Big Picture

More contemplating than writing recently – but a few thoughts on recent events.

I was like a hawk chasing starlings – too many targets to aim at.

Clearly the changing of guard in Federal politics is a biggy (see broader thoughts below).

But the big thing as far as the markets are concerned is what possible effect does the change have on future pricing? Well the answer so far has been bugger all. The AUD did not really move based on the election nor did bonds or equities. Little wonder since most economic policies were not that far differentiated. Action on climate might be one thing, but most businesses have been calling out for a workable long term strategy that they can plan around.

I agree that at the margin, Labor may be more supportive of higher wages, which if that gets out of control it could further fuel a nasty inflation whirly wind that may be hard to stop.

Unemployment is below 4% and staff/skill shortages are everywhere, so that may happen regardless of who sits in the big chair. Labor will be battling a number of issues on many fronts – most off them global rather than domestic.

Speaking globally, the Ukraine situation drags on. The market has a very short attention span for military conflict and is really only concentrating on food and energy impacts now. Certainly the humanitarian situation there is getting worse though. Perhaps a ‘good’ outcome would be for Putin to take his eastern province gains and sell that as a ‘win’ to his people and cool his jets – literally.

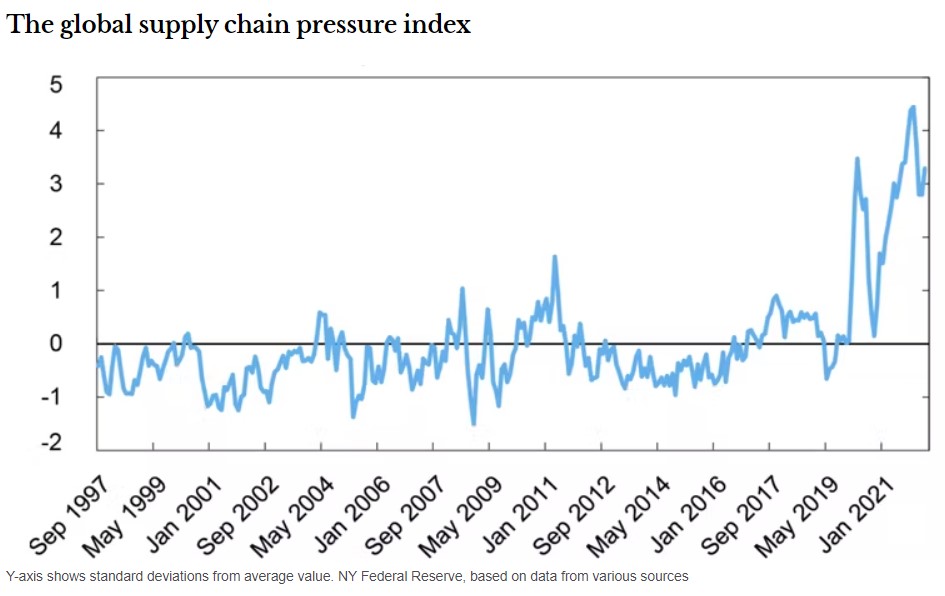

I was going to share a brilliant photo of ships waiting to be loaded/unloaded in Shanghai Port, a result of the Covid lockdown in China. However, a number of reports this week indicate that the Port is back to around 95% of through-put.

If correct that may be a big step to fixing at least some of the ongoing supply chain issues.

The US Central Bank seems very committed to reigning in inflation via the baseball bat approach of higher rates.

The market believes they will continue, and now the market will constantly assess the likely quantum and timing of that hit.

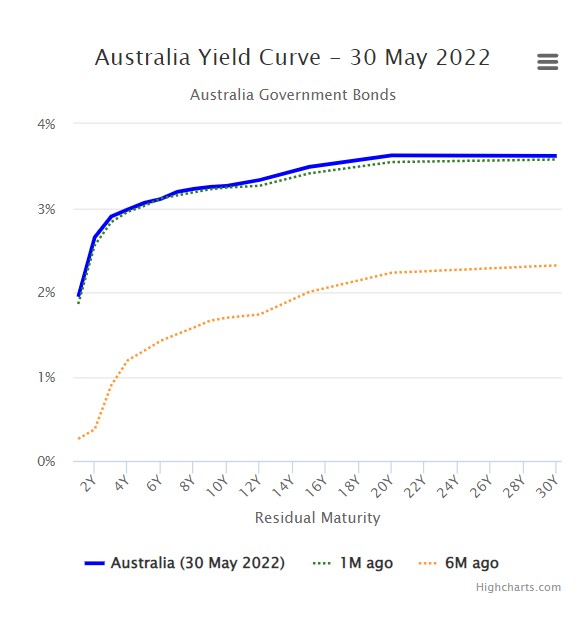

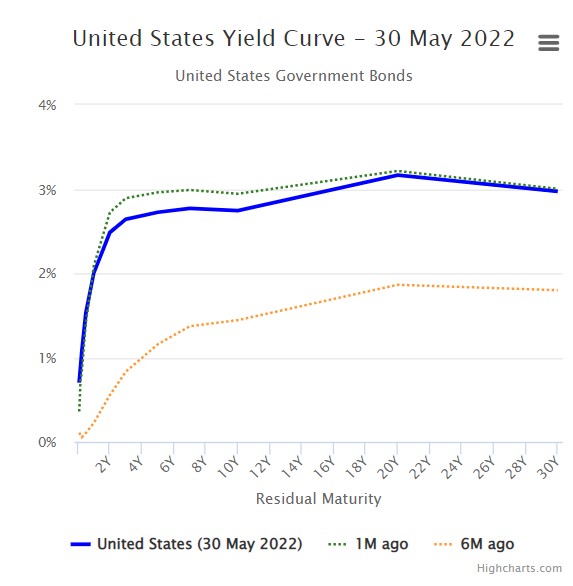

The ‘damage’ to yields both the USA has basically already happened – the yield curves below show how sharply they have moved from 6 months ago, but bugger all since. There’s even talk that it is a good time to buy bonds. Remember bond prices rise when yields fall.

The thinking being that the US Central Bank may need to pause or reverse quickly if business and households start to shut up shop. Of course, that goes against the demand side inflation trade that most people fear. And the very worst result would be the dreaded stagflation – GDP plummets but inflation stays high. I don’t see this as my base case… if it does I will look like this cat.

Equities were on the cusp of hitting technical bear turf when the S&P traded at circa 19% down from its highs. It has staged a bit of a comeback now to be only 13% down.

One reason for the stabilisation is that the lower share prices on offer started to make price/earnings (P/E) suddenly look less out of whack. Companies are generally making similar revenues (earnings) so the lower prices look more attractive, especially for dividend stocks.

Domestic Duties

GDP out this week – we are expecting a modest qtly result of 0.5% for an annual rate of 2.8%. That result will be a “move on, nothing to see here”. Bigger fish to fry in months ahead.

Labor will present their recommendation to the Fair Work Commission for increases to minimum wages. Personally, I don’t see a 5% odd increase being the end of the world. A lot of chat I am hearing is that wages are rising faster than that already in many private sector roles. As I mentioned above, the potential grenades come later if inflation moves from supply to demand, and wage increases become entrenched into the system. Inflation expectations are thus key. We are tracking better than most western economies in that regard so far.

CBA data:

Banks

Westpac sold an asset advisory business to Mercer for circa $225M and is rolling some BT funds into a merged Mercer outfit as well.

No big deal but the market liked it. Westpac have not covered themselves in glory with financial advisory accolades over recent years.

But all banks have had a pretty good run. I still remain overweight in banks in my portfolio but they are bloody hard to sell – good dividends and good prospects.

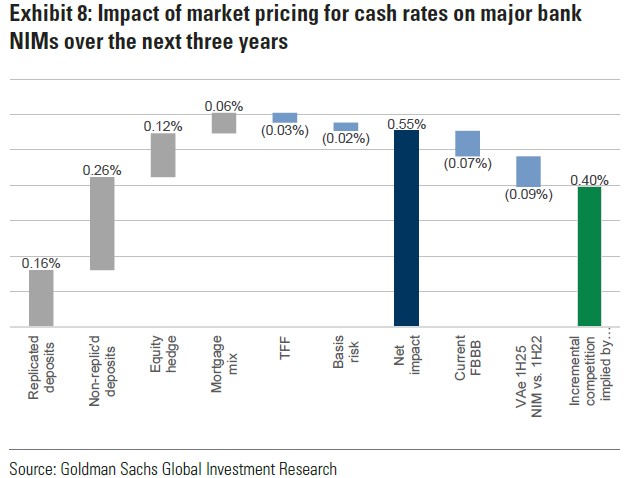

With current interest rate pricing, Goldman’s see a 55bp pick up in banks’ net interest margins in the next three years. Provided those same higher rates don’t blow up commercial or home loan defaults (which we are not expecting), then banks now have some great ‘tail winds’ to help.

Tweet of the week:

The Aussie Dollar and Commodities

Many may recall I tend to often have a negative bias against the AUD despite a wise man once telling me to “never under-estimate the Aussie battler”.

Well when everyone was calling the AUD to the moon on the back of commodity prices I didn’t drink that Kool-aid. When the AUD went below 69 cents I felt vindicated, but it has bounced back into the mid 71 cents.

As you can see in the forecasts for the quarter ahead, it is now evenly split between beliefs in a higher vs lower AUD, that sees it balance out to around current levels.

Could be right, but our currency is getting pushed around with increased volatility as:

- Commodities climb higher… good for AUD

- China’s economy slows on Covid lockdowns (and increased inflation/debt)

Oil is up around $120 a barrel – not good. Banning Russian oil via sea makes sense, but expect fuel to stay high for much longer. It is now costing Pom’s over a 100 quid to fill a 55 litre diesel tank.

Politics

You may expect I would be celebrating the Federal Election result.

Yes and no… I am thrilled to see a mean spirited, immoral, incompetent and corrupt government depart. The “quiet Australians” apparently are not all racist homophobes that favour bribes over a functioning planet. Surprisingly young people and women vote.

The dip in primary votes for Labor hardly shows them as being strongly mandated for their policies which, to be fair, are largely underwhelming. But they do have a majority in their own right.

Key interest to me is how do both major parties deal with this sudden new third power: independent’s. To treat them with contempt (e.g. LNP) is at your peril. I feel this is not a one off protest vote but rather what I have been saying for some time. The two party system is broken, and Australian voters demand better.

How good is the Barrier Reef…

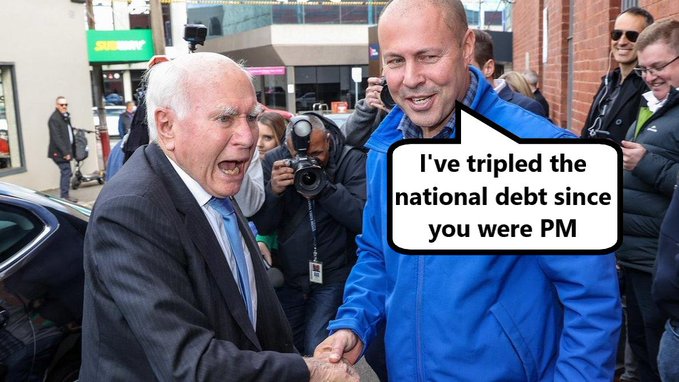

Bye Bye Josh

Bye Bye Josh

If the new Opposition Leader, the very handsome Peter Dutton, follows instructions from the LNP major sponsor, Uncle Rupert Murdoch, they will quietly slip to the Right as he instructed the Republican Party to. It matches so nicely with the Infotainment that is Sky-News.

If that prediction (fear) is true then it would be a huge mistake for them and Australia.

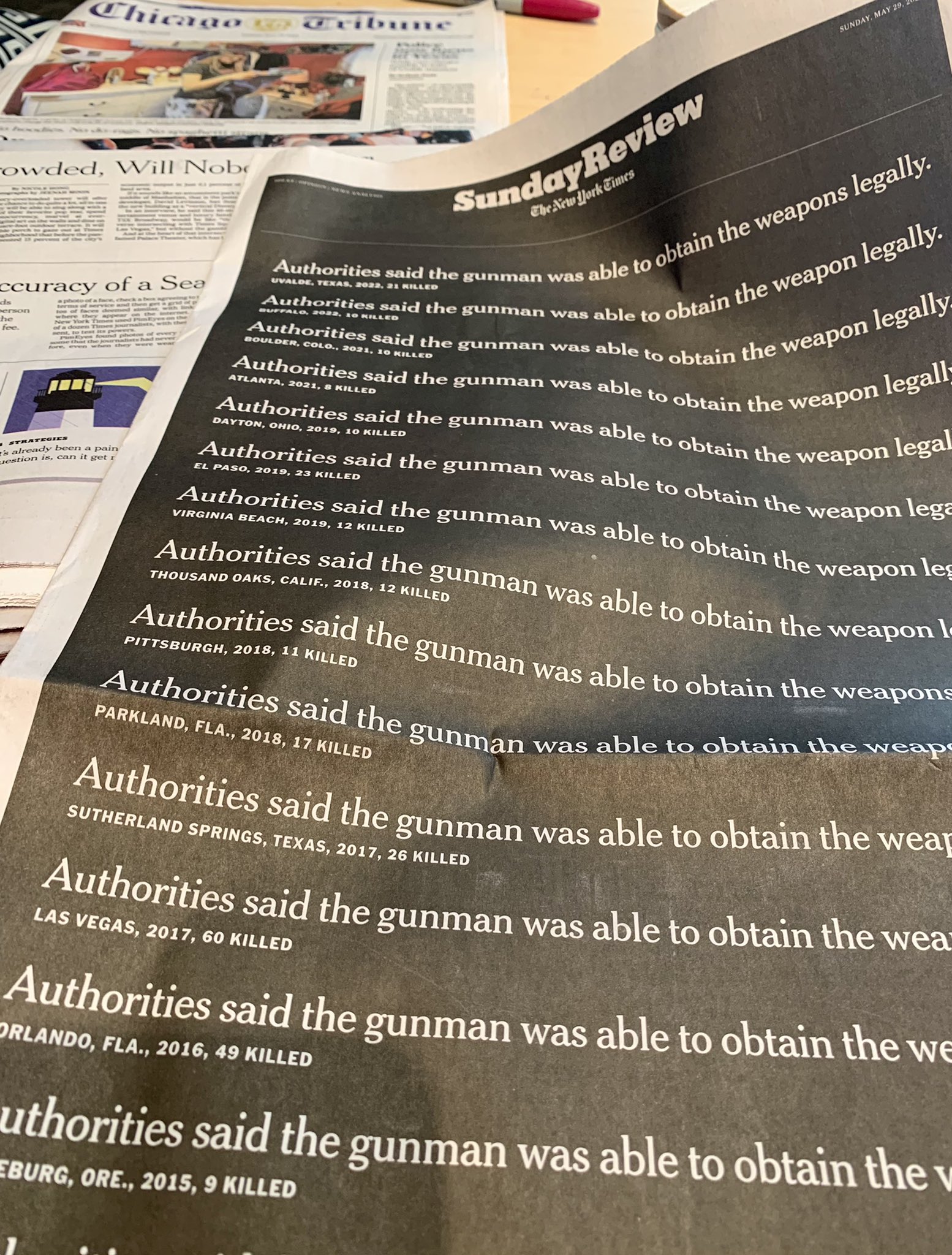

We are not the USA, as the New York Times explains very well. Hat’s off for gun control via Howard and Tim Fischer.

Political donations remain a major issue, here and in the USA. Gun Control will unfortunately never get traction in the USA. The plan now is to “harden up” schools with more weapons.

The once wacky, now seemingly normal Mitt Romney as a senior Republican has personally received $13.5M USD from the National Rifle Association. What do you reckon his chances are to vote for gun control?

Housing

Metricon construction company is getting a lot of attention, largely because they are large…

CBA have stumped up another $30m to help them, but they are not unique. Two Queensland builders folded this week.

How can this be, with housing ‘on fire’, you might ask?

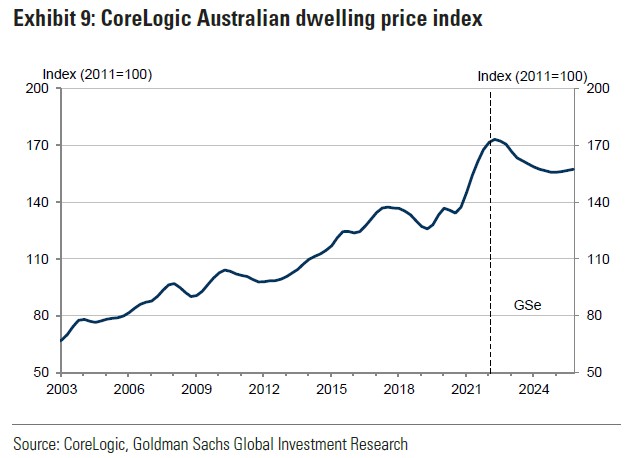

Forget the year 2000 in the chart below – that was a one off hit with the introduction of GST which was factored into sales and costs.

If a construction company entered into a fixed cost building contract in the last two years, there is a very good chance they lost money on it due to higher costs.

A senior Property banker told me it is not uncommon at the moment for builders to go back to their contract buyers and offer them a cash payment to withdraw and not do anything. Cheaper than building at a loss.

I do get asked often: “how big will the pull back in house prices be?” My crystal ball is probably as good as yours (who picked a 22% gain in 2021?). I feel it will be pretty tame though, more a plateau than a cliff.

Goldman’s did a deep dive and they see it as:

Seems about right. Westpac expect a 8% fall in 2023.

Media often refer to household debt leverage and what a disaster higher rates will be. No doubt for a few, but for most Goldman’s highlight that debt servicing will be at or below long run averages.

My Chateau will be ok. I have increased value by installing an outside kitchen.

And meanwhile:

Crypto and Gold Land

The whacking of crypto has gone mainstream. Every media outlet is now having a swing.

To be fair, most don’t understand Blockchain technology or what it can do – for good or evil.

But the very thing that makes it appealing to the rebels looks to be ensuring that it will only be successful in the hands of the old guard.

New punters like the fact it is UNREGULATED. Most old money and central authorities despise that it is UNREGULATED.

UNREGULATED means it is fantastic for punters that want to treat it like a BetFair account, but not for anyone that sees it as an investment and store of wealth.

CBA have paused its roll out of crypto trading, citing a need for more regulatory certainty.

Our guest writer, some 12 months ago, warned of just this thing. Big Banks, Central Banks and Old Guard money will only embrace this new world if they can control it and get their slice of the action.

Question now is how many new punters are there out there in the wings with money and an appetite to jump into crypto at these new “bargain” prices?

In AUD terms, BTC is down 45% on YTD. My Ripple investment more than that.

I could double up to catch up, or even triple up to f*ck up. Yeah-nah, I’ll pass.

Gold is doing very little price wise. I’m still holding gold in AUD as a small hedge.

ESG and Carbon

Aussie carbon credits went higher on the back of the Labor win with a belief that increased action will happen.

If you are looking for a classic case study of how to stuff up a company, you need to go no further than AGL.

They are Australia’s largest domestic polluter. Don’t get me wrong, I like my lights working. But their share price has fallen two thirds in five years.

They had an idea to move green and transition away from coal years ago. Under pressure from the LNP, they scrapped that idea and doubled down into coal, and lost their CEO in the process. This week they had their arses handed back to them on a platter when they failed in a bid to split company assets to allow the coal fired power stations to power on. And they lost a CEO AND a chairman in the process. Cock up after cock up.

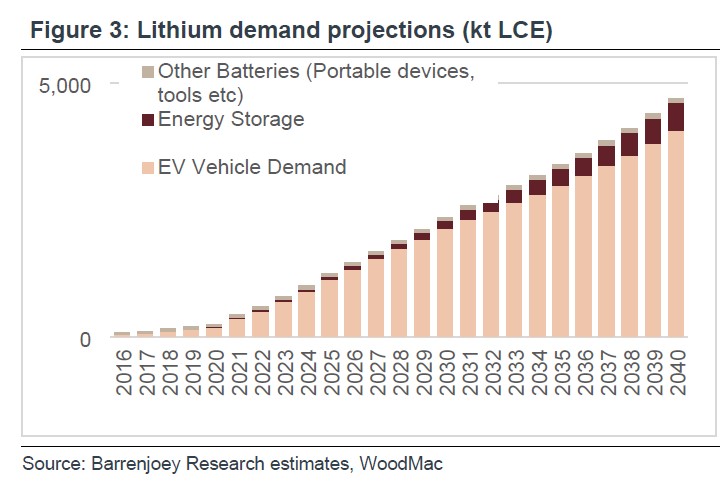

I’ve mentioned this before but expected future demand for EV’s and thus lithium is incredible.

Look at the chart below and find 2022, then look forward to 2040… not that far away.

Drinking favourite…

I was away with blokes last weekend, and a very nice meal at a toffee seaside pub/restaurant.

It’s highlight is a cracking cellar with aged wine.

We chose a 2011 Kangarilla Road Cab Sav. An 11 year old McLaren Vale red at $65 seemed worth a go.

Web says: ” Opaque black dark red colour with dark red hue. Aromas of blackcurrant and mulberry are to the fore followed by some cedar and spice. Medium to full bodied the palate possesses flavours of blackcurrant along with a touch of dark chocolate, some cedary tobacco like qualities and spice. Dryish finish with fine grained tannins. ”

Not sure it was a perfect match for my whiting, although I had a Chablis with entrée.

Collective vote was a resounding yes. Good drop. Not old and musty as some aged wine can get.

8.5/10

Listening to…

Moving away from Spotify this week.

This popped up on my YouTube as a random last week. I have been watching Peaky Blinders so maybe the ‘machine’ knows.

Anyway, play this on your telly, not your phone. Play it loud.

Make sure no kids (or those easily offended) are nearby.

Drink and dance.

The best version.

Speaking of easily offended… apologies… but funny:

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS