Big Picture

I can’t believe it has been nearly a month since episode #11.

I would love to blame a case of Covid or a boring economic landscape – but neither are true.

There is too much to cover – but I will try to keep it real….

In a global sense, I am cautious over the US economy, and even more sceptical over China.

But as a die hard pessimist, I still can’t see the case to argue that Armageddon is nigh – despite me calling such as likely by now in my blogs from mid 2021.

Slow to the party, the FOMC remains hellbent to “kill” rampant inflation with monetary policy as the main blunt instrument. Quantitative tightening seems to remain in the background for now…despite QE as being a primary catalyst for asset mis-pricing and ultimately the underlying inflation.

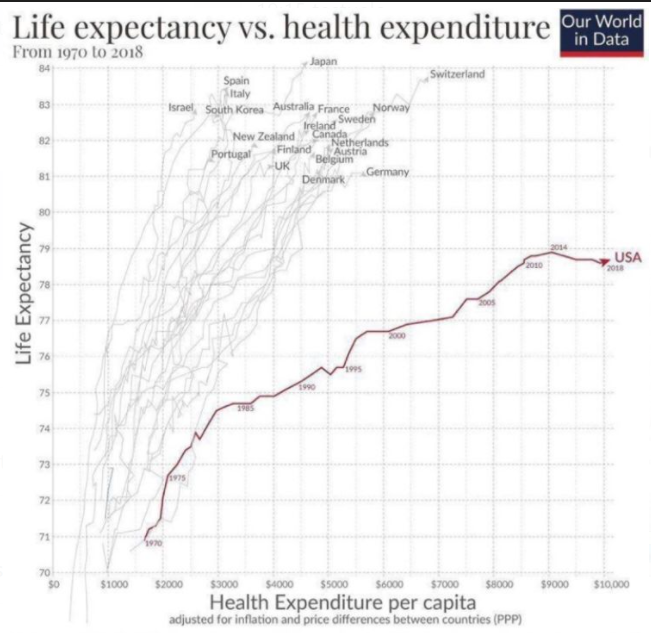

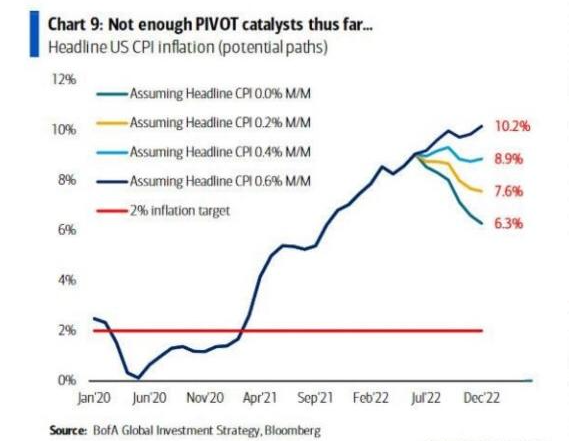

Already some evidence that the inflationary peak is very close in the USA (and likewise here). But the chart above highlights just how much catch-up the FOMC needs to do. IF inflation moves to 0.0% each month between now and year end, the USA will still have a 6.3% inflation rate.

Energy is one area where there may be a significant pullback in prices, but oil is back over $100 USD a barrel again. Little sign of a resolution in the Russian/Ukrainian stink despite at least the first shipping export of Ukrainian grain.

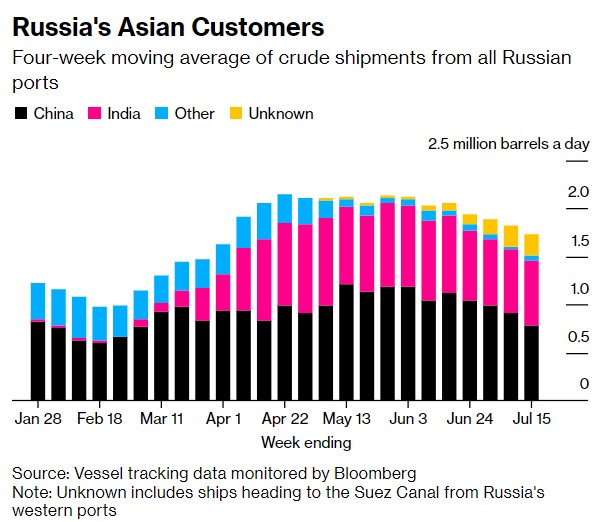

What feels a bit stinky is India increasing its buying of Russian oil. You can see the pink in the chart below – increasing from stuff all in March to over a third of their imports now. Bloomberg says they are buying the oil at about a 10% discount to market – dodgy brothers. They explain themselves by saying if they didn’t buy Russian oil, they would buy elsewhere and thus push prices even higher. Reasonable economic argument, buy explain that to Zelensky.

But the commodities basket index has clearly turned lower.

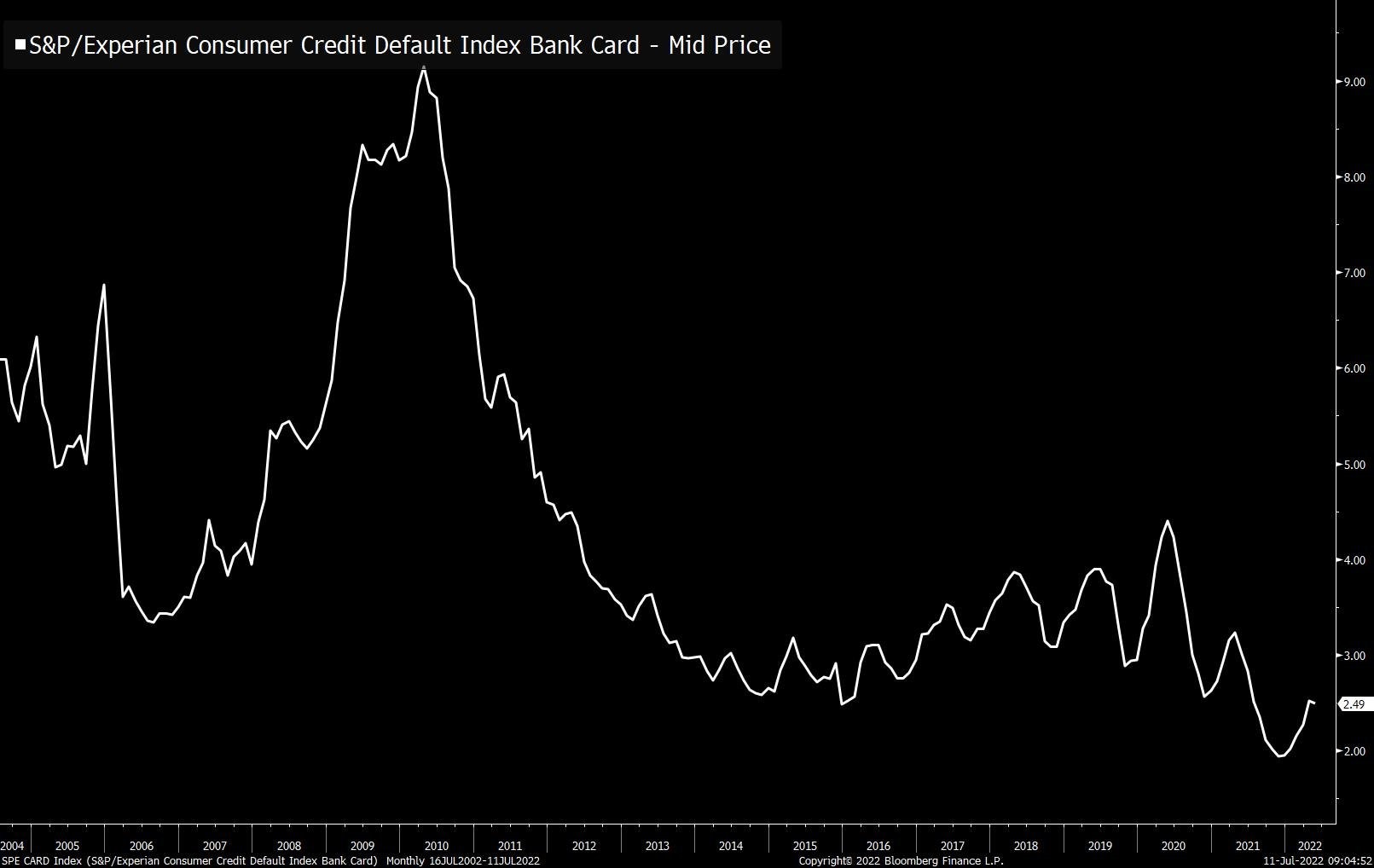

Defaults on consumer credit in the US is rising (chart below) but still at low levels.

US GDP is in “technical recession” after last weeks second consecutive quarter negative number. Biden avoided the nastiness as the National Bureau of Economic Research (NBER) apparently has the last say as to what is and what isn’t a recession. Bizarre.

So, why am I so calm on the markets? The pace of rate hikes is a concern (especially here) but the US equity market rallied after a 75 basis point hike last week. Why? There was talk of a possible 100 bps hike and the FOMC’s Powell indicated that future hikes may slow and become more “data dependant”. In other words we are back to the times where bad news is good news for equity and bond markets.

I struggle to see a prolonged bear market whilst unemployment remains low here and in the US. Certainly unemployment in the US will increase in the back half of this year – but anything less than a 5% number would be fine in my opinion. And if it breaks 5% the market is betting that the Fed will “pivot” towards cutting. That is a big if.

Speaking of BIG if’s. Collectively we are hoping that China will open up in a post Covid manner sooner and supply chains race back to norm.

Not 100% certain of that and some serious pessimism remains over the way the CCP and local municipalities are dealing (bickering) with tax sharing and property funding. Whilst this is happening, Chinese property is withering on the vine.

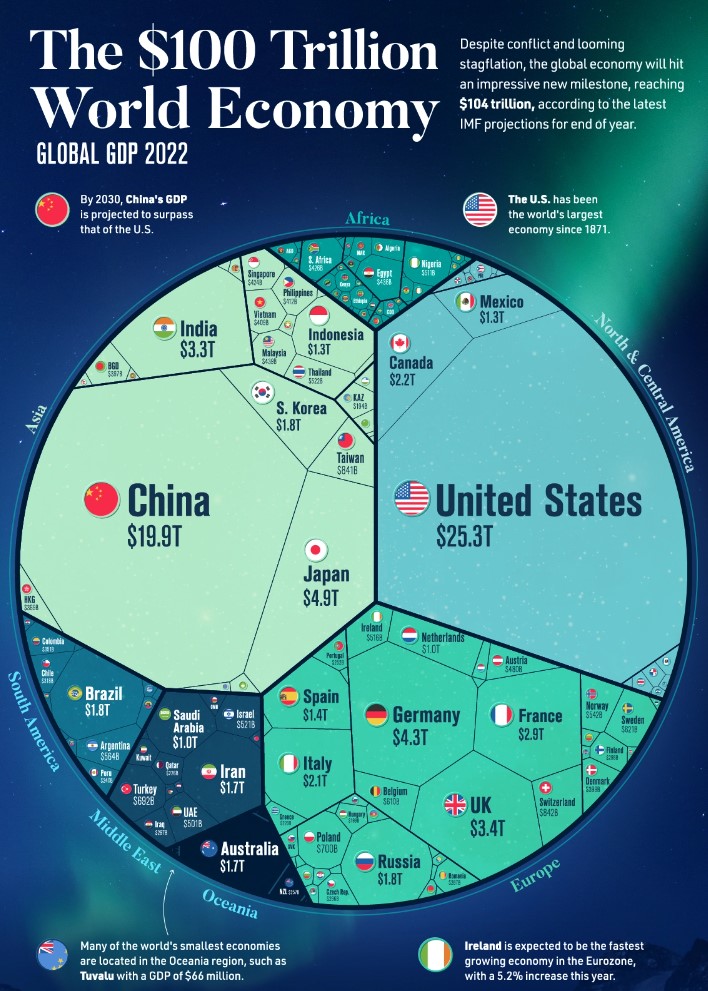

An interesting chart on where we all fit in “the world” – literally and economically.

That sliver to Australia’s bottom right is New Zealand for any Kiwi readers.

Finally – Boris Johnson is looking for a new job after his party tore him a new one.

His biggest plaudit and “legacy” is getting Brexit done.

History may not even look back at that with much glory.

The fear index (VIX) is trending down so for now the bulls can run – just be ready to be quick on your feet.

Domestic Duties

RBA lifted rates by the expected 50 bps to 1.85%.

The statement seemed to indicated more to come but acknowledging that the RBA will be flexible to changing domestic and international events.

Market reaction was fairly muted.

Lots of charts doing the rounds that mortgage holders are holding lots of “buffer” against higher mortgage rates, and valuations will be fine given the rapid run up in values in 2020/21. True enough, but if Aussie property is at its heart “the ultimate ponzi scheme” then you just wouldn’t want to be the last one jumping in.

The vibe is not brilliant at the moment. I oft lament the way media treat politics as a tool for quick clicks. The same is true for economics. The latest Aussie inflation number was no doubt high at 6.1% annualised. But it was BELOW forecasts and a number of the worst contributors to that figure (i.e. construction costs and fuel) may already be past the worst. We sometimes talk ourselves into a recession.

A good question was asked recently of a credentialed economist (is that in itself an oxymoron?). The question was “what is worse – high inflation or high unemployment?” They answered emphatically – high unemployment is much, much more damaging – and can be generational. So hopefully the RBA get their priorities worked out early.

We have historically low rates still, historically low unemployment and corporate profits here are holding up well.

There is a lot to like at the moment.

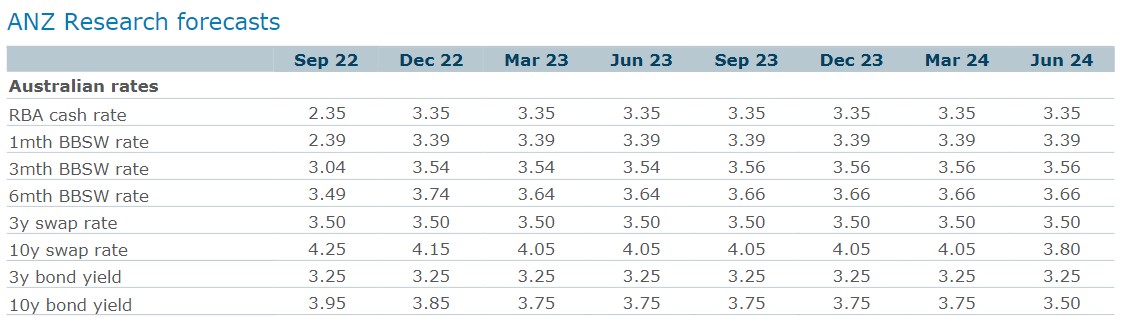

But that aside, ANZ have raised their cash rate forecasts again into 2023. They sit much higher than CBA;

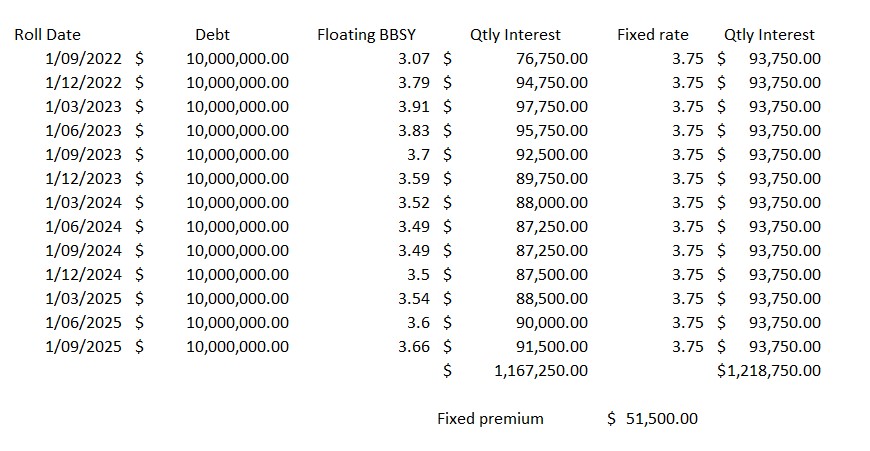

So for sport I mapped out how perhaps a business with say $10M debt would measure how current fixed rates “look” compared to variable.

Admittedly this was last week, and floating rates have moved since – but still good as a demonstration.

Floating rates assume 90 day Bill Futures as published by the ASX, but at BBSY.

Fixed rates assume ANZ 3 year swap rate with a 25 bps add on for execution;

The result was a premium for fixed (but not huge). What is certain is that floating rates will not track current expectations over the coming months – so that premium will either increase or perhaps become a discount…..

The result was a premium for fixed (but not huge). What is certain is that floating rates will not track current expectations over the coming months – so that premium will either increase or perhaps become a discount…..

ANZ data:

Banks

Just a quick reference to a recent AFR article.

It makes the case that we all suspect – banks give new customers a better deal than long standing customers.

Looking only at home loans it calculates customer loyalty is costing $4.5 billion a year. Some of its inputs are doubtful, but it suggests back book borrowers are paying circa 0.90% more for their loans than front book customers.

The message was clear – don’t consider banks like mummy dog below and shop around and revisit your facilities on a regular timely basis.

Maybe brokers have an important place in the world after all…..

The Aussie Dollar and Commodities

Commodities prices looked to collectively tip lower (see earlier CRB chart). Hard to see past that the market is expecting lower demand ahead – and especially from China.

The Aussie dollar has fought valiantly to regain 70 cents after dropping to the mid 60’s in recent weeks.

In a change from my usual perspective, I see a chance that the AUD moves even higher to the mid 70’s over the next few months. This is all about the expected continued slow down in the US economy and potential for the FOMC to “pivot” on higher interest rates. As such the USD is finally losing momentum and allowing the AUD to push up.

Politics

Plenty of sideshows, but actually pretty quiet finally.

Housing

Housing being the biggest talking point for most punters, the news seems somewhat bleak.

Remember however that almost all economists picked a 20% fall in housing in Covid 2020, only to see value race higher.

Well they are back and calling a potential 20% fall again.

Certainly prices (via reduced demand) will fall on decreased affordability – as it should.

Media seem to focus largely on Melbourne and Sydney. Perth, Darwin and Adelaide all are still rising…albeit slowing.

For what it is worth I see regional Australia property holding up well – with most likely a period of plateauing prices.

Keep in mind though that RBA do not place house prices high on their agenda when it comes to rate setting.

Crypto and Gold Land

My gold holdings are now only 6% up on purchase price (over 15 months), but just ticking along.

Interesting chart below. With gold being based in USD I always feel somewhat nervous about holding unhedged AUD gold exposure.

The chart shows some big swings in annual return, over time USD and AUD holdings return a very similar outcome.

Same old base story though – inflation is aiding the gold price, but higher rates are increasing holding costs and pushing prices down;

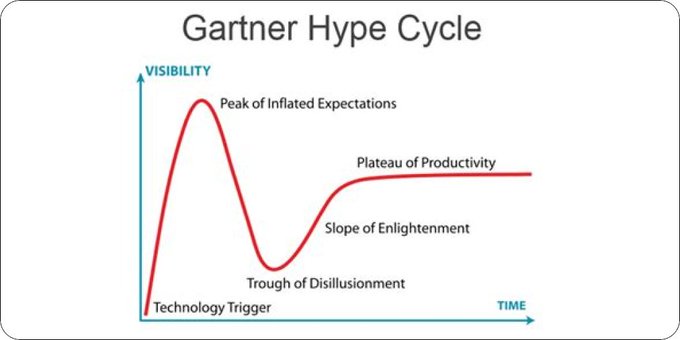

Crypto remains at an interesting cross road.

Research crowd Gartner seem to have tracked the broad theme of crypto.

Some serious players seem comfortable enough that the recent shakeout has cleared the deck of “uneducated” speculators, leaving room for the next run higher.

Certainly for Bitcoin I thought seeing the $20K USD level break would have seen a flood of panic – instead it bounced back over $20K and has held that as support for some weeks now.

Media, with very little understanding of crypto or blockchain technology, jump on any crypto exchange collapse as being the end of the world.

Certainly though there is some contagion risk. Crypto lender Celsius has fallen over owing a reported $4.7B to 1.7 million investors.

One of the best articles of recent times is here : AFR – Will crypto survive?

I can send you a dodgy PDF if you are not a subscriber – send an email to noreply@icognitomarkets.com (yes – I see the irony)

ESG and Carbon

ESG funds have massively underperformed fossil energy companies over recent times (as expected).

My sustainable EFT is square to the card after 18 months. Hold is the plan.

My lithium stocks (I doubled up recently with another Aussie miner) are on a flyer though.

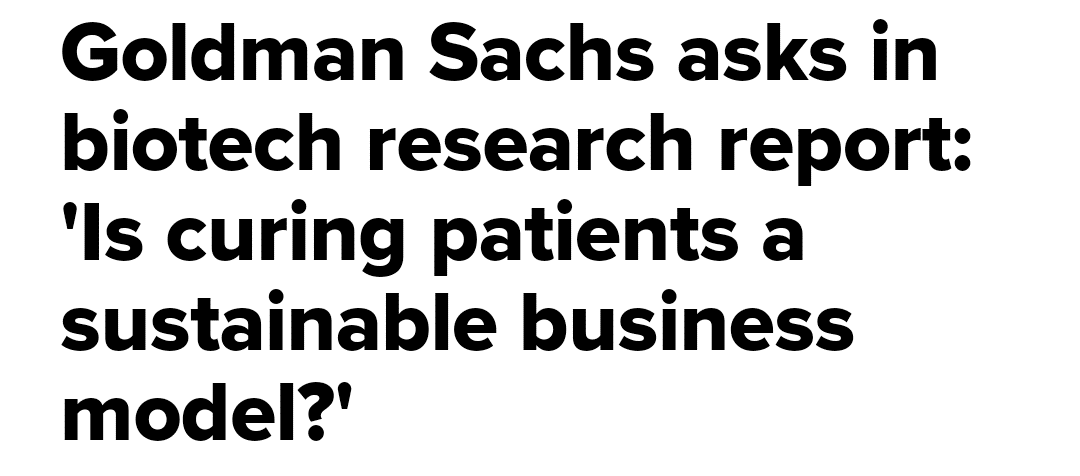

Slightly off target here is this chart below. It maps health expenditure per capita against life expectancy.

Incredibly, you have a better than even chance of dying younger in the USA. Perhaps part of the reason for that is that spending per head is not keeping up either. For what it is worth, Australia is mid pack.

Of course maybe Biden is listening to Goldman Sachs:

Drinking favourite…

Ceretto Dolcetto D’Alba Rossana 2017

Experts say:

“The Dolcetto Rossana of Ceretto is produced with grapes cultivated in the the “Monsordo Bernardina” estate, at the door of Alba city, in the earth of Langhe hills.

It has a ruby red colour with violet reflexes and a fresh and delicate aromas, with ripen cherry, black berry and currant scents. The taste is dry, elegant and fruity with a light aftertaste nut brittle. It is a perfect wine for all meal or in combination with typical piedmontese courses ” [sic].

A mate bought it for me a few years ago. I cellared it and shared it with him over a steak last week.

I thought it was uber expensive – but the net says it is circa $40 a bottle.

New grape variety to me – Dolcetto I’m told means little sweet one. To my palate it seemed more like a cross between merlot and cab sav.

Pleasant indeed.

8.75/10

Listening to…

Hard to go past Archie Roach this week.

I didn’t always like all his music, but his place in Australian story telling will be enshrined.

Takes awhile – but yep that is a night…:

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS