Big Picture

Never really understood that saying – storm being a negative and perfect being a positive.

Incredible how quickly “the vibe” can change. A few months ago, I was a zealot for calling the chance (to be fair not always my base expectation) that inflation might get away from Australia, like it had in the USA. Not possible, I was told – we are different.

A senior banker mate of mine spent considerable time explaining to me that our inflation was supply side, not demand side. Thus, all will be well. Supply side looks to be correcting, but demand push inflation looks like it has a foothold.

We will come back to inflation again of course, but RECESSION is the vibe now here and abroad.

The USA Federal Reserve hiked by 75 bps this week – biggest hike in over a quarter of a century. They added a clear statement that at least another 50 bps is coming next month. They are fully committed to crushing inflation by crushing demand. They had little choice to up it to 75 bps after last week’s headline inflation release showed a 8.6% annual rate.

What happened to all that wealth generated over the last few years?

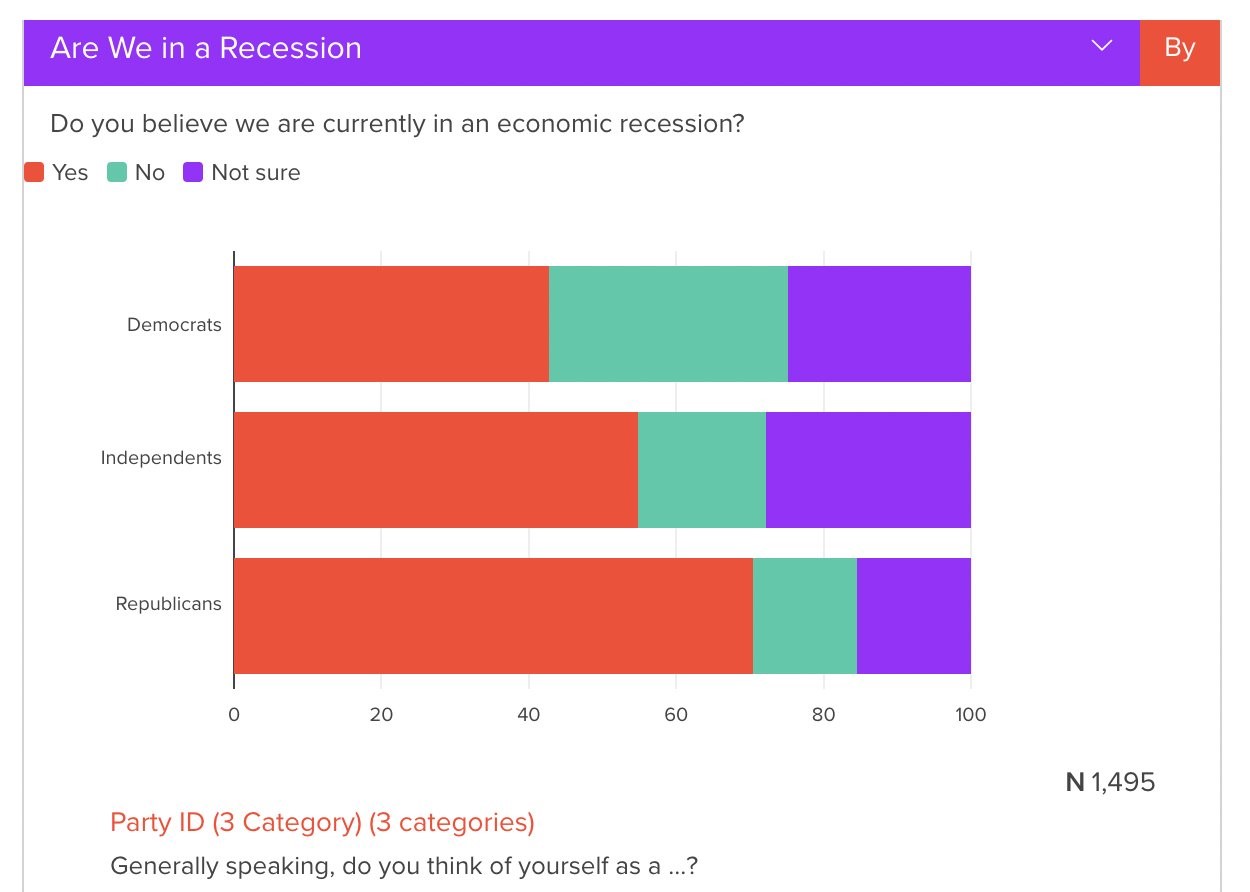

Many professional traders believe the USA can chart a course (albeit getting narrower and riskier) to a soft landing in 2024 without a technical or deep recession. The trickle down has clearly failed in the States – over 50% of people surveyed (and 75% of Republicans) believe they are already in a recession.

Like our most recent Westpac Consumer sentiment survey, the air is well out of the balloon. Pessimists are getting their time in the sun.

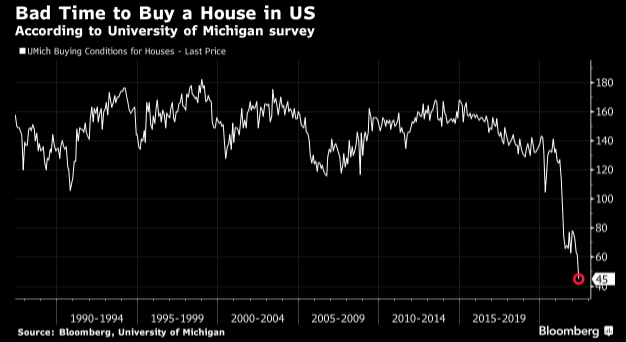

Worst time in 30 years to buy a house in the USA apparently. A strong school of thought that the FOMC has housing as a key target in this rate assault.

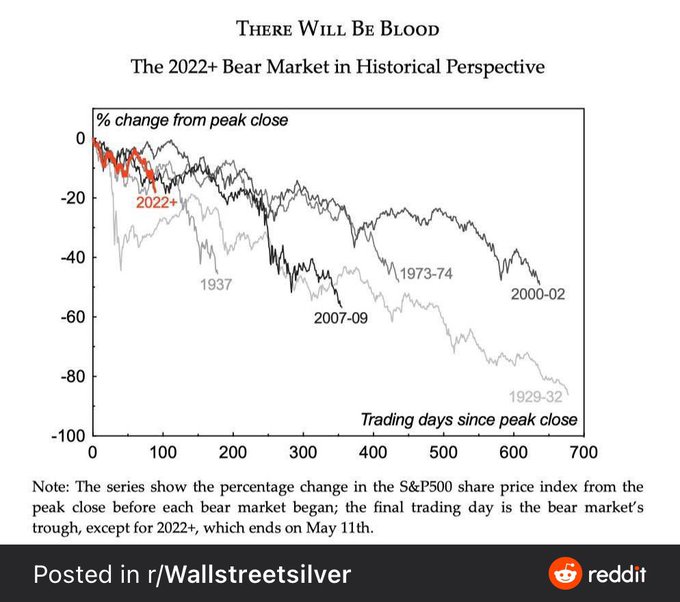

If you want a bit of fear in your diet, then the chart below can give it to you.

The US equity market now in a definite bear market. Down 21% since March 28 high. But in historical terms it has a lot further to run in time and dip.

For sure, I agree that the Aussie share market does not live with the level of leverage that the US holds.

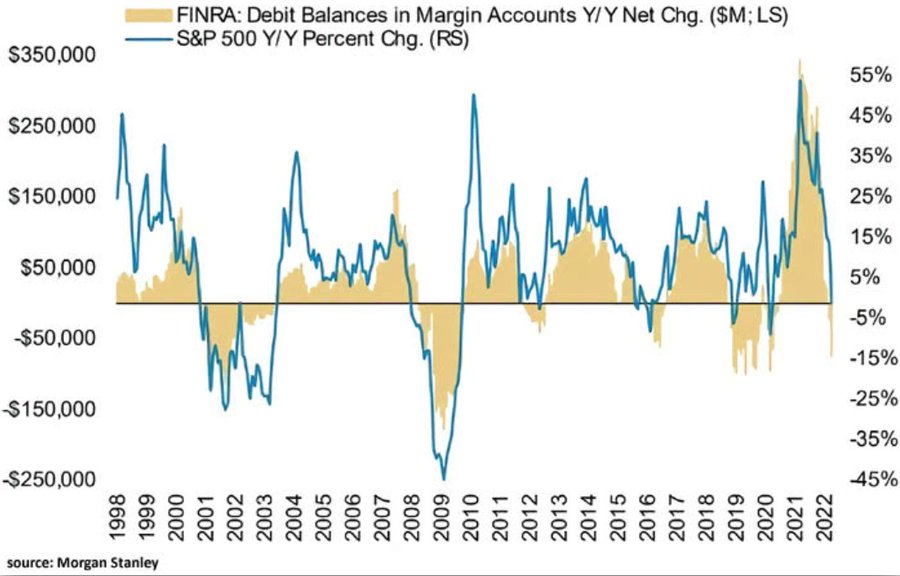

Leverage super-charges bull runs but fast tracks dips as well. Yellow below represents margin lending (leverage), whilst the blue line is percent gained or lost on the S&P 500. A pretty tight correlation.

Maybe a silver lining in that the margin lending levels have already fallen quickly. Damage already done?

Of course we can not forget the geo-political pressures that are building.

China bought up US treasury bonds big time when Trump got into the White House. It was falling before the 2019 election but has fast tracked its selling since.

What to make of it? War mongers believe China is positioning to protect its financial base should it decide to move against Taiwan. They don’t want USA to freeze their assets like it did to Russia.

Maybe that is the case, or it could just reflect the lowering of trade flows between the two super powers.

My question is, what is China doing with the USD’s they are getting back? Presumably converting to RMB? Gold price not reflecting they are buying big.

Time to pack the baked beans and tins of soup into the bunker?

You might be surprised that I am remarkably calm at present. Personal view is that Australia is actually in better shape than the USA. We will have higher rates and further equity dips, but a lot of the intellectual heavy lifting has been done already. Few still think we have a massive bull run ahead of us… and that actually is a good thing.

Sneaky side concern is this: Australia’s saviour yet again is commodity prices. Agriculture aside, I fear that if USA and China do hit a very rocky road, surely demand and prices for iron and coal will fall quickly. That will hurt us.

We might be able to save our economy like the Socceroo’s.

Domestic Duties

AFR did a scathing opinion piece on the performance of the RBA over recent years. I’ve got a copy if you want a read – let me know.

I have been a long time fan, but they have farked the last year up in particular. RBA Lowe said on ABC (a very rare interview) that they took “insurance” out to protect the economy. He was right – not many expected the economic impact to be anything less than catastrophic. But it has been clear for well over a year that money was getting too easy. They stuck to their 2024 timeline for change mantra for too long.

Just look at how quickly and how far the best minds in Australia got inflation wrong. A mere 4 months ago they expected it top out below 4%. Lowe is now talking 7%+ later this year.

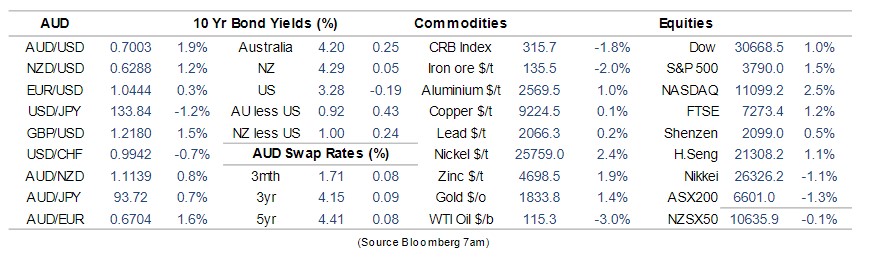

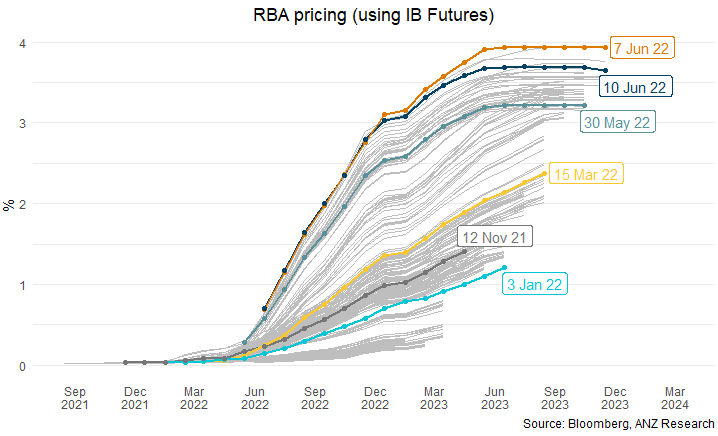

ANZ are suggesting RBA will hike to 2.6% by early 2023 before a pause. But then inflation to still be too high and require RBA to kick rates higher and over 3% by 2024. All that without a recession. UBS are saying similar, but early and harder pathway to a similar end point.

Market futures are still even higher than that. We mentioned before that the market can and does get it wrong often. But look at the chart below. Terminal rate virtually doubled since mid March.

Taking cash rates above neutral is the most agreed outcome. Once the inflation genie is back in the bottle, RBA can take their foot off our necks. A cash rate cut in 2024 is forecast by some already.

Of course the increase in minimum wages this week can be also be seen as “inflationary”. I remember in 2021 when RBA stated they would allow inflation to “run hot” for a period to help get wages higher. “Run hot” is now steaming.

Some trickle down fans were not supportive.

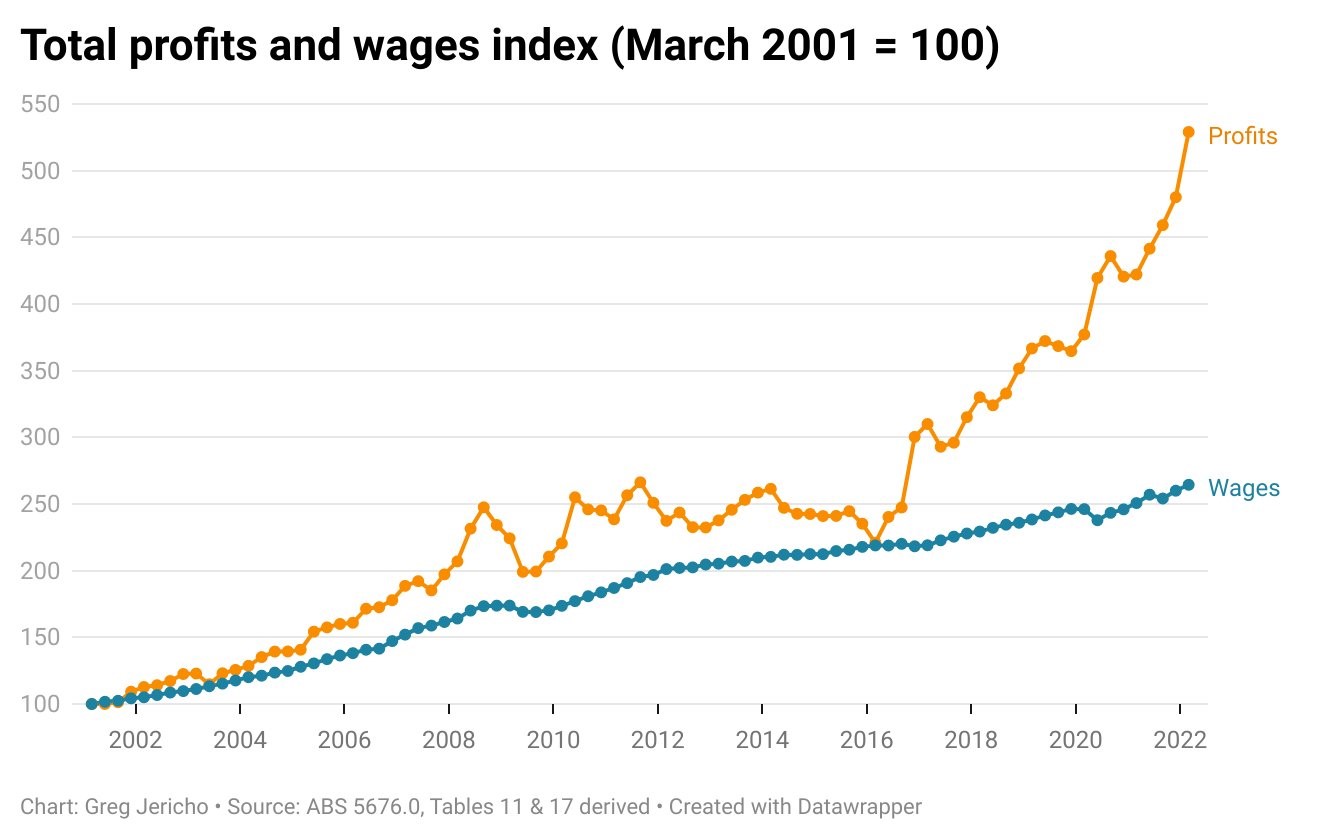

These same fans would perhaps find it hard to justify the distortion in historical norms in the chart below. Don’t get me wrong, I like companies making a healthy profit. Much better than the alternative. But the share of the bounty has skewed too far. And yes, I also expect profits to come back in coming years. Meet in the happy middle?

Useful to note that Citigroup see the rise as “above expectations” but still forecast real wages to remain negative until at least the end of next year. Common sense says if wages are growing less than the level of inflation, that is the very essence of DEFLATION pressure.

Dead set, we have lost the plot.

Employment data very strong. Historical high for participation rate. If you want a job you can get one. Under-utilisation is falling rapidly too.

Consumer Confidence is tanking courtesy of fear, but Business Confidence (and Conditions) still holding well.

On my equity portfolio, I have tipped out half of my BBOZ strong bear fund holdings. After being well under water for 18 months, they have done their job finally. I believe I will be able to buy back in at better levels in days ahead (i.e. a rally coming).

Tweet of the week:

CBA data:

Banks

After being negative banks in early Covid times, I have been telling everyone that the sell off in bank shares is just plain ridiculous – a huge buy opportunity. The sell off is based off a mistaken belief that lending will slow and possible increases in bad debts.

The first may be true, but unlikely to be immediate whilst banks have reasonable provisioning still… with no clear need to use any of it just yet or maybe at all. NAB for example have $5B stashed away for bad debts. Morgan Stanley suggest they would need nearly $8B though if NAB’s own downside economic scenario happens. Mind you, that assumes 2023 will see unemployment at 10% and GDP at minus 4.5%. House prices falling by 25% nationally. I challenge the biggest bears out there to see this happening.

As I pointed out, their NIM (retail margin if you like) will increase substantially with higher cash rates. At these buy levels, I expect their yields to go through the roof.

As always, just my thoughts – not a recommendation.

As an aside, all banks are still cutting back branch hours and closing branches. Somewhat understandable given how the way we use banks continues to shift to online and phone.

Still shits you. My local branch closed last year. They did send me a letter that explained they were responding to customer feedback.

Who contacts a bank and asks them to close a branch????

The Aussie Dollar and Commodities

The Aussie dollar has been extremely volatile in recent weeks. As a proxy currency for global stability and liquidity, it has had too much stimulus to get a good handle on direction. It has been into the 74 cents range and below 69 cents. Exporters and Importers have all had their chances to take cover.

Commodity prices have varied wildly, China looks soft (but is it?) and interest rates are rising faster in the USA than here – for now at least.

Oil looks like it will stay high for months to come. Somewhat surprising if global recession is on our doorstep.

Metals generally softer for that very reason.

Politics

Labor are making the most of “it is all the fault of the previous mob” argument. No doubt correct, but just get on with fixing it.

Albo and Penny Wong getting lots of frequent flyer points.

Energy is all the talk. Will be interesting if it energises the renewable argument or sinks it.

Ten years ago, I wanted Australia to review nuclear energy as an option. I have long since moved on and away from that thinking. Very expensive and incredible lead in time. More chance of getting subs and Snowy 2.0 up and running before nuclear.

Nice little side show for the Coalition that is increasingly becoming irrelevant.

Housing

The question I most get asked recently: where are house prices headed? Since I rarely go to dinner parties, it most likely is Black Swan’s Chateau gardener asking.

“The Kouk” aka Stephen Koukoulas is pretty bullish on house prices.

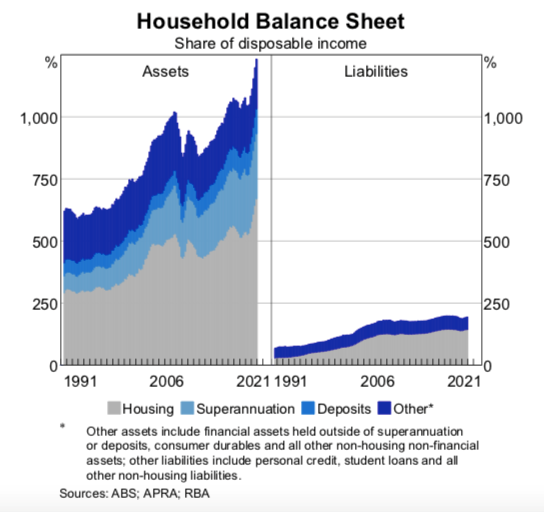

Main reason is that cash rates even at 3% is not historically expensive and on average, household balance sheets are very strong.

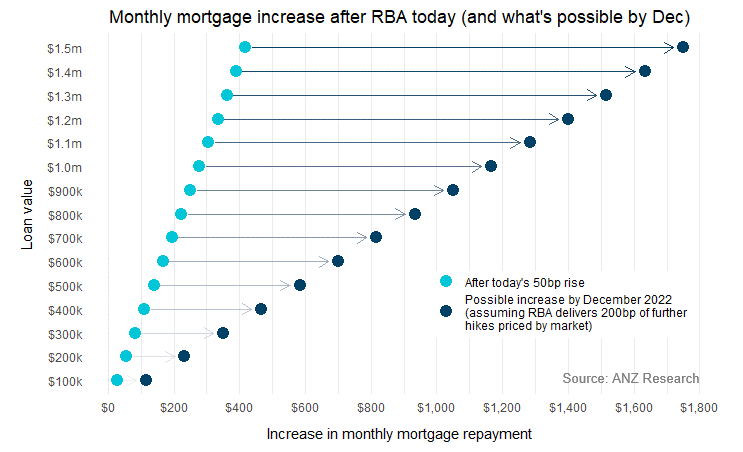

Similar theme to what I have said recently, but ANZ charted possible increased mortgage payments based on likely rates ahead by year end.

You would think that those with the biggest debts also have the biggest buffer to support, but it will no doubt slow consumer demand and spending – which, of course, is the very reason to hike rates in the first place.

Signs are that Sydney and Melbourne are seeing falls, but provincial cities are doing better. I’m pretty sanguine on house prices. A 10% or 15% pullback is possible but given 25% gains in the last 18 months, it will hurt only a minority. More likely a long Sleeping Beauty hiatus.

Crypto and Gold Land

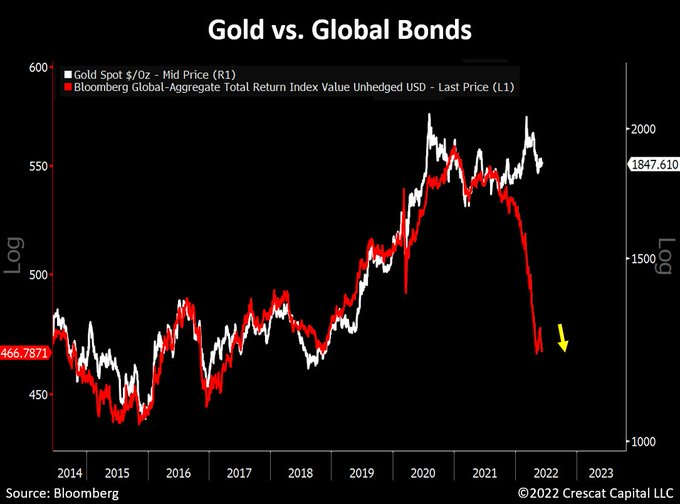

Gold first. At $1,850 it is doing ok but far from where I would expect it if buyers still see it as a hedge against inflation. Of course better than bonds as seen below.

Maybe I’m that whacky Uncle.

All the hype though is on crypto. Is that dog dead?

Exchanges falling over or suspending trades, Stable Coins being anything other than stable, and the mainstream blockchains getting smashed.

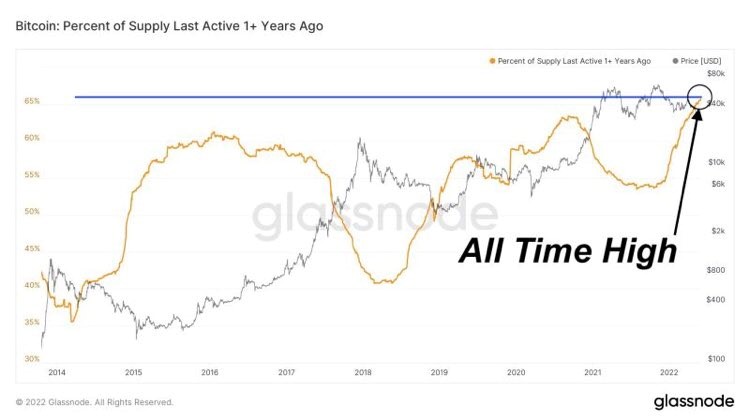

There is a group known as HODLers (hold on for dear life) that pride themselves on never selling Bitcoin. The yellow line below seems to be saying that even a few staunch HODLers have put up the white flag.

For those that see Jim Cramer as a guru: missed it by that much…

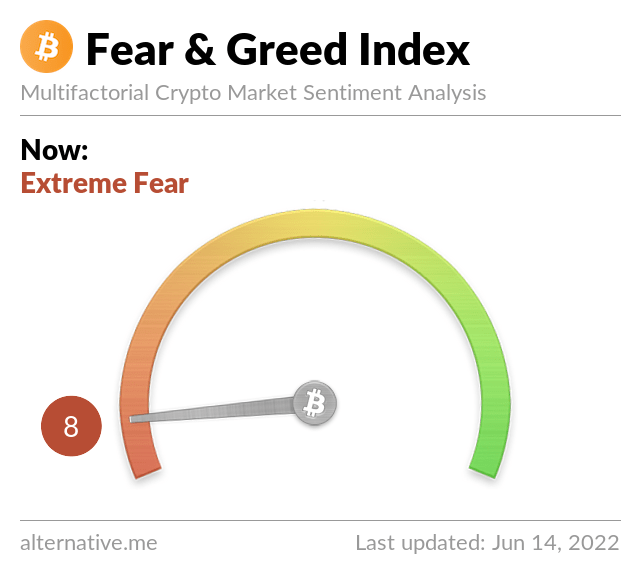

So with BTC just hanging on to $20k USD, it is off 60% odd YTD. If the fear index is at 8, what needs to happen to get it to a 10?

My XRP is in the same boat.

A recent crypto contributor here and a believer sees this as an opportunity and is selling hard assets to buy more.

As Matt Damon says: fortune to the brave.

ESG and Carbon

Short but sweet. Bain & Co are huge global consultants. All bankers fear and loathe them because their modus operandi is always the same – slash and burn.

They have released a report that says banks that adopt carbon transition by 2050 will see profits higher by 30%. Laggards will see profits fall by 20%. I haven’t read the full report (and will not), but you can bet a few CEO’s are reading it as we speak.

“Stranded assets” will be a term more used in the future. BHP have announced it will run down and close Mt Arthur coal mine in coming years after failing to find a buyer to take on the $700m liability to clean it up.

The current energy “crisis” is giving everyone a platform to stand on, even numbnuts like Matt Cosplay Canavan. He is selling us snake-oil.

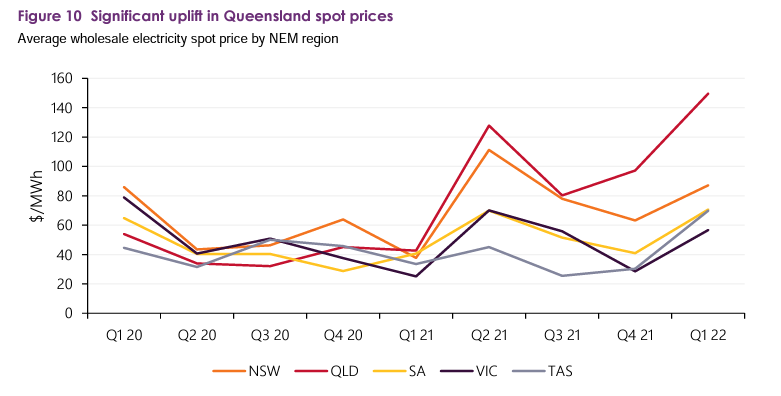

The red-line is electricity prices for coal reliant Queensland. It has gone from the cheapest State in 2017 to the most expensive when compared to renewable heavy States like SA. He is standing at the coast pushing against the tide and rising sea levels.

I don’t agree with breaking long term international contracts with the associated sovereign risk attached. So yes, good onya WA, but keeping gas back from export on the east coast is not the short-term fix.

But I did see the energy minister from Norway addressing an economic forum recently. Norway tax oil exports at a massive 78% tax rate. Businesses claimed that was outrageous and not possible to pay. Norway said “fair enough, goodbye”. They came back, they extracted and they paid.

Norway now has a sovereign wealth fund which is the largest in the world at $1.4 trillion USD. That is a quarter of a million for each child and adult. They have free health care and education.

They believe the resources belong to the people, not international companies.

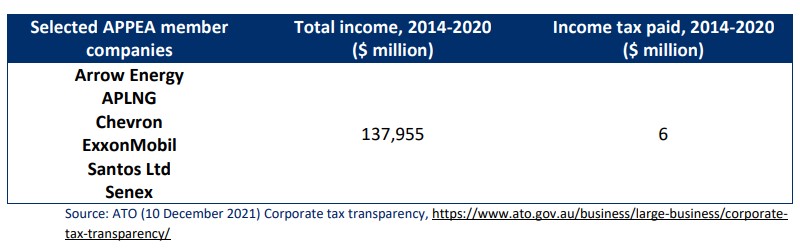

I haven’t gone communist, but believe in the same theory. How much tax are our big players paying, you ask? See below.

Tax appropriately and invest in energy updates and transition. Pretty simple stuff, Albo. And Cosplay Canavan… get stuffed.

Drinking favourite…

A local cellar door opened last weekend.

I know the wine maker that gave me a taste of his first release from 1999 (via a magnum)

It is called Casa Freschi and the wine is Profondo.

34% Cabernet Sauvignon, 33% Shiraz, 33% Malbec

WINEMAKERS NOTES: Deep violet red in colour, it has an alluring, deep and complex aroma. The palate is rich with multi-layered flavours, a silky texture, and fine, firm tannin that will soften with time to reveal the vineyard’s inherent character and breed. It’s subtle complexities, richness, and savoury quality makes Profondo a great accompaniment to most richly flavoured dishes.

It was far from dusty – plenty of life in it. Not sure if you can buy it or the cost. But bloody good.

If you get a chance, visit the winery.

9.5/10

Listening to…

Still using YouTube this week.

Keep this away from those easily offended.

Turn it up as loud as you can.

If this clip does not give you a desire to get into a mosh pit you need to check for a heart beat.

Are you ready?

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS