Big Picture

It is all about the bonds – and not James Bond.

But before we look at the shitshow that is the world market, an announcement.

This scribe has long had “a crack” at dodgy banks, politicians and market participants – and often brokers were in the cross-hairs.

I said we would never sell out to the man (no gender implied). But of course, that was until the man opened his wallet.

Issue three (when I get around to it) of 2023 will come out under the moniker of Black Swan, working for HT Capital Markets. HT Capital is an SA based commercial/resi broking business that I am proud to associate with this esteemed blog. Their only ask was that Black Swan continue doing what Black Swan does – so you can expect no change to format or content. You also don’t need to re-subscribe. Of course, this may also be a reminder that you have been meaning to unsubscribe – so do that for a full 100% refund…..

A few incoming calls of recent days asking if I was stocking my doomsday bunker ready for Armageddon as US and Euro banks fall. The short answer is no and I can’t put my finger on why I am so sanguine.

Credit Suisse was a $7 billion dollar bank on Friday. UBS have just bought it for $2 billion. Not without risk, but I reckon they have a steal.

It does highlight that contagion risk is always around the next corner.

To me though it shows further examples of poorly run companies (banks) that are bailed out on the public nipple – and that the world financial market will do ANYTHING rather than take bad tasting medicine.

Of course many theories on just why. But for SVB it appeared a shit bond portfolio was the catalyst.

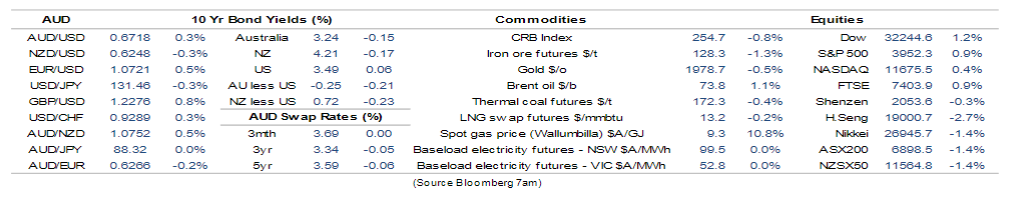

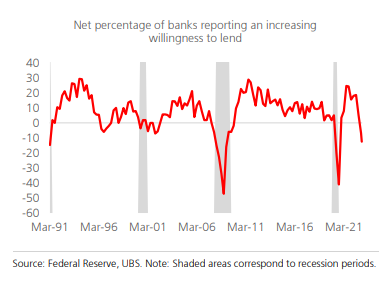

US banks need to hold “high quality assets” for a rainy day. Most elect US bonds as their default choice. As I often explain, when you hold bonds you make money when yields fall and lose money when interest rates rise. We all know what rates have done in the US and here. But unlike Aussie banks, US banks are allowed to effectively hide any bond losses via a loop-hole when they declare these bonds are a hold till maturity. This stuff is all not new – and a ton of regulation for small and mid-tier banks were removed under Trump.

But finally someone added all this value up and came to about $700 Billion USD.

But what is incredible about my world is that a good disaster is sometimes just what you need to avoid disaster.

US bond yields have plummeted and expectations are that the FOMC will now have a lower terminal cash rate – and cuts may be fast tracked.

So all those banks with crap bond portfolios have just had a 20% valuation boost by virtue of the immediate market response. The machine is brilliant.

But SVB had its own specific issued overlayed as well. Wrong industry concentration, poor management and then the classic deposit withdrawal run and it was all over.

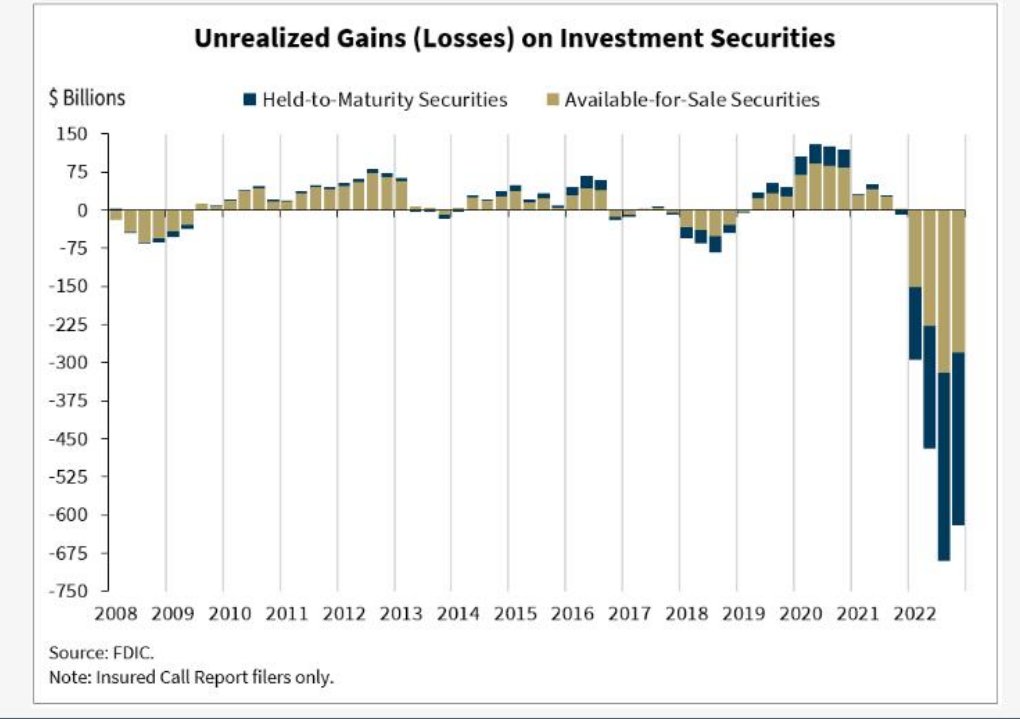

Interestingly unlike here in Oz, Mums and Dads seem more willing and able to buy US Treasuries direct. At 5% risk free yield it seems a lot decided to take it from banks and place it direct with the US Government.

Barrenjoey still sees Aussie banks share pricing falling further. I’m more bullish on Aussie banks for lots of reasons. NAB for example down 8% over the month and “damage” already dealt. I would buy more now other than I am still overweight in my portfolio.

Why bullish:

- “Bigger” – in the sense we have the cartel of 4 (5 if Macquarie are included) and the few small players are not leveraged like others.

- Although regulation is not brilliant here – it is clearly better than elsewhere

- Our economy is in a much better and sustainable state.

On my ever present flip-side though, it is not a zero chance that we go to hell in a hand basket very quickly. I am not blind to the effects to Australia of global events. If we look back to the US it would be easy to spell out a case for imminent disaster.

- US government debt against GDP has only been higher once (post WW2)

- Equity prices to earnings only higher once – pre 1990 crash

- Inflation highest since the 1970’s

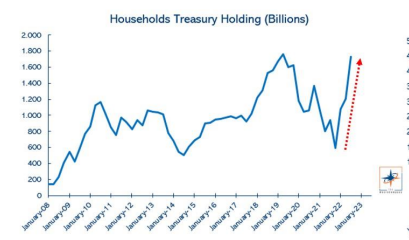

Another key risk is that getting your hand on a loan (business or otherwise) is getting harder. The chart below showed the lending slow down in the USA well before the current banking issues. This will only make it worse.

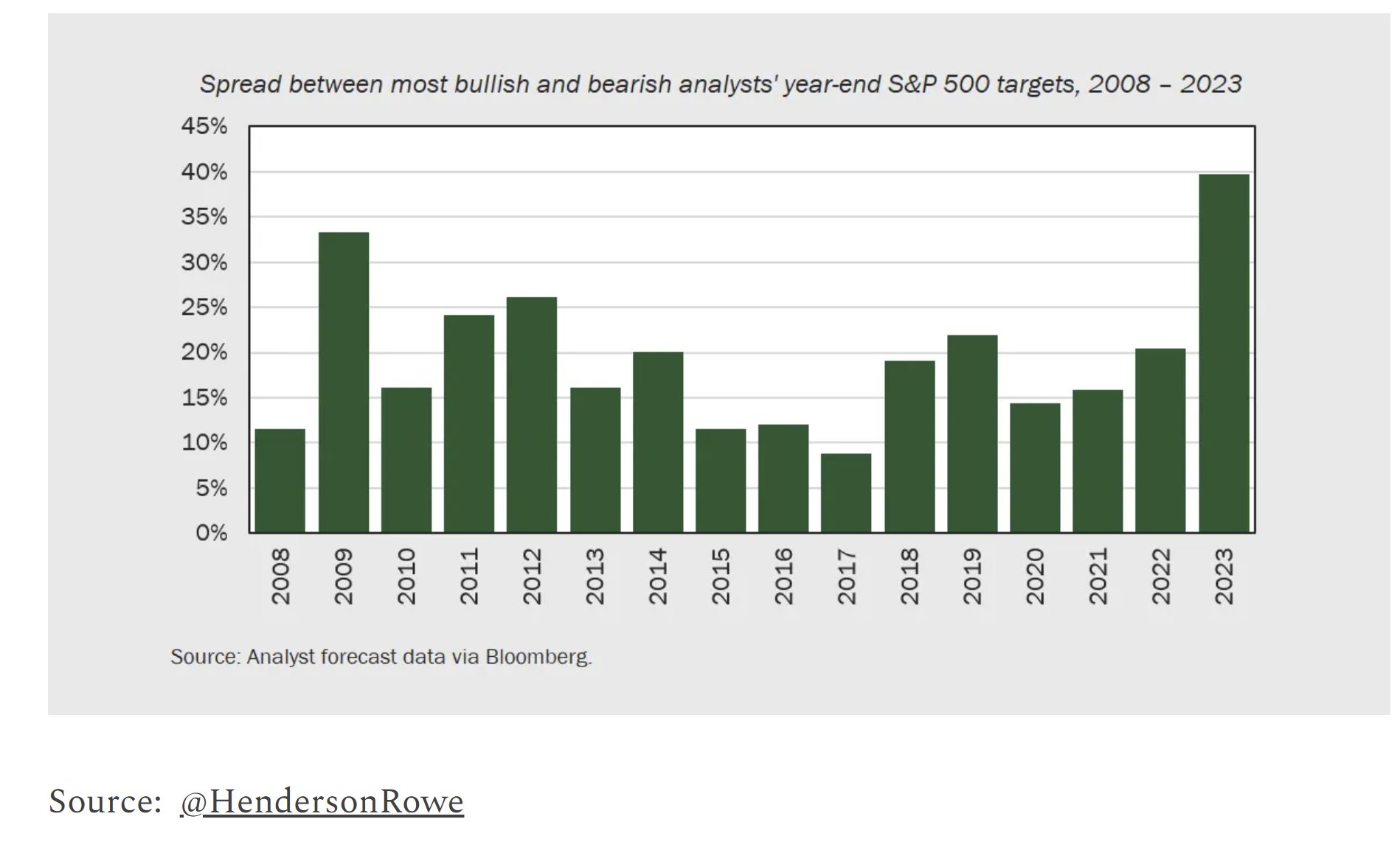

So not since the GFC has the spread between economic forecasters between growth and contraction been wider. Toss a coin – if you still have one.

Choose a side and do your own analysis.

China downgraded growth forecasts and everyone jumped on that as a really bad sign for world growth.

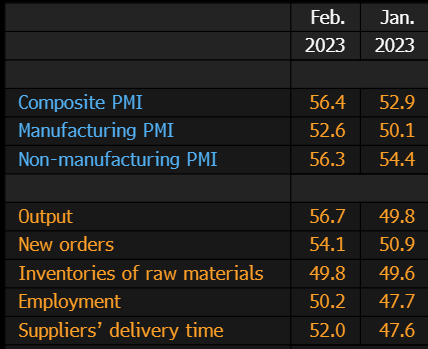

I looked at the February production data and all I see below is a hell of a lot of activity as they ramp up post zero Covid.

Data from China always taken with a pinch of Himalayan salt but looks positive to me.

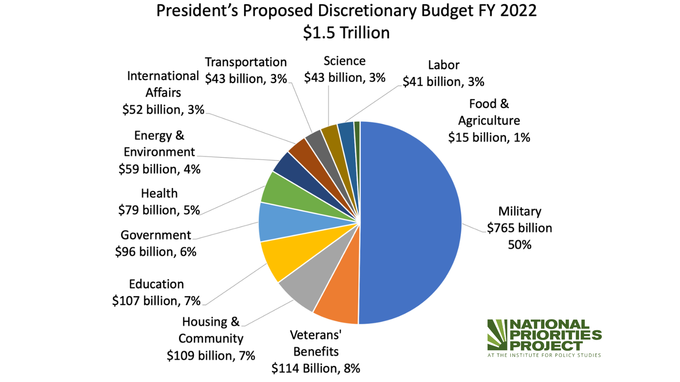

Finally, a lot of economic analysis of Biden’s infrastructure reform project – his reverse thinking “spend money now to drive inflation down” plan.

Like our submarine project all choices have a cost. It is projected to add $238 billion over 10 years.

Looks somewhat immaterial when the US spend $765 billion EVERY year on defence.

Domestic Duties

RBA kept the monthly hike cycle rolling. Who would want to be Philip Lowe – a really crap job. For what it is worth I think the RBA has made a lot of clear mistakes, but I admire his conviction and reasoning (even if I disagree). He steadfastly states he would do the same things the same way again if fronted with the cards he was dealt.

And without looking to sound like a Boomer, I’ve had it with “battlers” on Channel 9 and Kochie and their whining about mortgage costs on their outer fringe shitbox. Anyone that bought with FOMO and borrowed well past their capacity in 2020 without leaving a buffer and expecting rates to stay at ALL TIME lows are frankly silly or deluded. RBA and Lowe are lazy excuses. Extra government support not required.

Inflation here does look like it has rolled over. Certainly no signs yet that it has become embedded into wages.

RBA must be a tad pissed off though – the whole point of a fastest ever hiking cycle is to slow domestic demand via a never to be vocalised higher unemployment. The latest February report saw 65K new jobs created (and mainly full time) and unemployment falling back to 3.5%. Hours worked increased, under-utilisation participation rate increased – all good news…except for RBA.

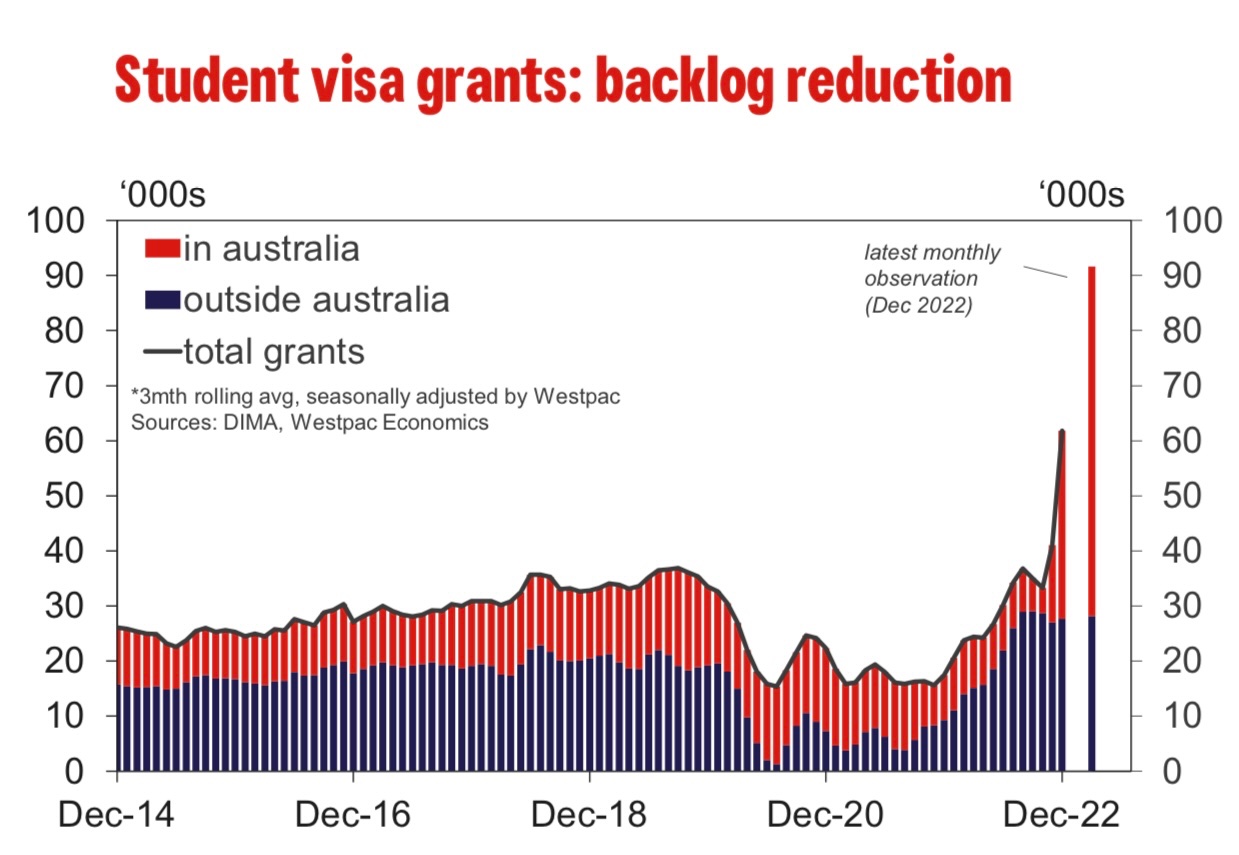

More good economic news in the fact that despite Chinese rhetoric, overseas students are heading back to Australia in numbers.

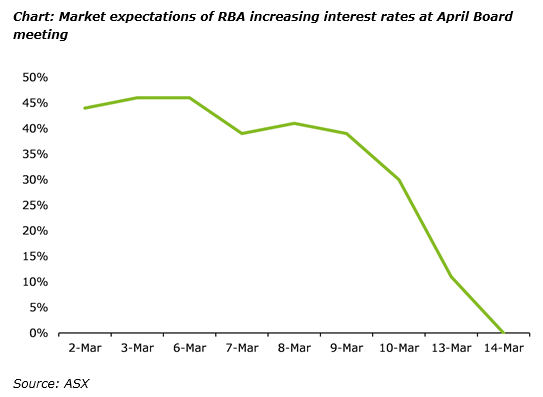

RBA Lowe did indicate that a rate pause is on his radar – but the market thought April would bring another 25 bps in hikes – at least until the last few weeks.

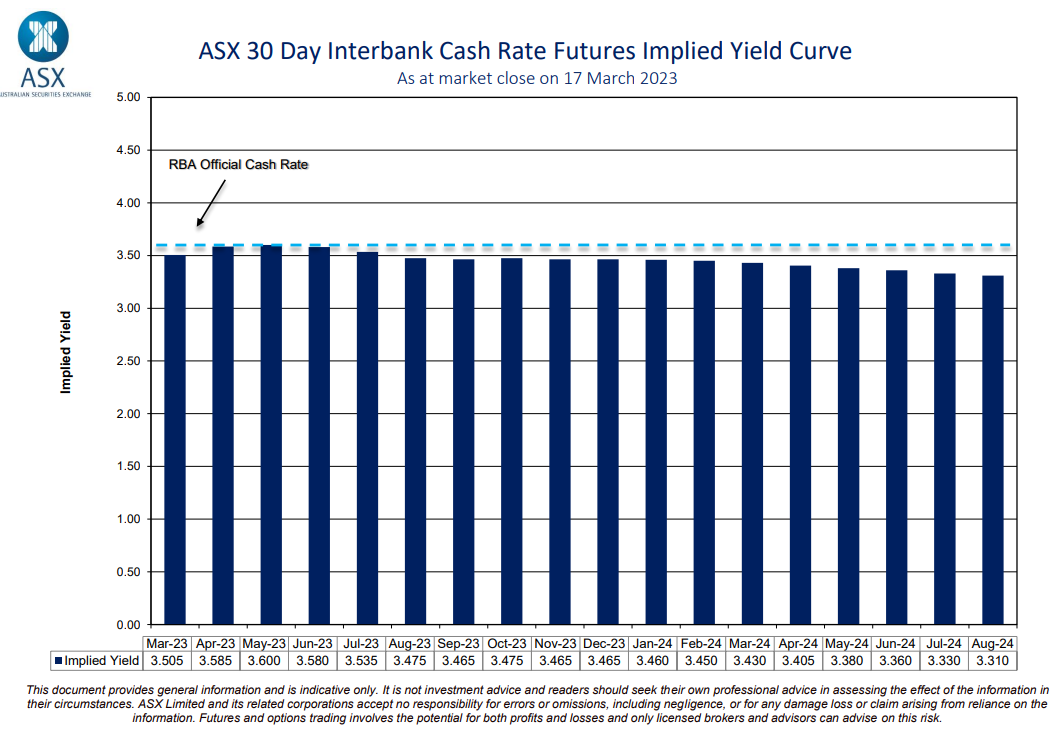

The market has decided that no hike will happen in April and the second chart below shows that the money bet is that we may have seen the peak of the hiking cycle now. Note though, that unlike the US, we haven’t penciled in aggressive cuts by 2024.

ANZ are still calling for an April rise – and for once I agree, based off the solid data that I talked about above and Lowe’s dogged determination to slay the inflation dragon.

As I said to a senior banker last weekend, the RBA has a history of always trying to take the path of least resistance. This time it may be easier to pause – but then May is very much a live meeting. Semantics.

My second month in a row of bashing Ed:

CBA data:

Banks

The root of all evil?

As I mentioned above, in my view the Aussie banks are getting more than their share of punishment for issues that they are not involved in.

On the upside, they still are getting P&L tailwinds from higher interest margins.

On the downside they do need to replace the Commonwealth cheap funding supplied early in the pandemic – and soon. If they were needing to do that now, funding costs would be much higher given historical highs in bond volatility. Some chat around water coolers though that the Government may extend their funding horizon to assist. Smart move if true.

The Aussie Dollar and Commodities

The US Fed seems almost obliged to hike by .25% this week. No hike and the market will crap out on why the Fed is so worried. 50 basis points would signal that the Fed is committed to driving the US into recession.

The reduction in US terminal rate expectations has seen the USD lose momentum.

The Aussie dollar should be getting a kick higher but falling commodities prices have dragged on the AUD. We are sitting around 0.67 cents.

Commodities (and the broader market) had a better Monday night so maybe the AUD can head towards 0.70 cents but not much air in that balloon.

Politics

The USA version of Married at First Sight continues. Why voters are at all interested in two blokes about to hit 80 is beyond me. We collectively dismissed Paul Keating as old and irrelevant last week – yet he is younger than both of them !

The “small” change to Superannuation concessions went through – as it should have.

In the thrust and parry of politics I did enjoy how the Coalition got wedged on the issue.

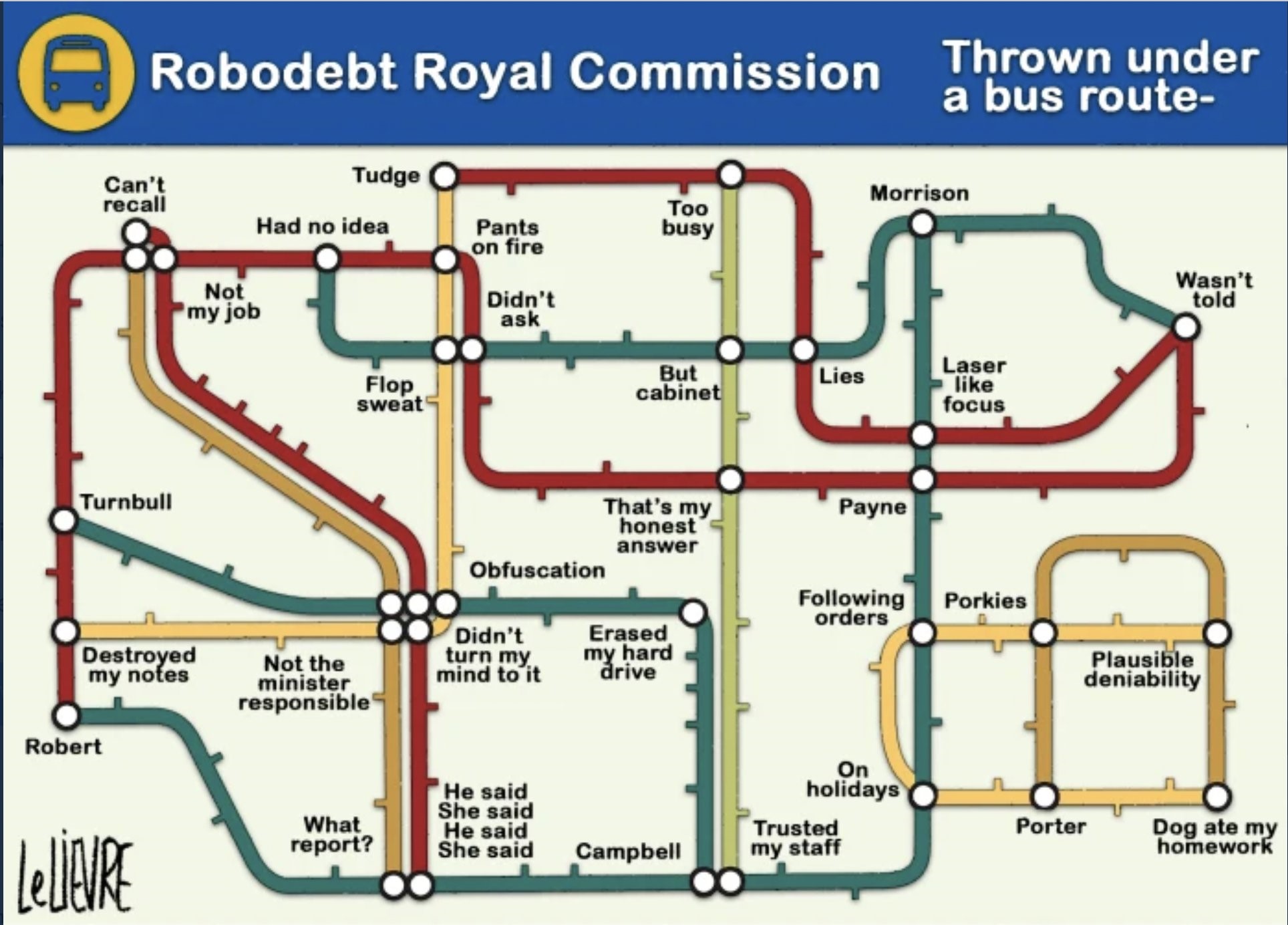

All that needs to be said about the reporting of Australian politics can be found with full coverage of Super changes to the rich and minimal to no coverage of the $2 billion Robo-Debt fiasco to the poor.

Will anyone ultimately be held accountable? Unlikely.

The press gallery were also highly excited about Australia’s new ultimate strike weapon that will be ready in the 2030’s if all goes well.

I did like Kudelka’s tweet though:

NSW votes this weekend. If we unfairly ignore Tassie like we usually do, then NSW is the last bastion of blue in a red nation. From limited views, and poor debates, both NSW major parties look inept.

Victoria had its own issues last weekend with a volatile mix of gender and Nazis.

Sky News had a field day.

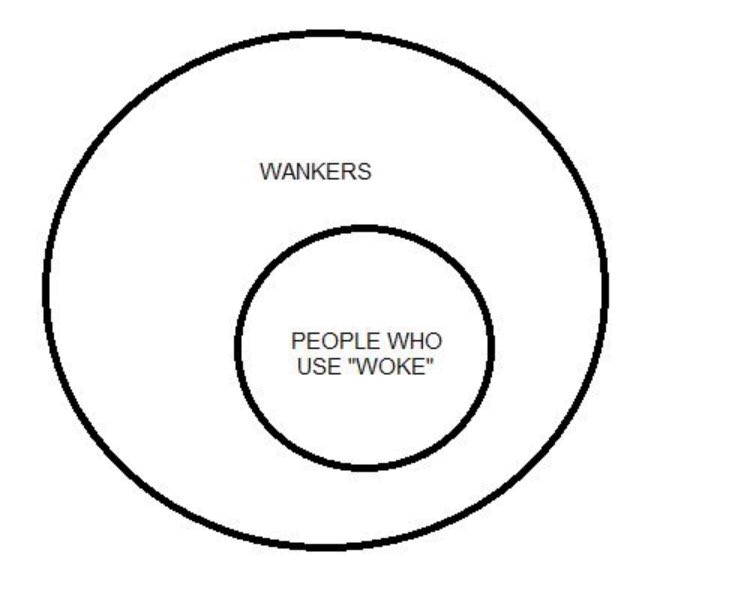

You are not likely to see me marching for either side, but I have reached my limit on those of the Right using “woke” as an insult to those that may have more equity and fairness views. Covered by;

Housing

Mortgage arrears fell in the last quarter – supporting the theory that people pay their mortgages when they have a job. Great for banks.

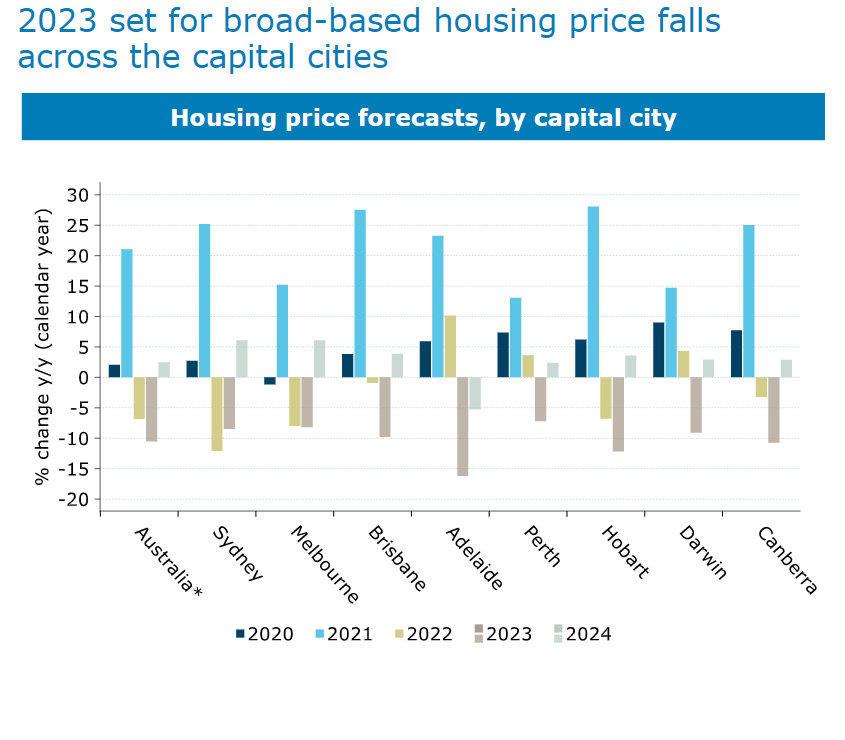

Some talk that the house price fall has stopped. CBA are calling for a further 10% fall this year before a modest bounce in 2024.

ANZ are calling Adelaide out as the likely worst performer of 2023.

I’m calling bullshit. Remember how historically bad banks are at predicting house prices – and how conflicted they are.

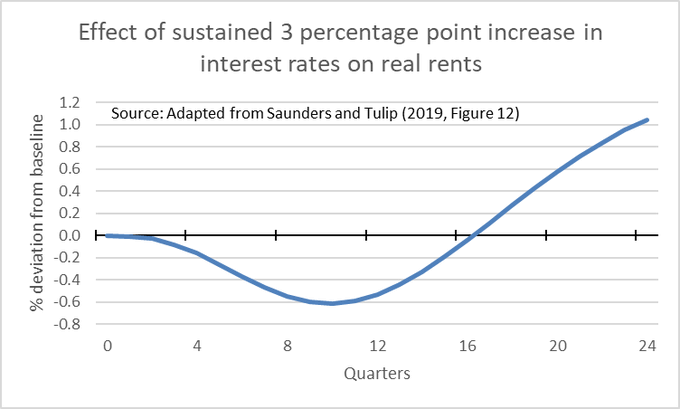

And finally I saw this chart of an extensive study done in Australia just pre Covid. It looked at the historical effects on rent changes and elasticity to interest rates.

It dispels the theory that landlords instantly respond to higher rates with higher rents. Over the longer journey it usually takes 18 months before the rate effects hit renters. So why so different this time?

Not sure, but “opportunity” via very low vacancy levels shouts out.

Crypto and Gold Land

Bitcoin up 50% over the last 6 months. Ethereum 40%. My XRP down over the same period. Says it all about my crypto skills.

They remain pretty volatile and a number of casual punters have been burned enough to stay away.

But fortune to the brave.

Time for a few of these “currencies” to show the key quality of being a store of wealth. Until then I will continue to have some nagging doubts.

You might as well throw this chart in for crypto correlation.

Yep irrelevant.

Gold on the other hand is on the fly.

Partly due to the global banking ructions and partly due to a falling USD. I’ll take it.

You may remember I’m a direct gold holder via a Perth Mint EFT.

Perth Mint got some very unwanted attention in recent weeks over money laundering, gold “doping” and general shenanigans.

Not good, but it doesn’t seem to have upset the apple cart.

Gold took at look at $2,000 USD an ounce overnight. It does seem to be very much a momentum commodity, so maybe a bit more to go in it yet.

ESG and Carbon

The politics of “carbon taxes” continue to play out.

Labor’s “Safeguard” proposal is backed by business but not the Noaltion or the Greens (as yet). Tightwire walking as too much scares the cattle and too little alienates the Teals and Greens…and most informed voters.

I think it will get through.

South Australia’s electricity emissions have fallen by circa 70% over the last 12 years thanks to renewables taking over coal and gas. That is “nice” but the question on many lips is why this super cheap form of generation has not flowed to household electricity costs – which are no cheaper than national averages. Apparently the answer lies in SA’s comparative high costs for transmission and distribution. Worth investigating why that is so, but one wonders how high the bills would have been without renewables?

Drinking favourite…

Black Swan’s “42 Rows” vineyard took a major step forward this month. Posts are in and vines ordered for mid year.

To whet my growing appetite I had to go back to Pinot for inspiration. Had a bottle of State of Nature pinot at lunch recently. Excitingly it was a brilliant mix of style and complexity. Like a good block of Lindt chocolate – easy to consume too much. Hard to find due to limited production and the fact it was made from 2 year old vines. Bring on 2025.

9.7/10

Listening to…

I’ve been listening a lot to Fat Freddy lately. A Kiwi band with a truly “fat” sound.

If you need something to listen to in the background as you exercise then get on it.

Most of my images may not be all that authentic, but the one below truly is. Posted on a FB group I follow.

Chiyo is the rooster.

Similarly the one below is true too. A tweet post by the US National Park Service in relation to what to do when under threat from a bear.

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS