Tag Archives: Wine

2023 July edition – The art (heart) of a deal

14 July

The Ashes series has been an absolute cracker. Early Tweet of the week contender in response to the English cricketers saying "we could have won both the first two tests". Big Picture Sometimes I can be persuaded into thinking "this...[Read More]

2023 Edition #3 or 1A ? Hurts me more than you.

12 June

Big Picture I could claim strategic and technical errors for delay, but truth is the market has me quite confused at present. A bit like the ABC getting abused for being too left and being abused at the same time for being too right,...[Read More]

2023 Edition #2: Revealing it all – must read.

21 March

Big Picture It is all about the bonds - and not James Bond. But before we look at the shitshow that is the world market, an announcement. This scribe has long had "a crack" at dodgy banks, politicians and market participants -...[Read More]

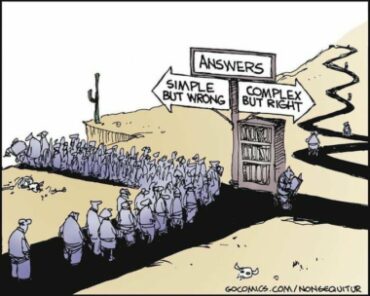

2023 Edition #1: What is ahead? Simple.

8 February

Big Picture OK - so regularity is not Black Swan's core strength. Bit of festive season lethargy overlaid with rapid time slippage. But the garden has never looked better - rather weed than write. So what is ahead? A bit like the...[Read More]

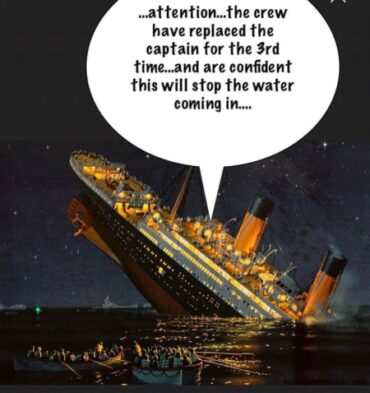

2022 Edition #15: UK – Let’s try again…

10 November

Big Picture It has been a while - we have had three UK Prime Ministers since the last update. Serious case of writers block - but I will try to unpick the bits that piqued my interest over the last month. The UK experience is amusing. ...[Read More]

2022 Edition #14: Magda not MAGA

27 September

Big Picture I said "Luv", I said "Dear" I've been in mourning. To be fair Queen Liz was a cracker, but none too keen on the next crop. Picture below of the real King and some bloke called Charles.... At least the...[Read More]

2022 Edition #13: Pivot…what pivot?

30 August

Big Picture It's just a jump to the leftAnd then a step to the right Put your hands on your hipsYou bring your knees in tight Been awhile - and I can't say that there is bugger all to talk about in the markets. But here is a metaphor for my...[Read More]

2022 Edition #12: By (buy) the Curlies

2 August

Big Picture I can't believe it has been nearly a month since episode #11. I would love to blame a case of Covid or a boring economic landscape - but neither are true. There is too much to cover - but I will try to keep it real.... In a...[Read More]

2022 Edition #11: Rock Bottom?

5 July

Big Picture Rock bottom? I'm not sure, but no razor blades are out for me. Some degree of near panic as asset prices in property, equities and bonds are all pretty volatile. Just when you see the smidgeon of calm and a rally, the rug...[Read More]

2022 Edition #10: Perfect storm

17 June

Big Picture Never really understood that saying - storm being a negative and perfect being a positive. Incredible how quickly "the vibe" can change. A few months ago, I was a zealot for calling the chance (to be fair not always my base...[Read More]

2022 Edition #9: Back to the whole (hole) one last time

31 May

Big Picture More contemplating than writing recently - but a few thoughts on recent events. I was like a hawk chasing starlings - too many targets to aim at. Clearly the changing of guard in Federal politics is a biggy (see...[Read More]

2022 Edition #8: Part 1 – The Big Picture… No Furphies

8 May

Hello volatility my old friend... glad to see you again. US and Aussie Central Bank hikes dominate the landscape. As pointed out to me this week, a 50 bps hike from the FOMC and US equities surge by nearly 3% and the US dollar weakens. That...[Read More]

2022 Edition #7 : Part 1 (Suck eggs) The Big Picture

20 April

Big Picture Easter has come and gone. No sign of Queen Bessy. Sincerely hope she is OK. Britain has had a rough few years - they need her. Worse... PM Boris Johnson has been placed on a Russian travel blacklist. Trips to Moscow are off the...[Read More]

2022 Edition #7 : Part 2 (F Off) – Banks, FX, Commodities & Politics

20 April

Banks Bank of Queensland bought ME Bank mid last year for $1.3B. It expected costs to be steady and profits to flow. They presented a profit result not too far from predictions but got smashed - share price fell by 6% odd. Pundits not happy with...[Read More]

2022 Edition #7 : Part 3 – Housing, Crypto & Thoughts

20 April

Housing A quick look overseas to see how they are dealing with rising prices. Who knows, it might be an electoral pledge from either major party in coming weeks. In Canada, house prices have gone up 50% in the last 24 months. Average price is...[Read More]