The Ashes series has been an absolute cracker.

Early Tweet of the week contender in response to the English cricketers saying “we could have won both the first two tests”.

Big Picture

Sometimes I can be persuaded into thinking “this time is different”. It rarely is.

More importantly you may be shocked that neither Westpac (Bill Evans is stepping down) or RBA (Lowe about to be rissoled) have tapped me up to take over the reigns – good luck to them.

Global inflation remains too high.

China the rare outlier – inflation running at zero, but that economy is best described as “controlled”. Latest there is that they will instruct banks to lend more and fix any slow down. The power of the CCP.

The apparent rapid change is that inflation is now concentrated in the services sector. Any thoughts of supply issues seems very much yesterdays news. Is it all those oat-milk latte’s and smashed avo’s?

Old school theory is that when interest rates rise, then employers sell less stuff and lay-off staff.

That isn’t working. Certainly not yet anyway.

Chart below tracks the US Central Bank cash rate (in blue) versus total employment numbers over the last few years.

Higher rates = Higher employment. Right? Not according to normal teachings. But there are similar results here and around the western economies.

US had some good news this week though. In fact the best inflation story in nearly two years. Annual core inflation fell from 5.3% to 4.8% .

They may be heading down the slope finally, but a BIG BUT.

Citibank have produced a Surprise chart for many years. Any economic release that is above forecast gets the chart above the zero line and vice versa.

June and so far July has seen a raft of economic releases better than expected. This would be annoying the Federal Reserve that would like a more rapid slowdown.

of course things are complicated…..

US trucking sales are heading back to the levels of early in the pandemic. This has long been seen as a leading indicator of what consumer spending may look like in 4-6 months hence.

This is not by Trucker Joe’s design in his 18 wheeler big rig. Tender rejects are at three year lows – i.e. truckers are taking anything on offer rather than sit idle.

A year ago the US Fed Rate was 1.75%. It is now 5.25%. I mentioned last year that studies show the chances of an economic recession tended to have a closer link to the pace of rate hikes rather than the ultimate terminal rate.

Both here and in the US the pace of hikes have been quicker (and further) than many expected.

There is a time lag though, and a good US punter I follow (Hedgeye) has calculated that to be between 14 and 16 months. That is now.

The VIX volatility index is resting at 13 which is very low (indicating that the market is very sanguine).

This is often the case before a Black Swan event comes in a shits on the market.

I was asked recently if it is worthwhile to move your superannuation into a defensive sector as protection.

I answered as I always do, by firstly acknowledging that I am a grumpy pessimistic bear, that always thinks the world is about to go tits up.

I do remember a fellow bear that sold his Sydney family home years ago and rented waiting for the inevitable property bust. I wouldn’t say it has been a one way street, but the median price of $700k in 2014 is now doubled. As far as I know he is still renting and “losing” over $100k a year in pre tax dollars.

My favourite saying remains…”the market can stay irrational for longer than you can stay solvent”.

You need to be in the game to play. I have changed my portfolio slightly in recent months and I will expand on that next month – a few winners and a number of losses.

Summary – I remain heavily weighted to defensive stocks and cash but still very much happier with an up market day.

Domestic Duties

I got this months RBA cash call wrong. I thought Lowe would go out with all guns blazing – and a look back legacy that says “I told you so”.

August is very much a live meeting (Canada raised rates to 5% this week) and all the things I said up higher still equally apply to Australia.

Employment remains very strong and lead indicators are showing no signs of near term weakness.

Different banks give different readings and interpretations, but services also look strong.

Cost of living crisis gets touted a lot by the Coalition, and there is absolutely no doubt that there are many battlers that are doing it very tough.

But the Bureau of Stats highlight that many are still doing it OK. Household wealth near all time highs.

So the pace and rate of interest rate rises come into play here as well – albeit with even more of a time lag because we started hiking later.

Chart below shows periods of economic “pain” for us since 2000. We hurt (eventually) when interest gets high, but look at the pace of the increase in this round. Aptly labeled.

Being a pictures man (person) the chart below to me is a raging warning flag too.

Stocks and interest rates have a pretty tight correlation which makes sense. As rates rise, alternate investments (like term deposits) take some shine off stocks. Meanwhile companies find it harder to make a dollar so dividends tend to get compressed.

The correlation is very tight from 2016 to late 2021 when the jaws widen. Share prices have held up very well, but 10 year bond yields (yellow and inverted) have risen quicker.

So if this time is not actually different then:

- The ASX may fall sharply

- 10 year yields fall sharply

- A mixture of both.

For me I fancy the last option.

A number of punters I speak to expect the RBA to move quickly to a cutting stance next year. I concede a recession may change a lot of things, but at this stage don’t bet on it.

Remember when I highlighted that whilst Lowe was talking rates as low for longer, the bills futures market (real money invested) did not agree and future rates moved higher.

Well that same market currently has 90 day bank bills as above 4% all the way through to June 2026.

We are not going back to silly money days any time soon. Basic math’s says that if inflation eventually gets down to mid point of RBA’s magic pudding range (2-3%) then real cash rates should be at least 1% above inflation. That puts RBA cash at 3.5% – if and when all goes well.

Proposed RBA changes to 8 meetings a year and more transparency seems dandy to me by the way.

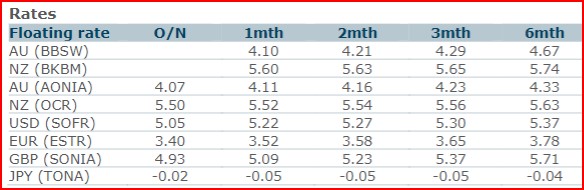

ANZ data:

Banks

I have also been guilty at times in a bit of bank bashing.

But as I said last month – their share price seems cheap at present.

“Smart money” has moved from banks to technology. Rationale is that banks get hurt badly in a recession (slow lending rates and bad debts).

But this smart money may have got their timing very wrong. Lending may have slowed, but bad debts remain below historical averages and higher rates have helped bank margins.

If a recession is an absolute, why has property risen and consumer discretionary up by a healthy 7%?

The International Monetary Fund has an interesting chart below.

Aussie banks lead the pack in share of a countries economy. Over double that of the USA banks.

So you would think that it must be a factor of the oligopoly system that the Big4 have established.

Clearly it helps – as Canada, Sweden and Netherlands can testify:

The answer for our “win” is also for another two reasons. Firstly Aussies love home ownership (and using your house as an investment asset) and the fact that we have a preference for floating home loans or very short term fixed loans as compared to the 30 year fixed loan norm that is the USA.

I’m not buying bank shares at present…but certainly not selling either. Even ANZ as the ugly duckling is yielding 6.4% fully franked.

If you want to read a short piece about the way AMP have torched value in recent decades read this : AMP cock up

The Aussie Dollar and Commodities

Ever since I said I want the Aussie higher against the euro it has fallen. My ANZ FX contact is not holding much hope for me. At least you can buy a house in Italy now for 1 euro so all good.

The Aussie has kicked higher though against the USD…or more to the point the USD has fallen. The soft inflation data has increased hopes that the Fed may have reached the terminal rate…or at least only one more hike.

Thoughts that China will take steps to reinvigorate its economy has helped kick commodities higher.

Goldman Sachs called for a commodity “super cycle” in March and most have fallen significantly since then. Reverse indicator right there.

Mining and energy companies are still making good profits though. The ASX averaged a dividend yield of 4.4% for the year. Miners averaged double that. For now.

Politics

I remain intrigued with the US political system – or more to the point watching the implosion of the great experiment that the USA claimed to be.

As an outsider there seems little doubt that one party took steps to illegitimately refute a democratic election, and surreptitiously take power. There can be no greater test to a system, and to date I just see fluff and bravado.

If you then throw in abortion laws, racial tension and gun chaos and maybe you can see why people might be looking to permanently cross the border to the north.

Domestically, the recent Royal Commission has probably sealed Morrison’s fate as the worst ever Australian Prime Minister. “Saving” $636 million turned into costing $2 billion. That is the price of a good social housing policy which has been proven in many studies to give a better than 1 -1 economic benefit to a country.

His complete lack of self reflection or awareness is staggering. Large parts of our media seem to similarly lack appropriate skills to probe and inquire unless it fits their agenda.

Housing

The mystery of house price rises is also not limited to Australia

It is a global phenomena.

What is quite different is that rents are not rising rapidly in the USA. Chart below shows that mortgage costs are now a third more expensive than renting.

Much of my thoughts on housing has already been covered above.

Whilst ANZ is now calling an extended pause on RBA hikes, you can already see below the effects of the rises to date in orange. I see one more hike at least, so we will move into the red zone.

I did mean to show this last month, but for overseas readers looking to see what bargains you can buy in Sydney, take a look at this “no brainer” – as in no brains if you paid that much.

Crypto and Gold Land

If there is a sign that crypto is losing its shine is that very little chat at the pub these days about who has bought or sold and how much mooney they made on something they didn’t understand.

My XRP Ripple investment has had a little baby rally on the back of likely positive legal outcomes. Only down by 50% now.

Gold is up over 7% this calendar year, but has dipped recently as rates rise. Holding gold gives you no return or dividend, so low rates are good for it. The US seem to be near their rate peak so the USD may weaken and rates on hold should both be good for gold prices ahead.

Perversely gold would also benefit from a US recession which remains a possibility but not a certainty in my opinion.

ESG and Carbon

Got my new electricity prices last week. Ouch

It remains the classic conundrum though, abort renewables in the short term and lower energy prices…but at what longer term cost to the environment and ultimately everybody?

Or short term pain for what should be sustainably cheaper prices ahead?

Cries for nuclear get louder, but market forces do not agree with political rhetoric.

Nuclear production topped out 25 years ago.

Compared to renewables the bus has already passed the stop – in costs alone.

Drinking favourite…

Something different this week.

I had a bottle of Hahndorf Hill Gruner Veltliner 2017.

An Austrian white wine varietal, it sat on my rack for a few years and was cherry ripe to drink.

Won a gold medal in 2018.

Experts say:

“Brilliant very pale straw colour with greenish tinged edges and a watery hue. Lovely aromatics of peach, a hint of apricot, honeysuckle and musk overlay some quince with spicy end notes. Ripe peach and apricot flavours fill the rich, expressive palate with underlying elements of honeysuckle, subtle musk and spice.

Rounded mouthfeel finishing dry with a burst of fresh acidity. Good length with a spicy peach, light apricot, honeysuckle, musk and quince aftertaste.”

I thought it was bland and rather tasteless.

Not expensive but don’t bother. Not bad – but better out there.

6/10

Listening to…

I saw Cake doing “The Distance” on Rage TV and remembered just how good it was.

#TrollDJ could use this in the musical interludes for the Tour De France.

Cheers.

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS