Big Picture

I said “Luv”, I said “Dear”

I’ve been in mourning.

To be fair Queen Liz was a cracker, but none too keen on the next crop.

Picture below of the real King and some bloke called Charles….

At least the saturated media coverage of the funeral took away some of the nasty economic headlines that now seem all too regular.

Not many of our younger regular readers have ever seen or felt the effects of a rate hike, so some unchartered waters.

The world seems united in killing off inflation before it gets a hold – if not perhaps a bit late.

Hyperinflation is a term that is now being bandied about (earlier this year it was deflation or stagflation)

Even Black Swan can’t remember back to Germany 100 years ago. A loaf of bread cost 163 marks in November 1922. By September the following year, that same loaf cost 1,500,000 marks and by November a staggering 200,000,000,000 marks.

Germanys producer price inflation rose by 7.9% in just the month of August this year to be 46% higher year on year. That is the fastest increase since the survey started in 1949.

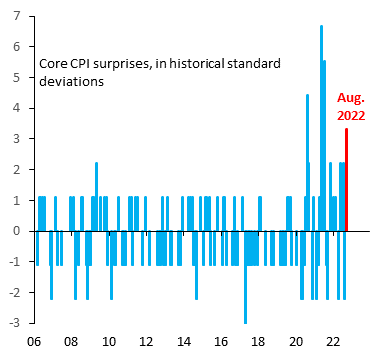

In the USA there was some sort of belief that peak inflation was already delivered, and better days ahead. Recent inflation surprises have however been to the high side.

Inflation in August remained too high at an annual rate of 8.3%. The Federal Reserve responded with a 75 bp hike (again).

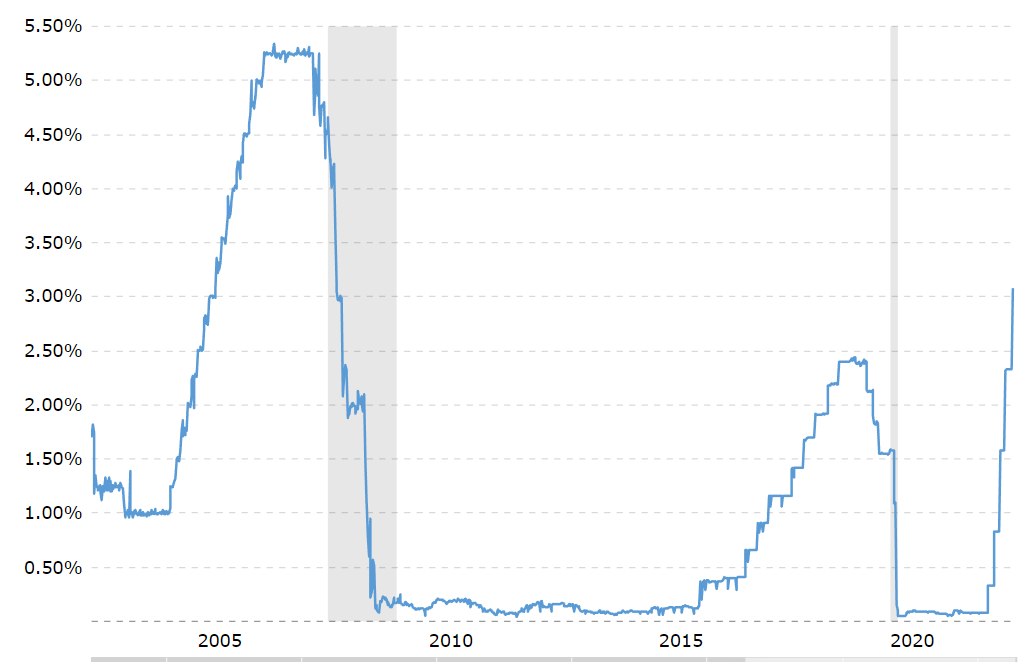

The market always knows what’s ahead – right? Well exactly one year ago the bond market had one 25 bp hike priced in for late 2022. The USA has seen 300 bps of hikes SO FAR, and the FOMC themselves are saying they expect that blue line below to keep heading north towards 4.5% by the end of this year – and stay high well into 2023. No sign of pivot there.

Chairman Powell is still talking about a narrow pathway to a soft landing and avoiding a recession.

As one pundit put it…“Just to be clear. The bull case here is that Ukraine defeats Russia, Putin sighs and turns the gas back on, while the global economy goes gangbusters and inflation magically falls to exactly 2% while the Fed cuts rates?”

The broader market and, especially the stock market, do not believe that a soft landing is possible.

Whilst on the this – the UK hiked cash rates by 50 bps last week (the seventh straight hike) to 2.25%. More to come you would think, with August UK inflation rate sitting at an annual rate of 9.9%.

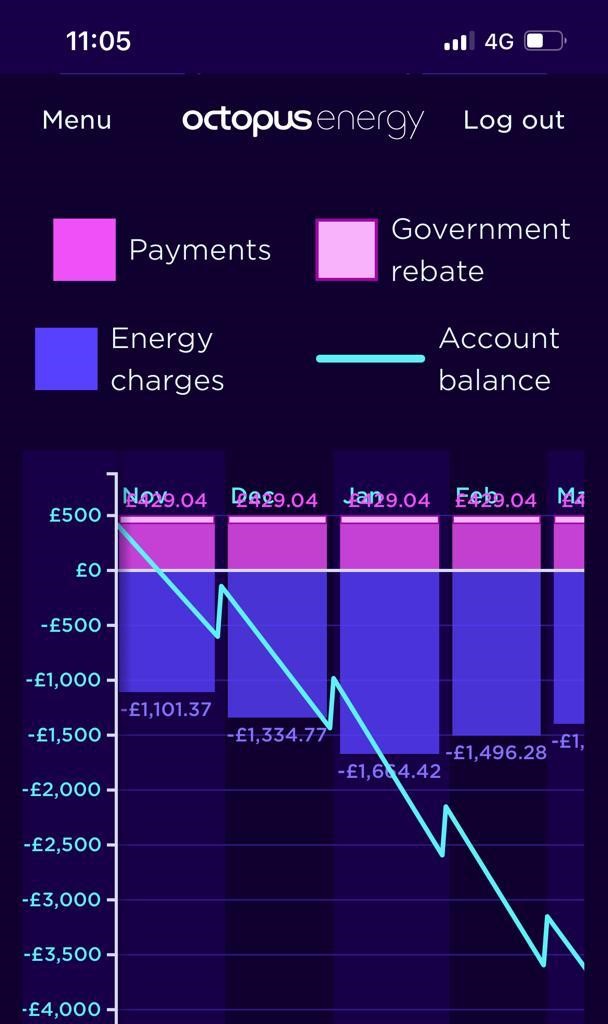

A good friend and ex-colleague of mine sent a copy of his UK energy bill to me. Reading his story made it seem more real to me. His annual energy bill was usually around 3,600 pounds a year. It is expected to be 12,000 pounds this year.

He did say it was worse for businesses and he expected a sharp increase in bankruptcy. For at least some balance, the Bank of England are aware of this pain, and have stated they factor that into their rate settings (ie cash rates would be higher already if not for this).

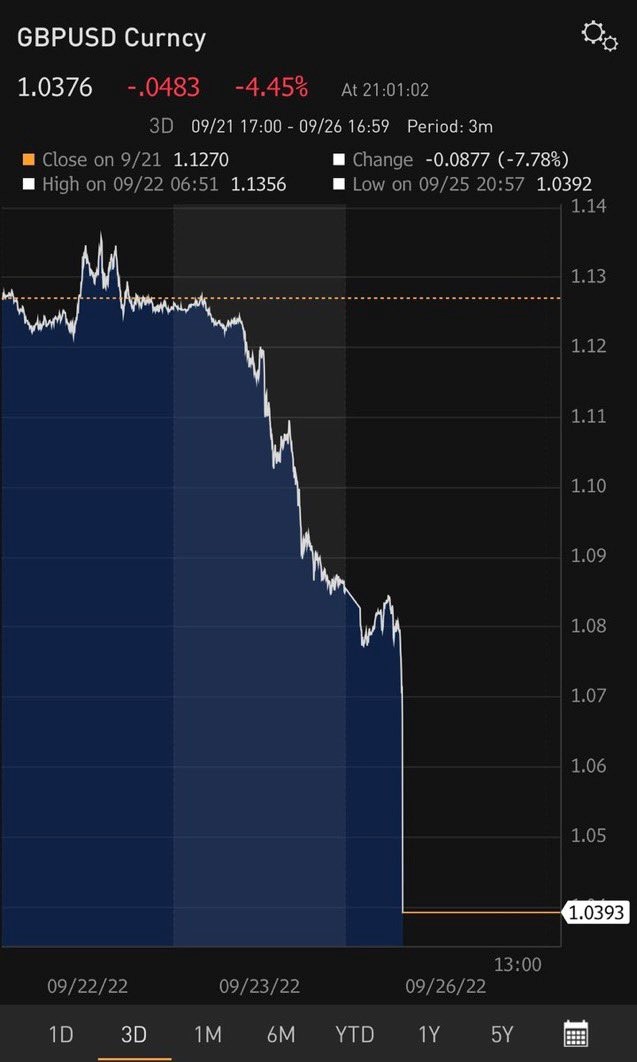

The UK itself must be rethinking the “joys” of Brexit lately. They seem to be in a world of pain, and the British Pound looks like a Bitcoin crash against the rampaging USD. At 40 year lows it may even hit parity.

If there is some big positive to read, it is that European gas prices have fallen sharply in August and reports that inventory is high going into their winter.

So as I have pushed before – higher interest rates are meant to hurt. Meant to lower spending (demand) and meant to see unemployment increase (even if unstated).

US and UK employment is holding up well so far – and unemployment remains low.

It means little to the US equity players though.

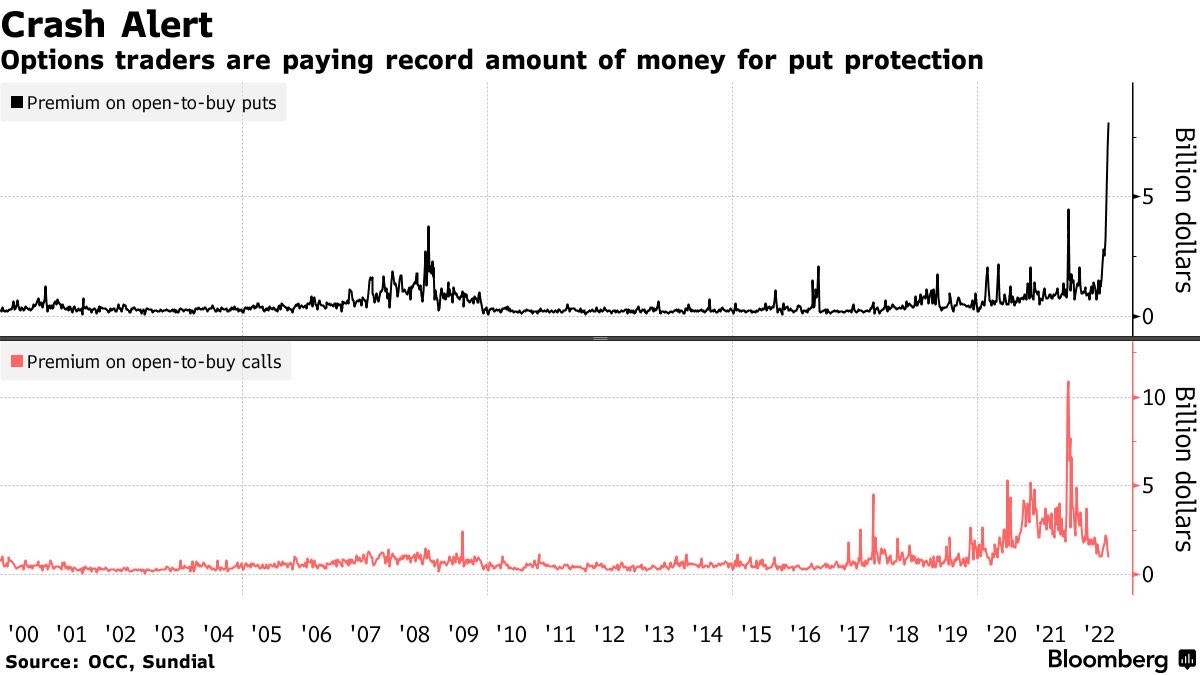

I would not say panic just yet, but getting close. A put allows you to sell your shares if they fall in price. You would traditionally buy a put as “insurance” when you are getting nervous. The exact opposite is true for calls.

When the market becomes a “one way” street, then prices are getting skewed. The cost of buying a put is higher now than any time since 2000 – including of course the GFC.

The Dow Jones is the only US equity index not officially in a bear market…and only just.

Speaking of bears…:

I could be mistaken, but I think Japan is the only country of note to hold negative yields on government debt anymore.

Putin getting squeezed but it still looks like a long dragged out issue in Ukraine.

Hot rumours of a coup in China have been dispelled, but the fact that it was given so much credence highlights just how volatile the world is at the moment.

Domestic Duties

For some bizarre (perhaps foolish) reason, I remain a little too comfortable in the broader Aussie markets than most of my peers.

A dent not a crash…

Corporate profits seem to be holding up ok. Unemployment remains at historical lows. Whilst people have jobs they tend to pay their bills.

Interestingly industrial disputes (as measured by working days lost) were higher in the June quarter than anytime since 2004. The natives are restless for wage rises.

Cries for more support for the squeeze on disposable income to the city mortgage belt need to be ignored. Should the Federal Government (for example) have extended the fuel excise tax break, then the logical response from RBA would be for higher cash rates. They want cash out of pockets.

A very good chance the media will jump on a few stories of increased bankruptcies. To me it is a story of culling the weaker buffalo. Poor performing and poorly run businesses should go bust to allow space for new businesses. Government legislation eliminated bankruptcies during the 2020/21 Covid pandemic. There must be a significant backlog of shit businesses that would have gone bust years ago if not for the government handouts.

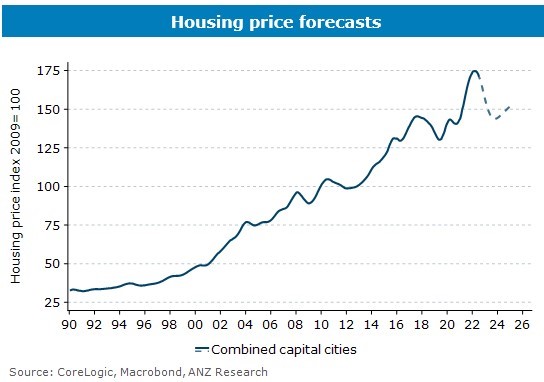

ANZ are forecasting another 50 bps hike in Oct before a 25 bps hike in Nov and Feb 2023. This would take the cash rate to a hefty 3.6%.

No doubt this will offend all those borrowers that could have fixed their rates last year for 3 or 5 year terms at well below 2%.

To me it highlights that it is ALWAYS good policy for companies to have a blend of fixed and floating.

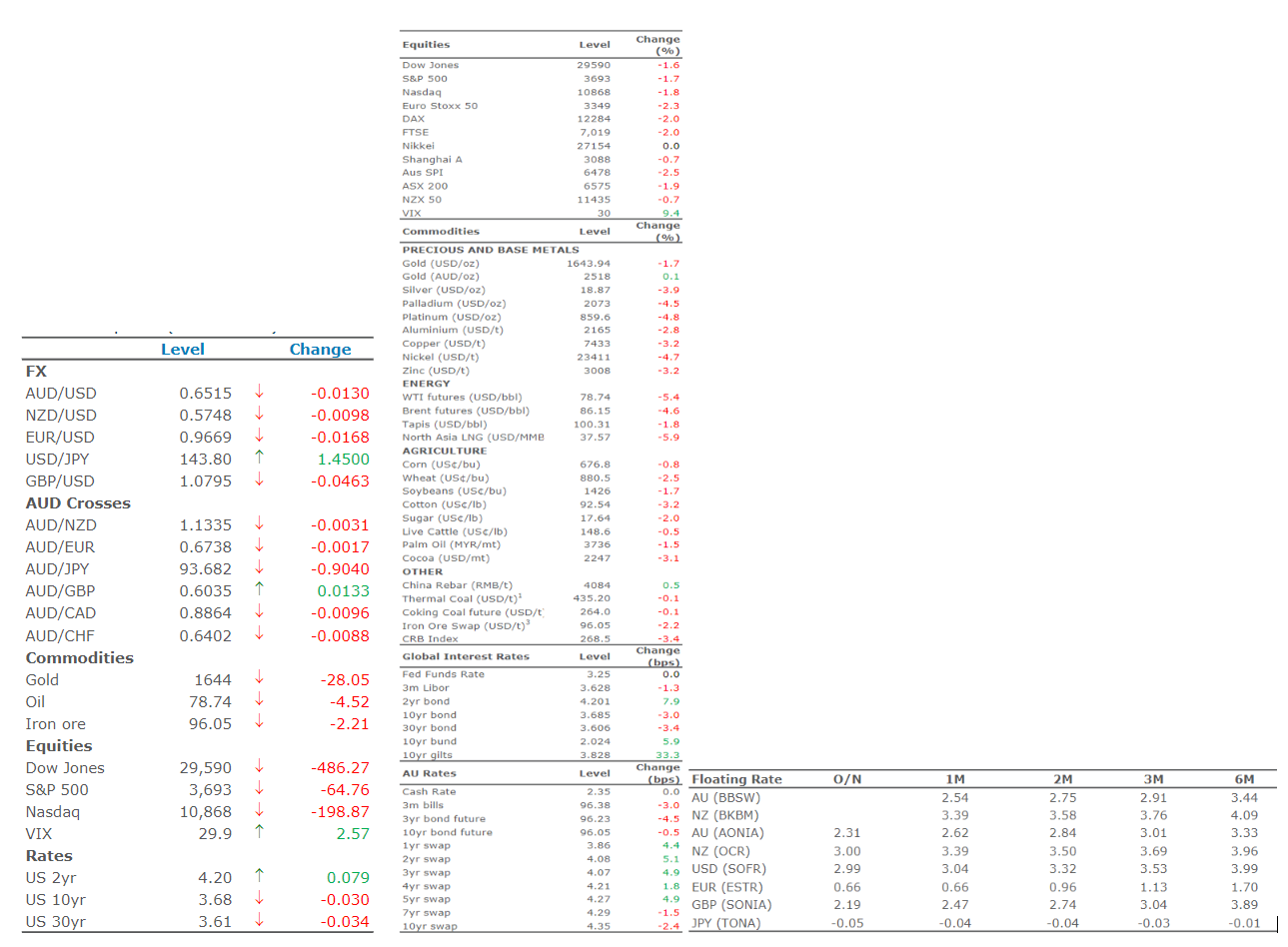

ANZ data:

Banks

Not much to add. Bank share prices getting hit along with the broader market – I think overly so given their propensity to gain value from higher cash rates.

Citi did a review of Aussie banks capital positions this week. Most banks built up a war chest of capital when Covid hit. Most of that seems to have been severely diluted recently.

They don’t see a major problem however, and see buybacks maybe reappearing in 2024.

They have a buy on all banks (WBC as best) except CBA.

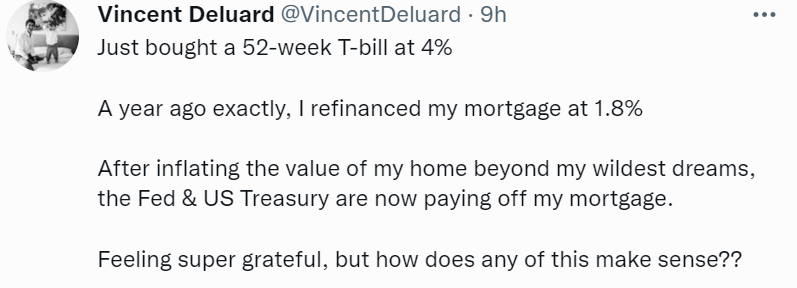

Tweet of the week nominee #1

One bank that doesn’t get a mention here often is the Reserve Bank of Australia. A good trivia question is which is the most profitable business in Australia? Most would say BHP or Fortescue or the like. Most years however it is the RBA. All profits get paid as dividends to their lord and master, the Australian Government.

The way they dealt with the pandemic though (bond buying and giving away virtual free money) has seen them report a loss of $37 Billion in 2021/22.

No way that Treasury will stump up with that sort of cash to support though. RBA will just keep on trucking and try to fix those carried forward losses in coming years. Try that in private business…..

The Aussie Dollar and Commodities

No doubt the RBA will continue its rate hike path (especially when it is looking to what is happening overseas). This is perhaps especially likely given the current low AUD level. Remember it is a “net zero” international FX game. The higher the USD then the lower the AUD.

The USD is at a 20 year international high. Most of that is the reappraisal of US interest rates.

So if the RBA does not keep pace with the FOMC rate hikes then the AUD will fall further. To a point that is good as it makes us more competitive for exports. But the flip side is that imports get more expensive – and we risk “importing” a good dose of inflation. Probably only a problem if the AUD gets a 5 handle.

The AUD is at a 5 year high against the GBP though – so maybe travel to London next winter and not New York.

Commodities are at an interesting cross road. Some demand (or lack of) pressures that are seeing prices drop, at the same time as energy costs, wages costs and raw material costs are rising. Yet capital expenditure is rising so companies are seeing a bright future. Whether this is led by the old favourites of iron and coal or the new darlings like rare earths is unclear.

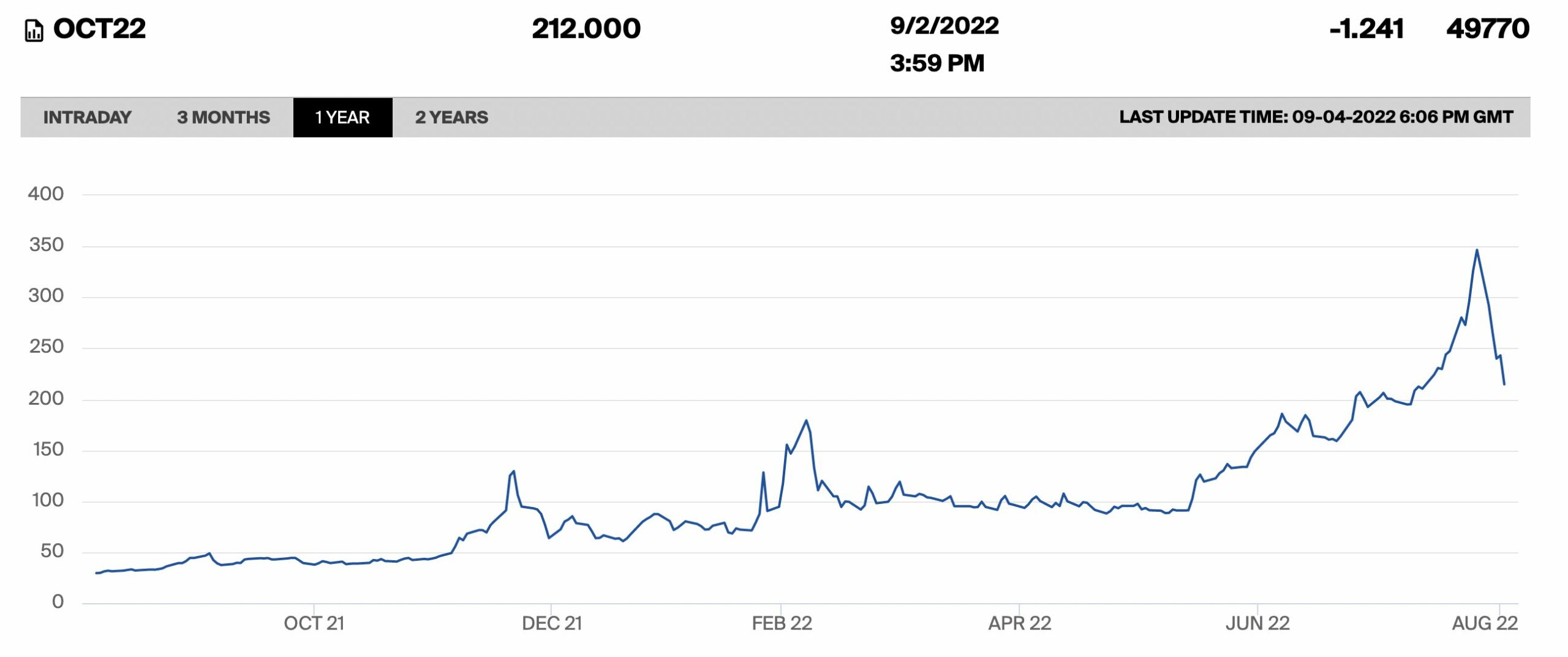

Lithium hit record prices this week (albeit my two lithium miners went backwards on share price…)

Politics

You get the sense that the Federal honeymoon period is coming to a close. Not much longer can the Albanese government claim “its their fault”….even if true.

ICAC will be a real test. Independents want it to be rigorous. Labor wants it to be rigorous enough to pass the pub test, but not get themselves caught. The Coalition wants none of it.

The Coalition is still finding its feet in Opposition. Shadow Finance Minister Jane Hume messed up her ABC interview on the weekend.

Asked where the opposition stood on the fuel excise policy, Senator Hume instead opted to dance around the question by saying it was up to Labor to make the policy decision.

“We don’t have policies, we are in opposition, not in government,” she said.

ABC Insiders is becoming a hard watch of late, but James Campbell on Sunday took it to new comedic heights when he claimed Angus Taylor had better credentials as a Treasurer than Josh Frydenberg.

The Coalition must be looking overseas, and still trying to work out if it needs to shift more to the centre or more to the right.

My money is on them making the wrong decision and moving to the right.

Certainly that seems the approach at State level.

Housing

A quick look overseas first.

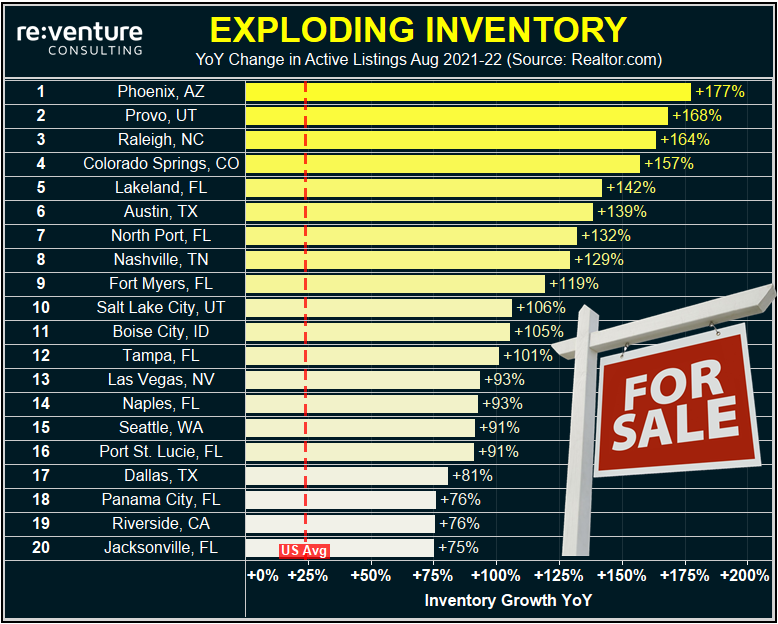

Housing inventory for sale has gone through the roof.

The map below shows though that it is not universal. West and south coasts bearing the brunt.

In Australia it is somewhat of a similar story. Morgan Stanley believe that Sydney and Melbourne will now give back just about all of the capital gains made on housing since 2019/20.

If national house prices fall 20% as they expect, it will make for a solid basis for a potential recession. Our bricks and mortar makes up nearly 70% of national household wealth. That amounts to $10 trillion dollars. Take 2 trillion dollars of perceived “wealth” away and that next new car or holiday may need to wait.

I mentioned early last year, when the world was a different place, that with rates so low, why wouldn’t you gear up? It was the smart thing to do. The BIG question now is how to deleverage debt from 185% of income as rates rise…without blowing our economy up.

For reasons I can’t fully explain, I still think it is possible. Naïve ?

Tweet of the week nominee #2:

Crypto and Gold Land

Gold price is getting smashed on two fronts. Firstly the holding or opportunity cost of gold is making it more expensive to hold as interest rates rise. Secondly it is benchmarked against the USD which is flying high.

Fortunately my holdings are AUD based and whilst not heading northward is holding value ok.

A lot less chatter around office water coolers of late re crypto. Bitcoin remains glued around $20k USD. Ethereum is also down 50% over the last six months, but having a better week this week, after it forked its chain. You tell me what the hell that means.

My one and only leap into crypto is having something of a resurgence. XRP/Ripple after losing about the same percentage over recent months, jumped a third in price as hopes grow that it will win its case against the US SEC and prove it is not a security….that needs to be thus regulated and controlled.

Hope springs eternal, so I will hold on and see if my humble investment does in fact go to the moon.

ESG and Carbon

Ethical investments are certainly under-shooting the market – especially alternate funds that hold fossil energy stocks that are returning mega dollars.

Interesting to see if investors are happy to hold the line or surrender to the money gods and switch.

Lithium going well as mentioned. Everyone is gearing up for EV’s.

At my age and income, the best I could hope for would be an electric bike.

Drinking favourite…

Picture below of Germany this week as Oktoberfest begins. Love to be there one year.

Bizarre week where I actually went 7 days without alcohol. Perhaps for the first time since high school.

The week before however I did get to taste an Adelaide Hills ripper. A Scanlon 2021 Pinot Noir.

They say “Pinot Noir of both intensity and elegance. Whilst a quarter of this wine is made up of their old block 777 clone, the rest is made up for the first time from their new block on the property. Containing clones 667, 115 and Abel, these vines are at a higher density, higher altitude and on an east facing slope.”

Around $35 a bottle but you would swear you are in Burgundy.

The main reason is that I am getting serious about planting a small vineyard myself, and my prospective future winemaker wanted me to taste wine from 2 year old vines – to give me hope that the fruits of any labour may not be that far off.

Hoping mine will be as good eventually.

9/10

Listening to…

To go with a “French” wine, whilst listening to Moby’s latest release. He is one strange cat.

As an aside, if you have Netflix, track down the documentary “Skandal”. It is about the German heavyweight company Wirecard. It would be hard to believe as fiction. Well worth a look.

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS