Big Picture

It’s just a jump to the leftAnd then a step to the right

Put your hands on your hipsYou bring your knees in tight

Been awhile – and I can’t say that there is bugger all to talk about in the markets. But here is a metaphor for my approach to starting Edition #13 so far..

The world waited with wild expectations that the US Federal Reserve would embed a feeling of an imminent “pivot” in their tightening stance. Head honcho, Chairman Powell, chose to reinforce his teams mission to drop a few more hike missiles onto the USA economy. Bringing down inflation remains THE priority. The market is expecting a 75 bps hike at the next FOMC meeting.

Plenty of updates indicating a slowing of the US economy, but US employment is growing around 400k a month…and low unemployment continues despite announcements of proposed labour layoffs.

So the pessimists say that yet again the FOMC is behind the curve – that the FOMC is “looking backwards” at historical data rather than the vibe on the street.

The optimists say that the Fed will do what it has to, and a soft landing is very achievable.

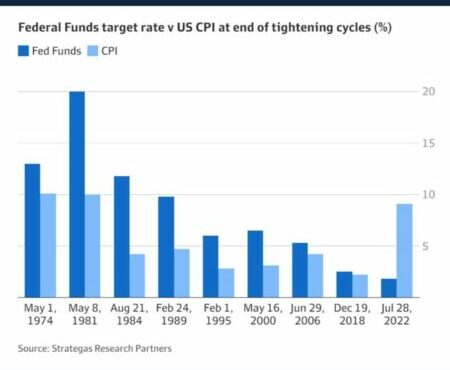

One chart for you worth reviewing. It is the last 9 US tightening cycles. The light blue bar is the inflation rate at the time of the last hike. You will note that the dark blue bar (Fed cash rate) was higher than inflation in all of the last 8 times – but has a LONG WAY to go before that holds true for 2022. Maybe why Powell is so committed ?

For what it is worth, my current view is that the US has a lot of real issues that could see it in danger of a sharp slow-down and possible recession. But their private domestic demand looks to be strong still, and I struggle to see economic mayhem with historical low unemployment.

That same scenario holds true for us here as well – I’m even more optimistic on the Oz front.

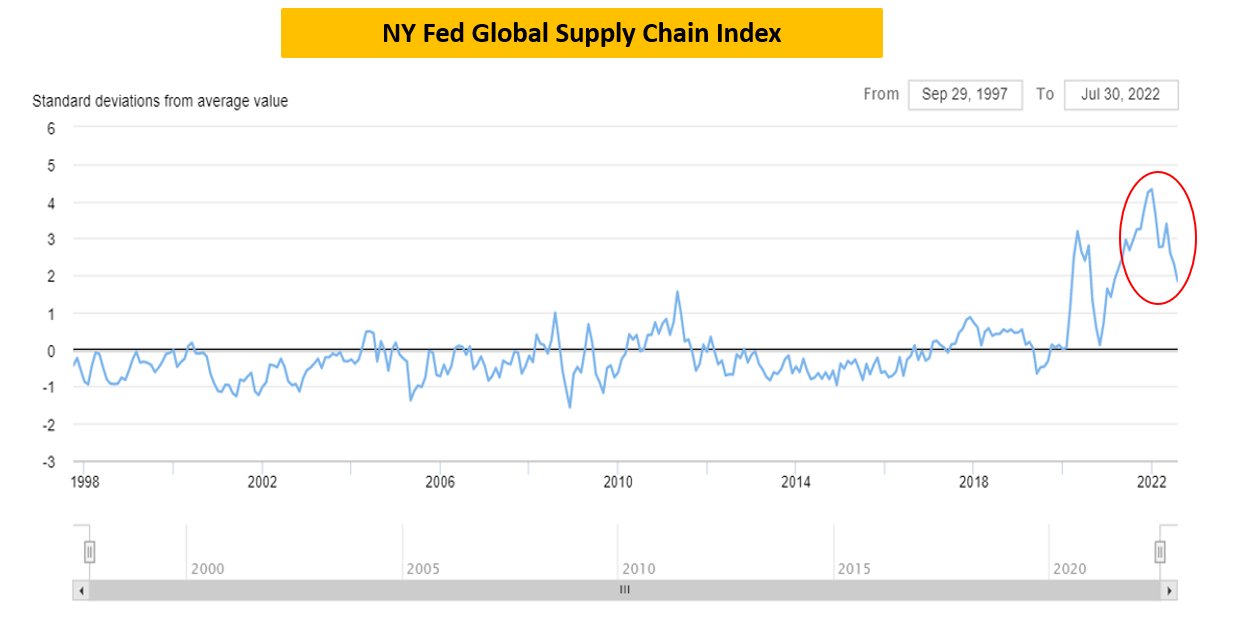

The New York Federal Reserve recently released a great chart showing the global supply chain.

It shows supply is trending very quickly back towards “norm”. If you believed current inflation is only caused from the supply side, then this might make you rethink. Demand certainly has a hand in the inflation pie.

US house prices are turning south pretty aggressively though.

This is partly due to supply of new housing being surplus to needs – very unlike here.

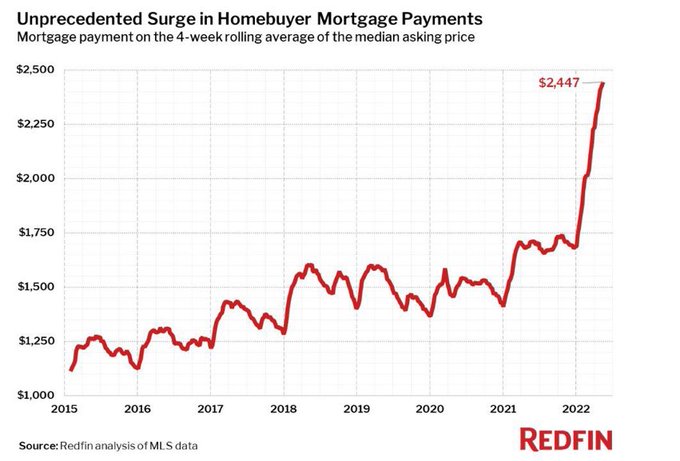

The other major issue is housing “costs” via mortgages. Chart below shows mortgage costs rising on the median house price for new borrowers.

Yes this will eventually see a downturn in broader US demand and retail sales – but as I’ve pointed out before…that IS EXACTLY what the FOMC (and RBA) want to see. It is the very essence of why they are tightening.

Regular readers also may know I love a good correlation chart … and ultimately believe it means a market’s reversion to norm. “This time is different” rarely cuts it for me.

The charts below map the current US equity market to various time horizons.

It highlights how charts can be bastards. Pick your dates and you can mount a very strong argument for a 20% movement in coming months – either way !!

So no panic for now I reckon, but don’t be complacent.

- I could be wrong

- A fall is coming – only a matter of timing.

On my portfolio I have steered a fraction more to cash, but not selling in large. I’m also topping up my strong bear fund EFT’s along the way as part “insurance”.

To quote former FOMC Chair Alan Greenspan from 1999: -“To spot a bubble in advance requires a judgement that hundreds of thousands of informed investors have it all wrong”.

For the Jim Cramer fans, a great professional put down by the Fin Times:

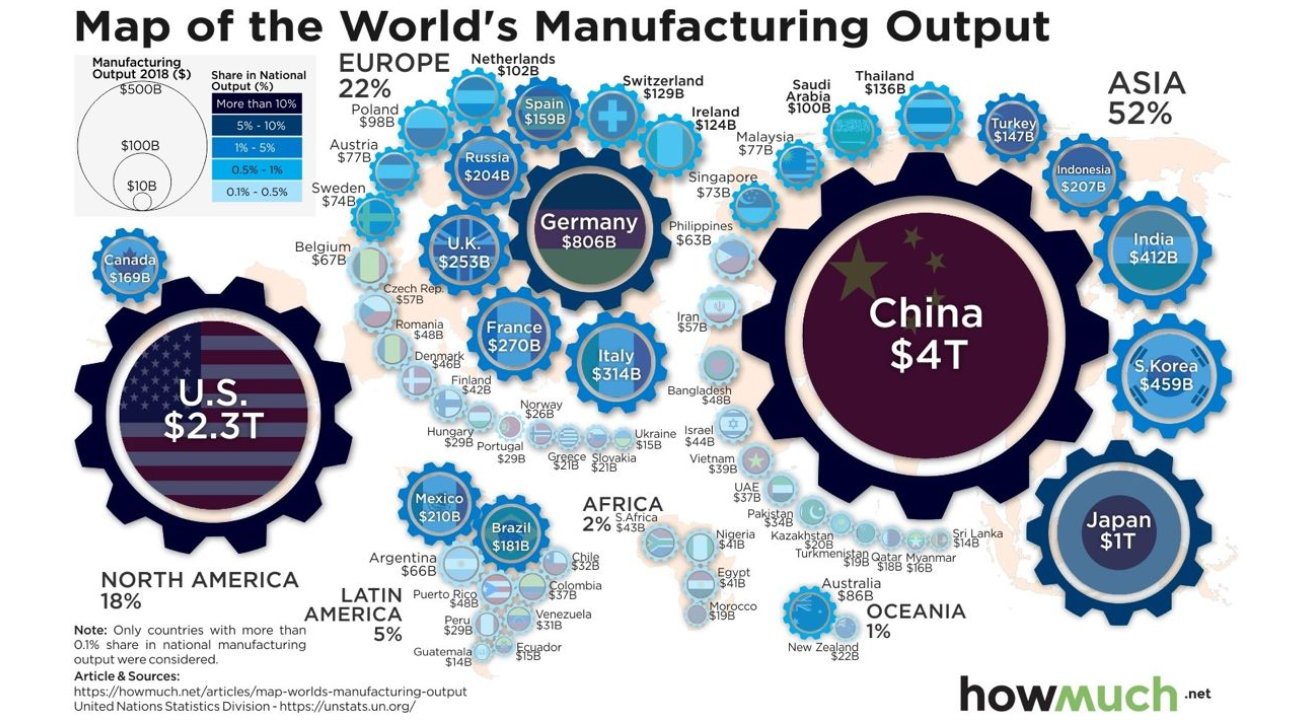

Last edition held a chart of global GDP comparisons. The one below is stripped down to manufacturing only.

Certainly sees China as the big dog.

It also shows that while Australia is really good at digging, we are not that good at makin’ stuff.

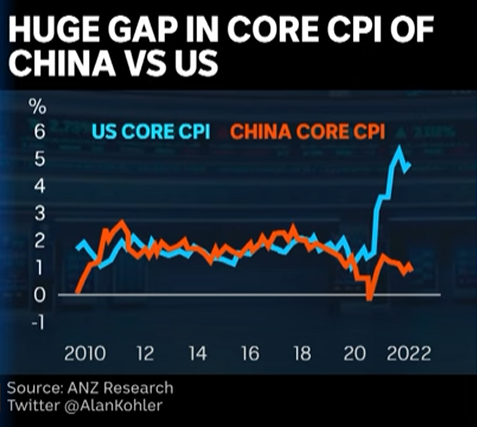

China still looks a potential wild card (black swanish) for global markets. They are in a very different place than most of the world.

Chinese authorities have cut rates and increased payments to stop the chance of massive property construction company failures.

Inflation not an issue for them.

Xi Jinping looks pretty set to win his 3rd term as Chinese President later this year, but zero Covid strategy has hammered economic activity.

Many politicians faced with challenges and poor popularity (refer Dutton) then head to sovereignty and safety to appeal to the masses. For Xi that could mean a move on Taiwan, but he would also be aware of the Russian shit-show and current Western countries holding a somewhat more than usual solidarity.

The UK is going through it’s own political challenges and inflation over there is truly out of control. Energy costs are wild.

All of these challenges are not necessarily related to Brexit, but six years on, I did chuckle at this front page:

Domestic Duties

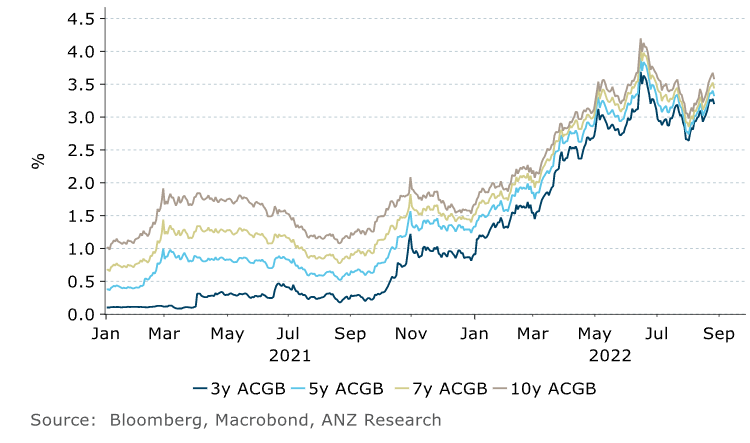

Our yields have started to creep higher again.

Partly as a result of the US Fed’s stance and partly domestic “strength”.

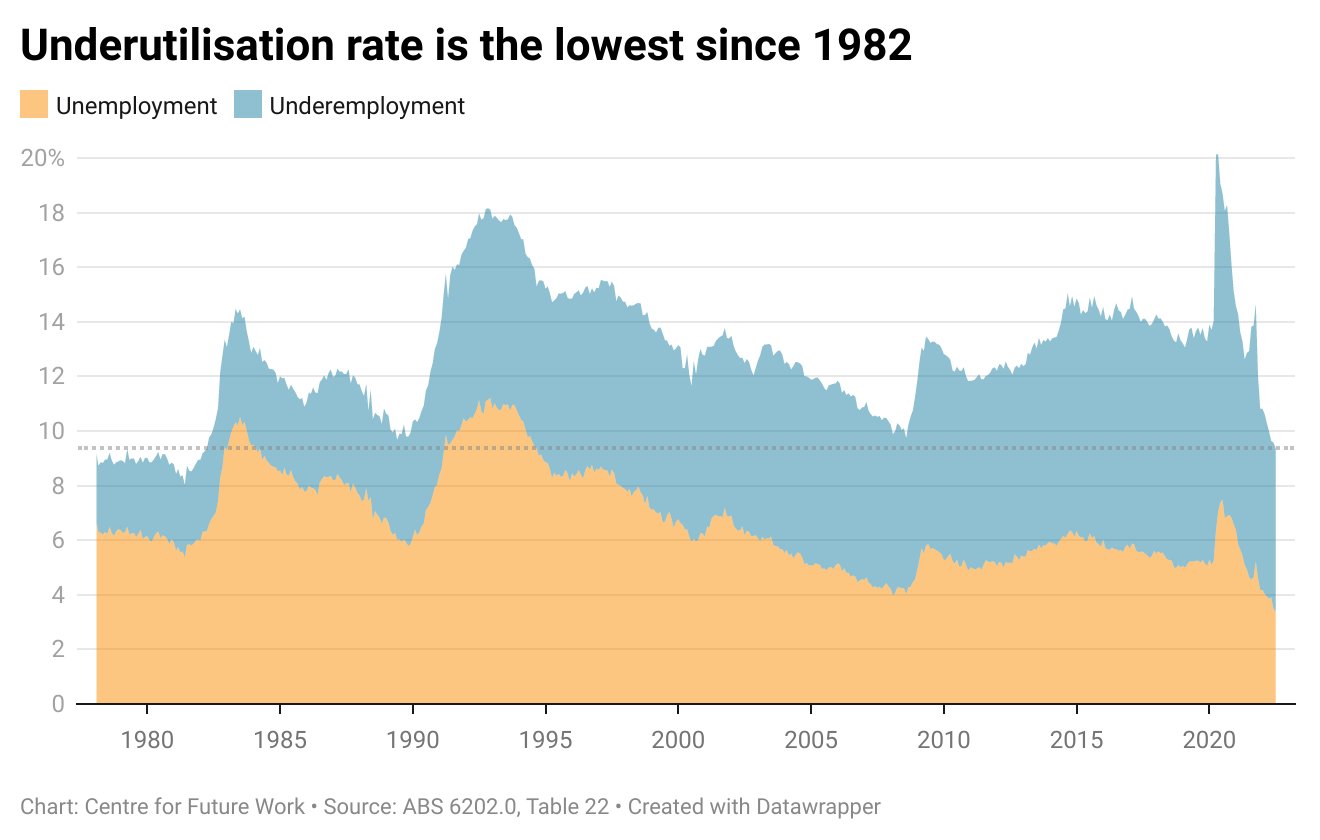

August unemployment dropped marginally to 3.4%, but mainly due to a fall in people looking for jobs.

Most pleasing was a new 40 year low in under-employment – those with a job that would like more hours. Remembering the ABS definition of a “job” is one hour per week. This is a great result.

It will be interesting how all this pans out post the Jobs Summit talk-fest and a no doubt increased focus on getting an increased migrant work force into Australia.

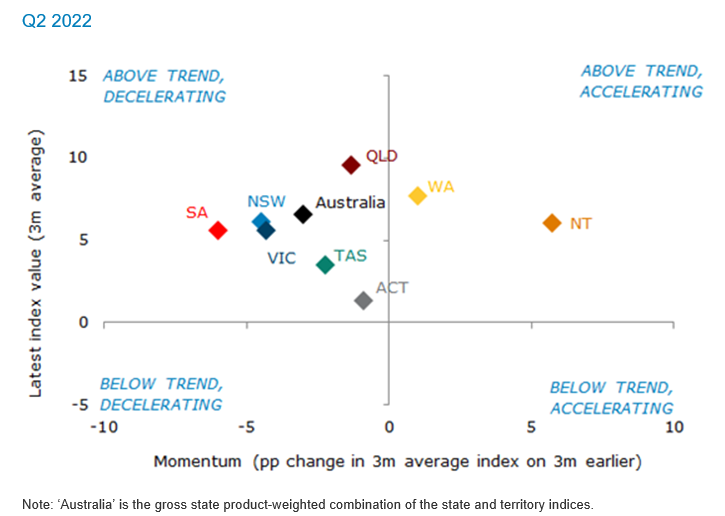

ANZ research is showing all states above trend. Only WA and NT have their foot on the accelerator though – most states touching the brakes.

RBA hikes will continue. As someone from Twittersphere noted yesterday:

“The average home loan size in NSW is $788,121. Last year the average interest rate was 2% and now it’s going to be 6% shortly. That’s an annual increase of over $21,000 in repayments. Do you know many people who can fit an extra $21,000 in after tax income into their budget?”

Business confidence remains ok. Consumer confidence is still sub par but a bit better of late.

The Employment talk-fest will also focus on wages.

The person responsible for below should be the first to earn a pay rise:

CBA data:

Banks

Whilst some of the personalities involved have question marks hanging over their heads, I have referenced Judo Bank a number of times as being “different” and likely to build a profitable niche.

The share price shows that most people disagree with me – it has fallen a long way from float price.

But it released its 2022 annual results last week – and beat most of its prospectus forecasts. NPBT at $15.6M is hardly spectacular when compared to the big boys, but over double forecasts.

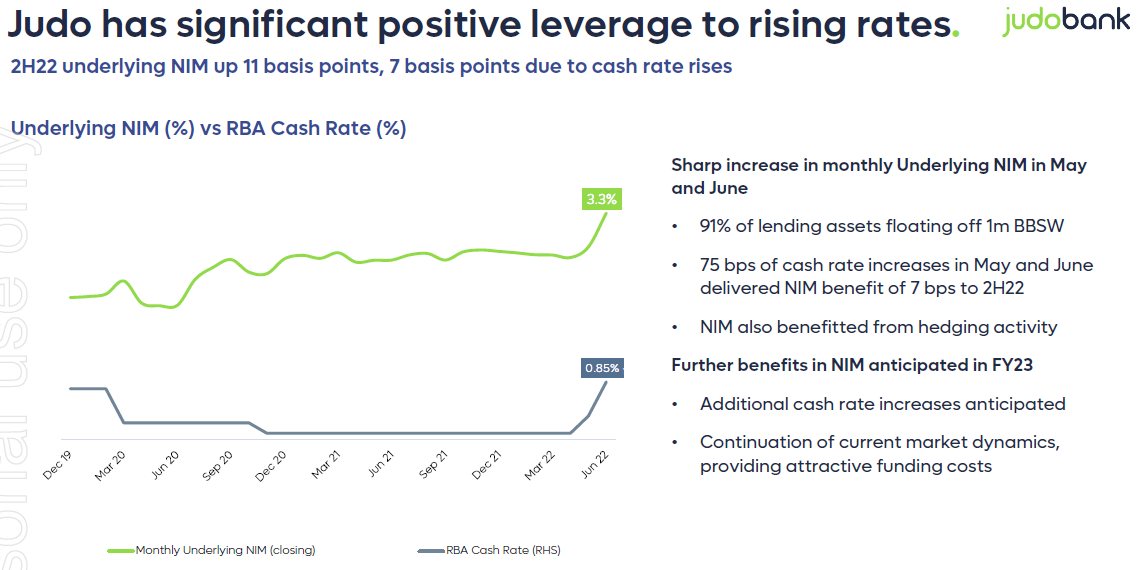

The graph that really was spectacular from their investor presso was net interest margin (NIM).

Focussing almost exclusively on the SME sector, the majority of lending is benchmarked to 30 day BBSW.

NIM of 3.30% is huge.

If they do achieve $20B in lending (from current 6B) then unless they stuff up credit assessment they should do very nicely.

I note that Judo is reducing it’s exposure to commercial property lending under a broader risk assessment. That is interesting.

CBA is publicly stating they want to grow their SME lending share, especially targeting NAB customers.

I see nothing of note to convince me either have the ultimate relationship model right.

Speaking of relationships…:

The Aussie Dollar and Commodities

Gas is the big mover. Europe is bracing for shortages after Russian Gazprom is stopping gas flows for maintenance. Could be just me, but maybe it is Russia being a prick. They are matching their maintenance timing with Norwegian down time.

Brilliant chart below. As you may guess I am not a great fan of gas fracking. But look at gas prices in Europe, the UK and the USA. Blue line is the USA – barely higher at all.

Northern hemisphere hydro-electricity generation is also falling as extended droughts take their toll.

The Aussie dollar seems stuck around 70 cents. Many other countries are seeing their currencies trashed by USD strength.

Lucky we are good at digging.

Politics

Where to start.

I truly spat my coffee out laughing when I read a SMH opinion piece from George Brandis. He states that Peter Dutton has hardly put a foot wrong. With a preferred PM score of 17%, I reckon there are a few that differ with Brandis’s opinion.

Since the last edition, the ‘Scott does everything’ secret portfolio(s) has emerged.

Many of my esteemed friends believe this is a big “so what” issue – just a political hit job that distracts from the real issue of “governing”.

I could not disagree with them any more. Funny how overseas media thought it a big thing.

The USA is holding onto democracy by a very thin thread. The trashing of long held democratic conventions may not be illegal (although taking top secret documents home may be…) – but each chip weakens the checks and balances.

Apart from the lunacy of what Morrison did (and the final trashing of any legacy he had) I want to know HOW this happened.

The Public Service has some questions to answer here as well. I am thinking of Yes Minister. Humphrey Appelby would tell Jim Hacker that doing something like this would be “very courageous”- that being enough to scare Hacker off it.

Barnaby Joyce also laid his credentials and lack of morals out for all to see as well, when he confirmed a National Minister and staffing were more important to him that ethics.

I wonder how my mates will feel, when the cancelled gas project of the NSW Central Coast wins millions of dollars in compensation, paid from their taxes.

Housing

“Fun fact about all those terrifying predictions of home prices falling six figures around the nation: they’re kind of made up.

Hocus pocus, mumbo jumbo, whatever you prefer.

They’re still important, mind you, it’s just they’re not, well, real.”

Well that is good news. It wouldn’t be like this is from News Corp and published on RealEstate.com.au – and they have a vested interest and bias?

Oh wait…

Housing is coming off the boil. As it should and as I keep saying…as RBA would expect it to.

Crypto and Gold Land

Gold doing bugger all. The cost of holding gold is increasing as rates rise.

We have mentioned before that the London Metal Exchange has had a few troubles.

Well there are also a few critics of London Bullion Market Association (LBMA). Cries of market manipulation are not just from the whacky Russians.

I’m not sure of the origins of the writer of this article Russian bullion market

It proffers the theory that Russia has a possible access to circa 62% of the worlds gold production and wants to create a new separate gold backed currency. Maybe. One to watch.

Crypto still doesn’t know if it wants to stabilise, head back to the moon or tank. If we look solely at BTC it appears buyers always emerge when the price gets below $20k USD. But at $23k sellers appear. So maybe the real question is how deep is that well of buyers at $20K? If deep then all good, if shallow then a more serious run lower looks likely.

If I could “action chart” the 2022 run, it might look like this:

ESG and Carbon

A very interesting article in the SMH (not my usual “go to” paper) titled What if China saved the world and nobody noticed?

It looks at Biden’s success with his Build Back Better legislation which commits billions of dollars to renewables. It also looks at China which leads the world in coal use.

China has cut of climate talks with USA after Aunt Nancy went on a vacation to Taiwan.

But lets look at what China IS doing:

- Stopped all funding to offshore coal power – taking away 70% of global investment in this space

- Is spending $8B AUD building the worlds largest battery factory (100 GWh) to supply European EV’s.

- 80% of global solar panels are made in China – and expected to be 95% within 3 years.

The Western world’s plan to decarbonise is only on track because of China’s production skills which is bringing down technology costs.

One thought though – will China be able to hold the world to future ransom (aka Putin) by with-holding future production, or will the world look to diversify this production?

Alan Kohler presented a chart that was used by the RBA during a speech last week.

It was about the economic dangers that investors into Aussie coal face.

The yellow line will be our coal exports under current policies, whilst the blue is adjusted to hit net zero by 2050.

No pun intended, but this is where the rubber hits the road, and the deniers will have their day.

If we don’t replace coal value to our GDP in quick time, our “lucky country” status will be shot to pieces. While you may not have a pick and shovel or drive a coal truck, your economic wealth will be eroded.

The Coalition’s push towards Small Modular Reactors is a direct copy of what the Republicans are doing in the USA. The technology will not be workable until at least 2030. It is classic distraction and diversion. Nuclear is unlikely to be part of the energy solution. Let Barnaby Joyce know if you want the first one in your backyard (waste included for free).

Drinking favourite…

Thomas Hardy Cabernet Sauvignon 2017

Experts say: Blended from the cool 2017 vintage which enjoyed near-perfect growing conditions and shows fruit intensity with a fine acid line. Wine enthusiasts can anticipate youthful aromatics of red and blackberry fruits, spices of clove and cinnamon, fragrant wild mint and subtle oak. The palate offers a tight and muscular frame with a wave of fresh plums, mulberry and ripe blackberry moving to a more structural finish and beautifully integrated with oak and fine, natural tannins. The Thomas Hardy Cabernet Sauvignon 2017 can be enjoyed now or will cellar beautifully, reaching its peak in 20 plus years.

I must confess this one is not opened yet.

It was given to me by my friends of the Blog. At $140 a bottle it should be good.

I’ve cellared it till 2027 and will update you once opened….

??/10

Listening to…

Just a random song selection this week.

You gotta go with the Flo, but this “classic” gets a real zip via Dizzy Rascal doing his thang…

I’m sure you can get some inspiration from below. I’ve certainly known a few Sensor Lights.

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS