(written down by Black Swan)

Not sure who Mr Morans is but he must be good.

Big Picture

Long edition – but I promise a shorter one next week.

In an edition late last year we concentrated on the investment time clock theory and I was asked “when will the growth balloon bust?”. I offered Nov 2021 as a possible time.

It would appear most unlikely that anything is going to go bang this calendar year now. Of course the bigger the balloon is pumped to, the bigger the eventual bang.

But there remains a truckload of cash slushing around in both households and business. The second chart below highlights how much money was thrown around under Covid compared to the GFC – almost five times as much. That is a lot of pink batts.

But underlying all that, the wealth divide between the “haves” and the “have nots” seems to get wider here and in most developed countries.

Those of us on the good side of that divide no doubt feel pretty good about the world. In a non market sense though, I can’t but feel that comes at a cost of squeezing out a middle class. It also takes away that wonderful Aussie lethargy about everything. We just become obsessed in the growing value of our property portfolios and keeping the down trodden down.

This also allows unscrupulous and shady characters to enlist the disenfranchised into various right wing nut job organisations. From there it is only a small step to the left and a jump to the right before we follow the shemozzle that the US endured on Jan 6. Signs of that already in Victoria. As if Dan has not had enough on his plate, he had a visitor this week. The photo reminds me of when Black Swan’s mother-in-law visits. Cordial but not overly warm.

Overseas President Biden finally got his Infrastructure Bill away. I must say it got little fanfare and markets barely reacted as I would have expected. Perhaps more a case of its success was already baked in, and if it had failed then all hell may have broken loose.

Lots of chatter that the US Fed had lost the fight with inflation and all hell is coming. Janet Yellen didn’t help when she gave less than a glowing endorsement of Fed Chair Powell on his chances of getting re-elected in the upcoming appointment.

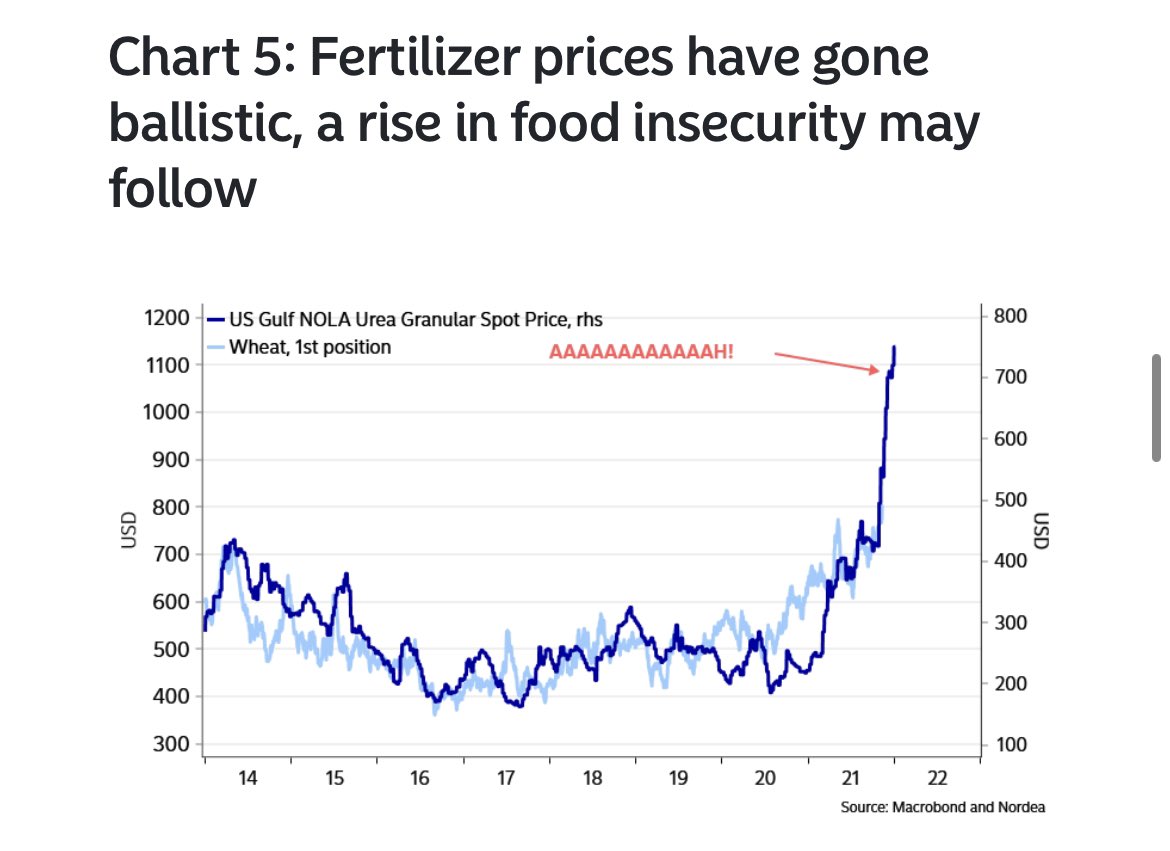

In the USA, the case to worry rests on a few things. Fertiliser costs are through the roof. A major input cost to farmers, this will undoubtedly flow through to food costs.

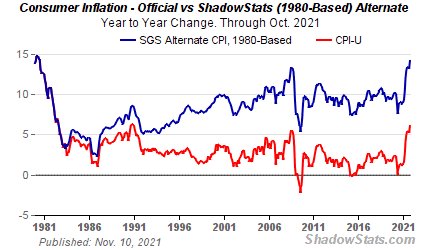

Imagine, if you will, if US inflation was not trading about 6% but rather closer to 15%? The panic for the exit doors would be dangerous. The Fed regularly adjusts and changes the way it measures inflation – often for the right reasons and sometimes for convenience. There is an alternate measure provided by Shadow Statistics that show just that. This crowd have been around for many years. They have a fan base and they have critics. Like most things, I suspect the truth lies in the middle.

On the flip side, oil prices are starting to fall (3% overnight) and OPEC are warning against over-supply in coming months. I’m sure many motorists are saying bring it on.

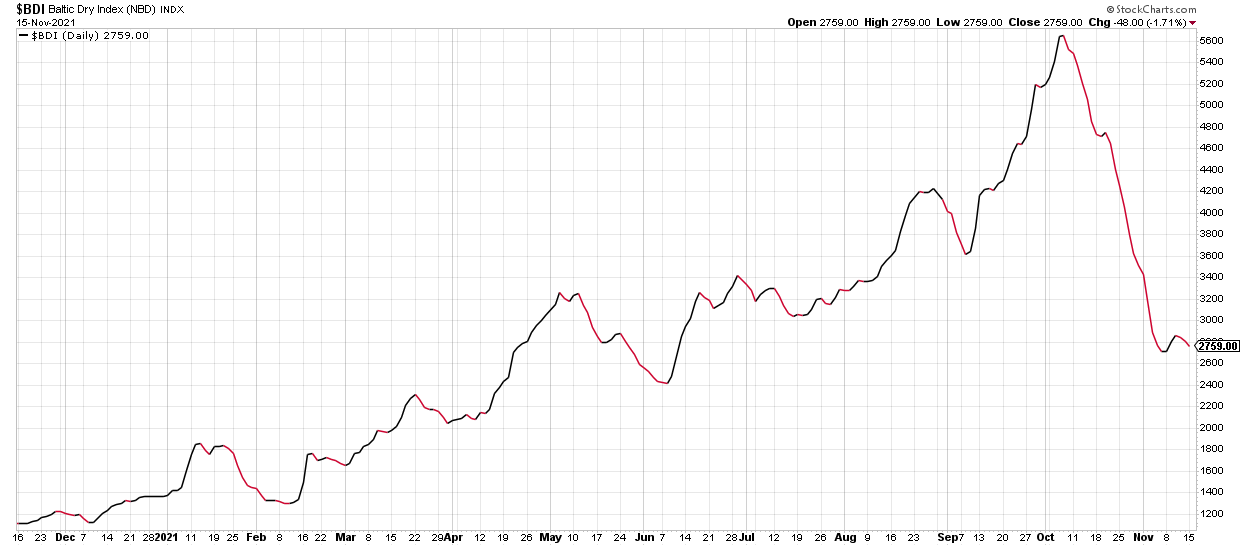

Supporting the transitory supply side theory (i.e. everything will be OK in 2022) is one of my favourite charts – the Baltic Dry Index.

This is the cost of shipping stuff around the world. It peaked in early October and has rapidly fallen. It would be a fair conclusion then that the supply chain is getting back on line.

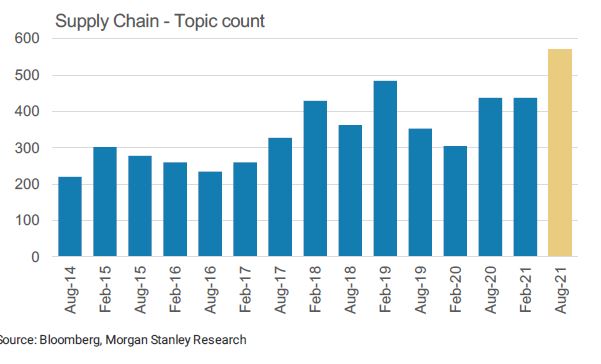

Who would have thought Supply Chain would be such an important term these days – interweb searches tripling.

I will remain on the fence about inflation for just a bit longer. Our RBA sees our inflation world very differently (Thought of the week) and we can chill.

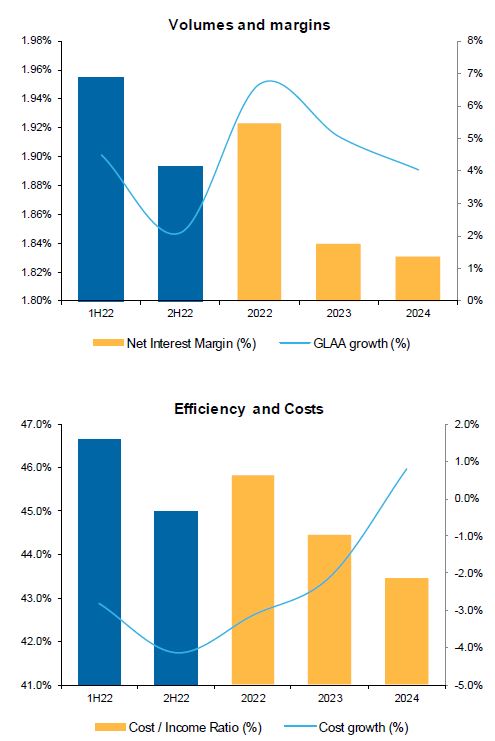

CBA data:

My old mate Elon, has been poking bears again.

Banks

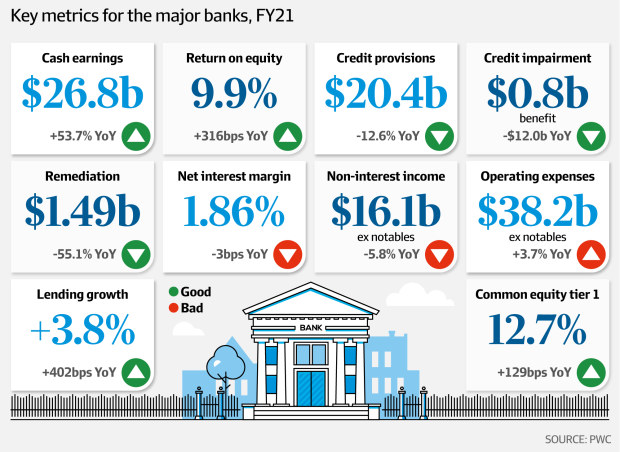

Bank reporting season coming to a close. General consensus was pretty good bounce back.

Dividends up driven by balance sheet growth and a truck load of bad debt provisions written back that are thought to be no longer required. The worst of remediation (past bad banking practices) are now behind them too.

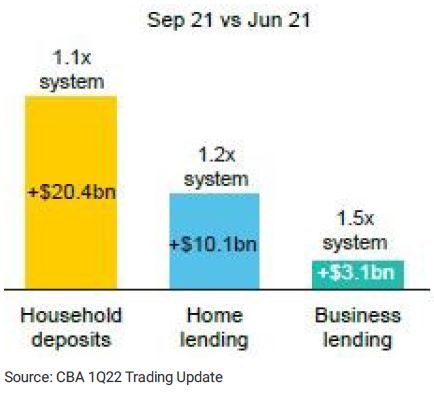

CBA report on a different time line horizon, but their first first quarter FinYear 2022 result yesterday was well below expectations. Their share price (in my opinion) was ‘overs’ compared to the three other majors – mainly based on the old historical ‘bank with the strength’ theory.

They got punished with a 8% share price fall yesterday when expenses went up and revenue didn’t match. Worse still their net interest margin fell.

They grew their balance sheet above system growth – especially in business banking. The perception is that they have been ‘buying’ market share by offering lending in business and housing below normal rates. From what Black Swan is hearing, that is exactly what they have been doing.

If they had done that as a stated strategy, then they may have got away with it – but in this markets blind-sided shocks are punished.

APRA are nearing completion of their banking capital review. Boring stuff for sure, but leaks indicate they may require banks to set aside more capital for residential lending. If so, maybe a bit more pressure on home loan rates. In a relative sense that would hurt WBC and CBA far more than NAB and ANZ.

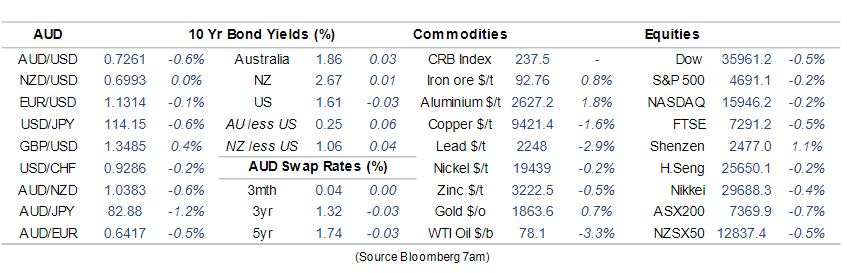

The Aussie Dollar and Commodities

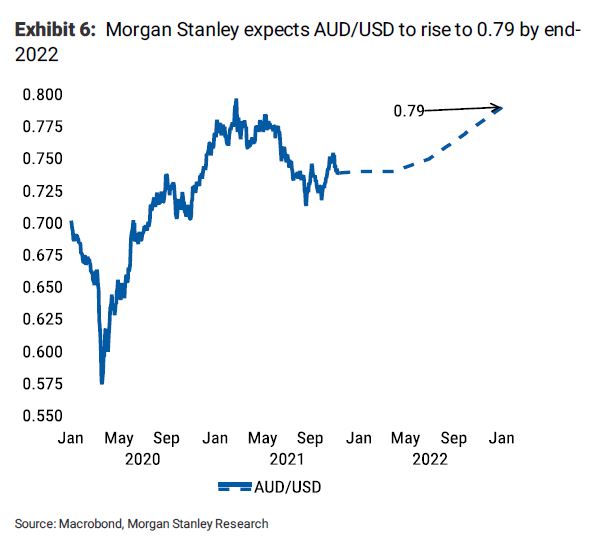

Aussie dollar continues to weaken and is trading at .7260 at present – our baseline of last week did not hold.

Iron Ore prices are one reason for the fall. The chart highlights how quickly it has moved. No real sign that Chinese demand will lift in the near term, so little chance of a big lift. One positive out of that though, is that the good quality iron ore we have and the low cost and efficient extraction means our miners can still make good money at current prices. Well done Twiggy.

Morgan Stanley see the Aussie going steadily up from here towards 80 cents by year end 2022.

Not my base case.

Politics

Both parties seem to have moved into campaign mode. Intriguing that Smirko looks to be going with trust, safety and economics.

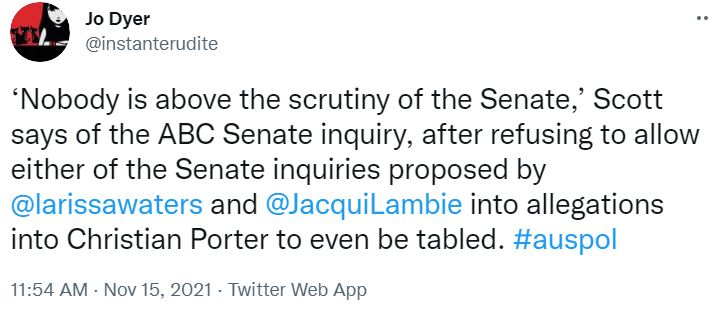

He rolled out the old favourite “interest rates will always be lower under a Coalition government” line. Other than the RBA is truly independent, the entire argument seems strange to me. RBA move rates higher when the economy is doing well and likely to be over-heating. So Smirko is basically saying that the economy will be doing less well under his government than an alternative. Interesting pitch. And as for trust and integrity…

Speaking of trust and independence, ABC in the cross-hairs of the Coalition. Not sure how they would know of bias in the ABC – none of them appear willing to even get interviewed.

They would much rather pander to the Murdoch camp and sycophants. Almost tweet of the week:

Interestingly though, data shows the bulk of Australians still go to the ABC for information. The Daily Telegraph a noticeable absentee.

But tweet of the week goes to below, with Beetroot Barnyard Joyce having a shocker. He is 100% behind Smirko’s 2050 Plan – so far behind we can’t see him.

So gird your loins for slogans by the dozen. “Australians have had enough of governments telling them what to do and how to spend their money”.

We did warn you about the security ‘push’ as well and Mr Potato Head is in full ‘Yellow Peril’ mode now. Latest data shows that Australians are more concerned about the threat to Taiwan from China than the actual Taiwanese are. Both amazing and disgraceful.

Housing

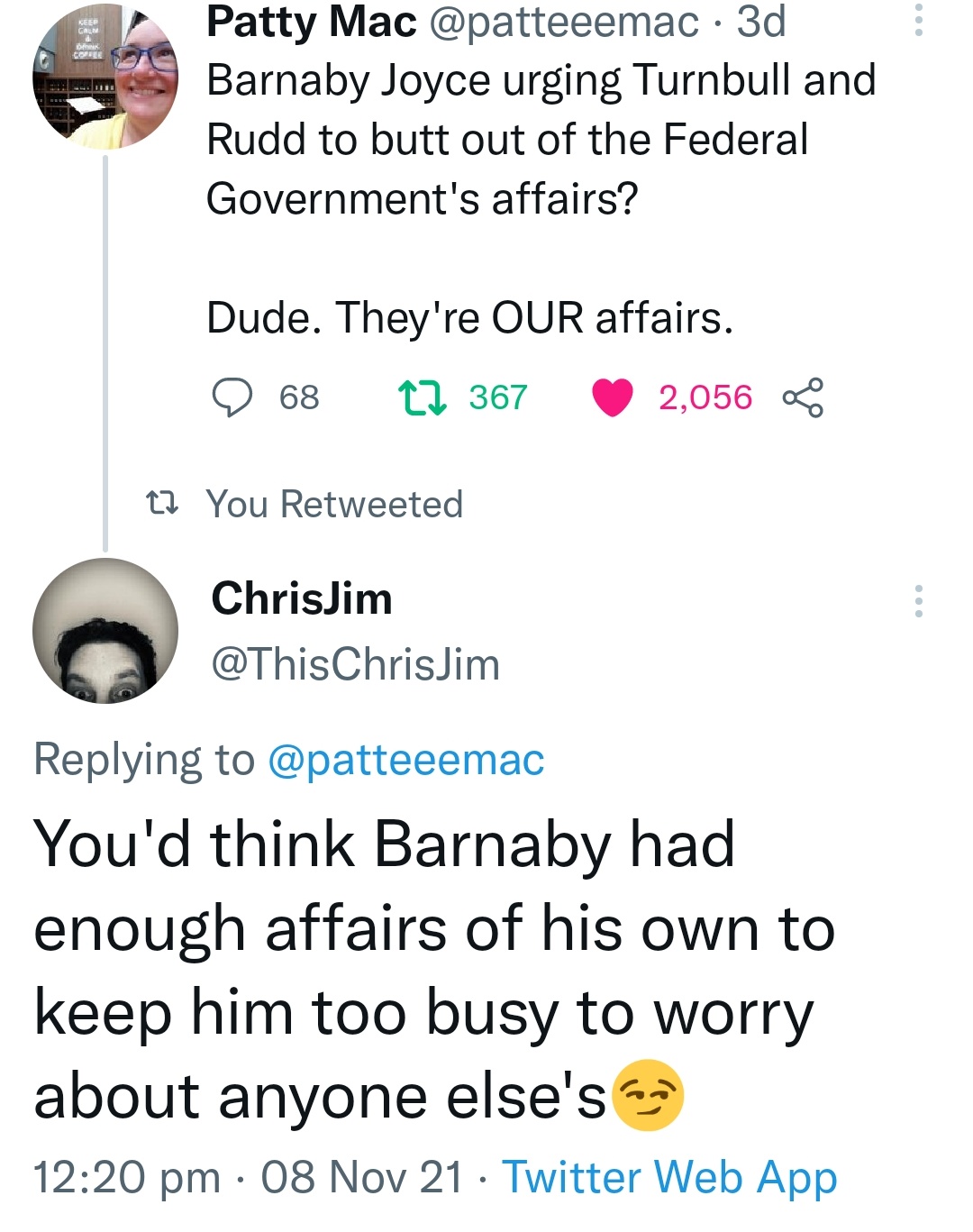

CBA data this week still show a much larger percentage of new borrowers electing to go fixed than usual.

Makes perfect sense, but as the RBA Governor highlights, just be careful when that rate expires in 2024 and your interest bill maybe doubles.

Lastly on housing, Black Swan has been busy building my own dog house. Pleased with the end result:

Crypto and Gold Land

Bitcoin fell heavily off its all time highs this week. Now sitting around $60K USD the reason behind the fall is not clear (to me) anyway. China had another swipe at BTC mining being energy inefficient – which makes sense when they have a massive energy shortage going into winter. Or it could be momentum shifts – every man and his doge is coming up with a new crypto.

There should have been upward support given the Indian Prime Minister has indicated his government wanted to engage in new crypto technologies.

Not sure how our mad punter is going – I know they are weighted heavily towards BTC, but their other new investments seem to be going gangbusters.

They did approach me this week with their latest hairbrained scheme – Abracadabra Money with the use of spells.

Highlight of this Ponzi is that you can leverage big time into it… I think.

I tried to get an understanding here Abracadabra and bingo

According to that it will give me a deep insight to the risks and rewards. I challenge any reader here to be able to explain it to me…

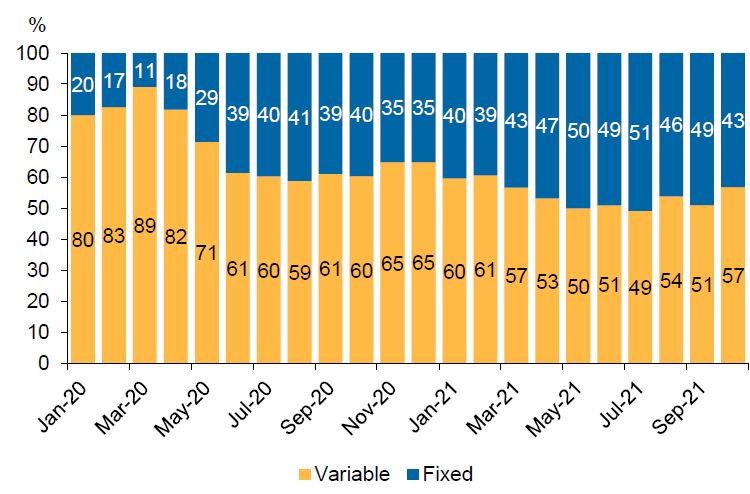

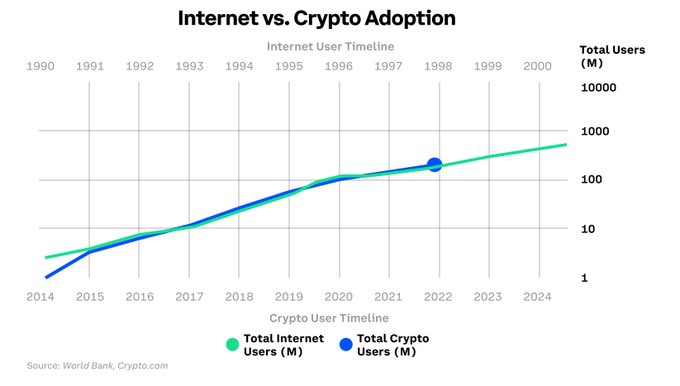

The other crypto article of interest this week is one for all you who think you may want to give it a crack… but have missed the boat. Am I too late?

Clearly a biased article but general theme is that there is plenty of run left in this horse.

Pointing a couple of arrows to a spot on a chart is one thing, but maybe the chart below has a bit more authenticity.

My XRP/Ripple is still doing bugger all.

My gold continues to inch higher. My investment now up 10% on the year. Not exactly crypto pace of gain, but happy enough.

Looks like Queen Liz is onto it as well…

ESG and Carbon

New section – because there is money to be made and lost.

First of all, predictions for Australian energy sources to 2050 defies the current Coalition claims that coal will be an important input for decades to come.

Secondly, the fun fact that energy prices will be lower under the Coalition (presumably using that black gold).

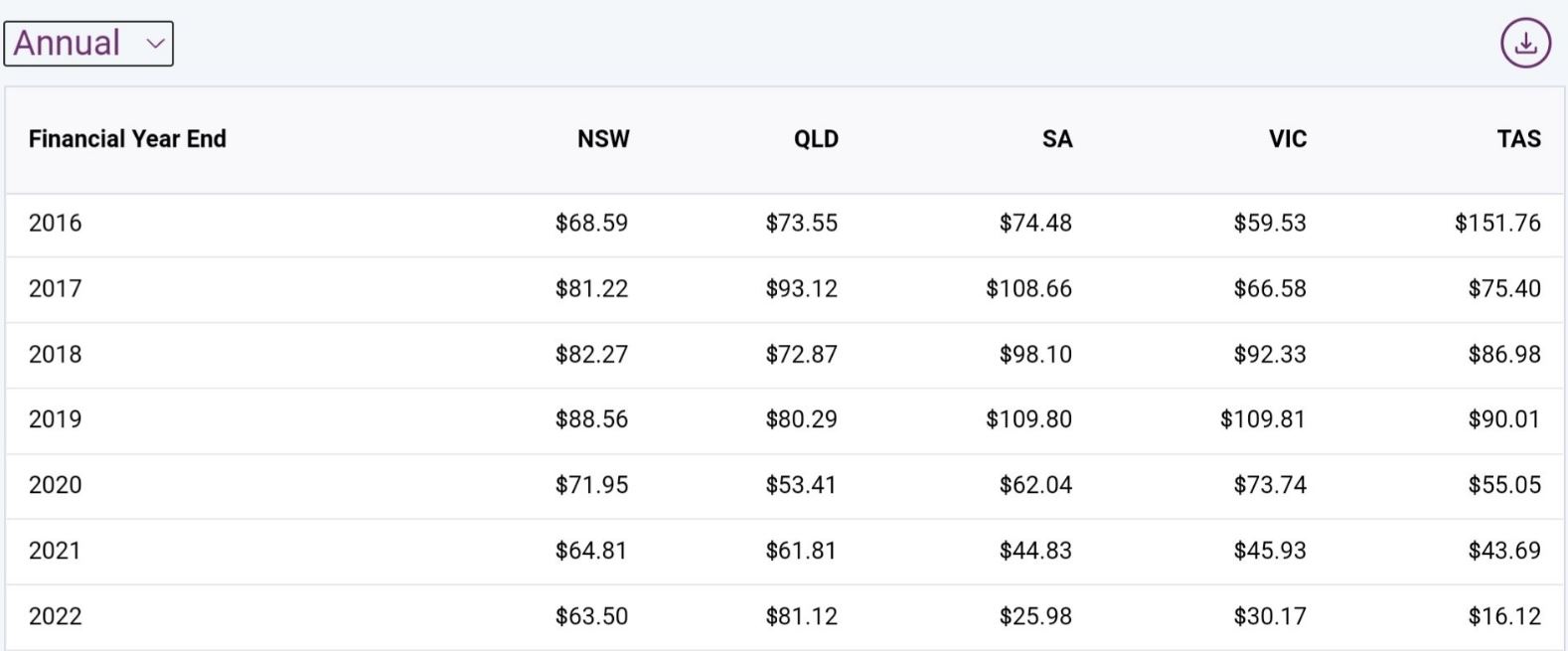

Take a look at SA/Vic and Tassie spot prices on an annual basis. Price reductions from the use of renewables is incredible. The coal states are stuck in the mud.

Meanwhile, Barnyard Joyce denies that the Nats ever signed on to anything.

Hidden deep in the bowels of the 2050 Net Zero Plan is a pricing assumption that Australia will move to a $24 price on carbon, higher than that originally proposed by Labor under Gillard – the one that Abbott won an election on.

A good thing, but hidden deep.

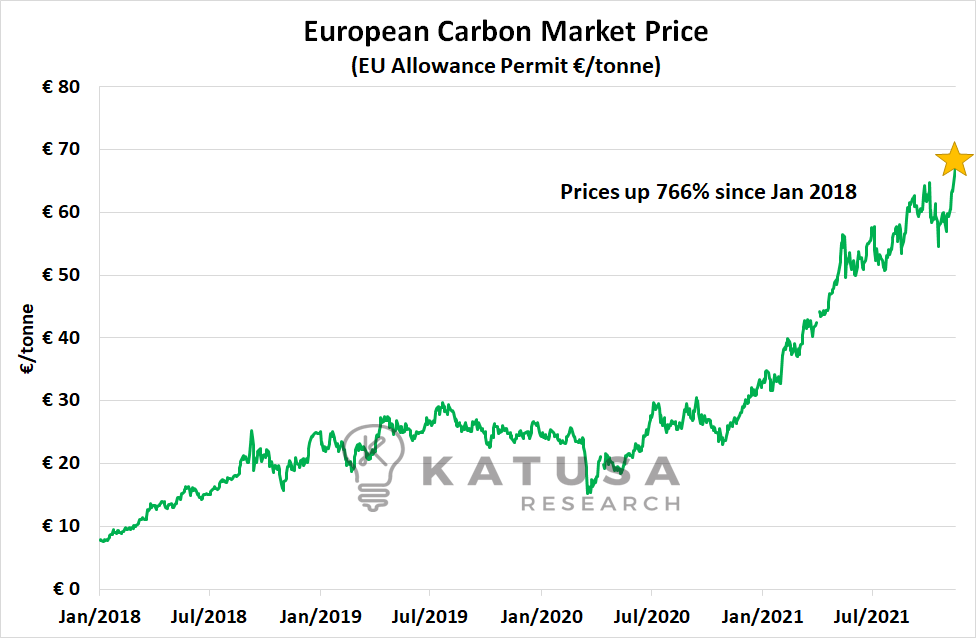

Meanwhile, if you look at Europe, carbon prices are going nuts.

This is not leftie bullshit – real $$ on the table for the taking. There is money to be made for astute investors that maybe don’t want to bung funds into crypto. The carbon market topped USD $1 billion this month for the first time ever.

Chevron, for example, needs to buy $40M in carbon offsets to make up for its underperforming CCS (carbon capture and storage) attempts… on which its modelling was conditional for initial approval.

On the flipside, a good article why banks and other businesses are becoming cautious on carbon. Funding projects in the future will certainly not be risk free.

Even the directors and executives appear at some risk. Bank of New York Mellon have pulled out of funding for Adani as it is incompatible with their ESG rules.

I am not a huge fan yet of ‘clean’ hydrogen, but like crypto investing, getting in early may pay dividends. I have tossed a bit into a Hydrogen EFT (HGEN). Would love to buy into Aussie carbon once the obvious is declared.

Thought of the week – the banal

Morgan Stanley did a report this week that confirmed they believe the RBA have it right. Inflation IS transitory, wage growth will be anaemic for some time and the cash rate will not rise till late 2023/24.

The bills futures market and the swap curve suggests many players don’t believe Morgan Stanley or the RBA.

RBA Governor Phil Lowe spoke this week to explain RBA’s thinking. Important (if not boring) stuff for us all.

To save you time, here is his highlights and my takeaways:

1/ Many countries have undershot their inflation targets for many years – he believes globalisation and technology are the key causes together with a changing labour market.

2/ Current global high inflation will not last into 2022… Lowe believes Covid lockdowns have seen households spend money on ‘stuff’ rather than services (since they can’t go out to dinner or travel on holidays).

Increase in demand for goods not met with increased supply that had got into a ‘just in time’ mode. Signs that this is correcting already.

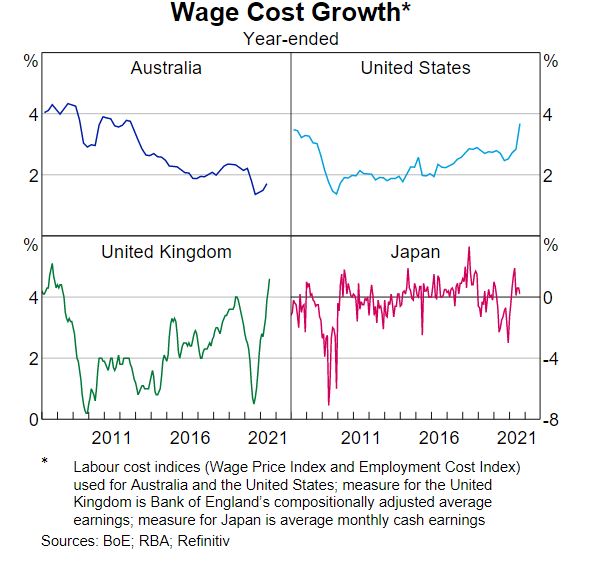

3/ Labour changes are different here. In the US they have a less attached workforce to employers. US participation rates lower, so unemployment levels lower. Some sign of wage pressures. Less of that here.

Chart does seem to support that:

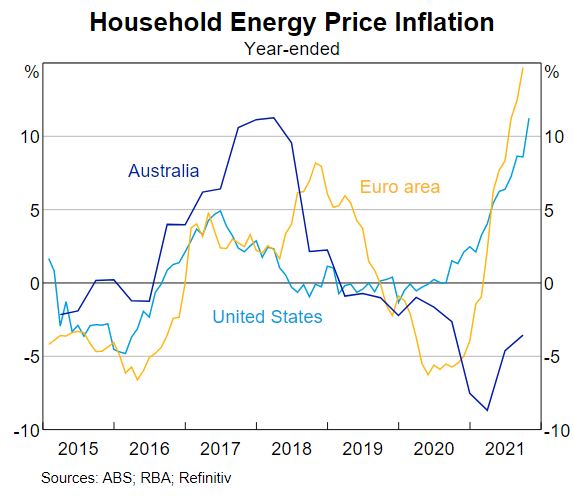

4/ Australian Inflation – Household energy costs are MUCH lower here than overseas. Lowe puts this down to Australia adapting to the use of wind and solar. Tell that to Angus Taylor please, Phil…

5/ Wages – Australia has a lot of workers on multi year enterprise agreements that may keep a lid on wage growth and employers are not keen to pay up. This is (in my opinion) one of his weaker arguments.

6/ Monetary Policy – given above all good. Economic recovery on track and will continue at a steady pace. Unemployment to hit 4% by the end of 2023. Inflation will settle like a magic porridge at 2-3%.

If ‘we’ are wrong and growth is quicker then we may need to hike sooner than 2024… but we don’t see that at this point.

Summary – maybe… but he needs a lot of things to go his way.

Whilst not in his speech, I am told in the Q&A Lowe indicated that he saw the future neutral rate for cash somewhere around 2.5%. That is much lower than the historical norms, but interestingly higher than many long range cash forecasts.

Drinking favourite…

Back to familiar roots.

Mate brought a bottle of this for dinner on Saturday night.

Critics say:

The bright natural acidity creates a kaleidoscopic effect on the palate, highlighting the purity of red fruit and the elegance of perfectly balanced acid, fruit, and lightly chalky textures. It is amazingly focused and clean and charismatic yet extremely generous in its composition and is capable of significant dividends in the years to come.

McLaren Vale has some of the worlds oldest vines planted in some of the worlds oldest geology. Taste the rocks and listen to their unique and ancient stories and celebrate some of the best terroirs in Australia.

I say – a unique but definitely a Grenache taste. Got better with some air.

Tried to buy it at Dan Murphy’s (on special at 2 for $50) but sold out.

If you can find it sub $50 then buy it.

8.5/10

Listening to…

This suggestion came into Black Swan’s inbox.

Why is it that the English can just produce music almost as good as ours.

Sam Fender – good when you are on a bender.

As a final aside, Coles have confirmed that two thirds of their 1,400 butchers will be retrenched under the new model on no in-house butchers. Am I the only one pissed off by this ‘improvement’? Retrench a coal miner and all hell breaks loose… but you can cut a butcher.

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

Cheers, BS