hope your festive break was as relaxed as mine. The nuts were very complimentary.

Not all good department stores value Incognito:

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

Cheers, BS