Big Picture

I’ve been contemplating my navel for a week or so in a mountain cave. So, what has been happening?

The epiphany I had was that these reports are too long – well at least a few reader’s complaints helped me come to that conclusion.

Will thus shorten.

Big dog, the USA, has been distracted by the Russian/Ukrainian conflict. The US Federal Reserve did hike cash rates by a lazy 25 bps, but this week their head man finally conceded that they were well behind the curve and that inflation was way too high. He has committed to do what it takes to get it under control.

Current thinking is there is now a 80% chance of a 50 point hike in May and an acceleration of QT. I have talked about ‘neutral rates’ before – the Goldilocks level when everything is just right. In the USA, that was previously thought to be 2.4%. Market pricing for cash is now higher than that in 2023.

Equity markets seem not overly concerned. The US and Aussie indexes had a strong few weeks and are higher now than pre Russian invasion. Although, it seems the equity players are almost pleased that the FOMC have committed to getting inflation under control.

Of course that sets the Perma-Bears into hyperdrive. If the FOMC (or RBA for that matter) hike cash rates too much, then the obvious result is crushed demand and a high likelihood of an economic slowdown, or even a recession. There is the old joke that economic bears have predicted 85 of the last 5 recessions.

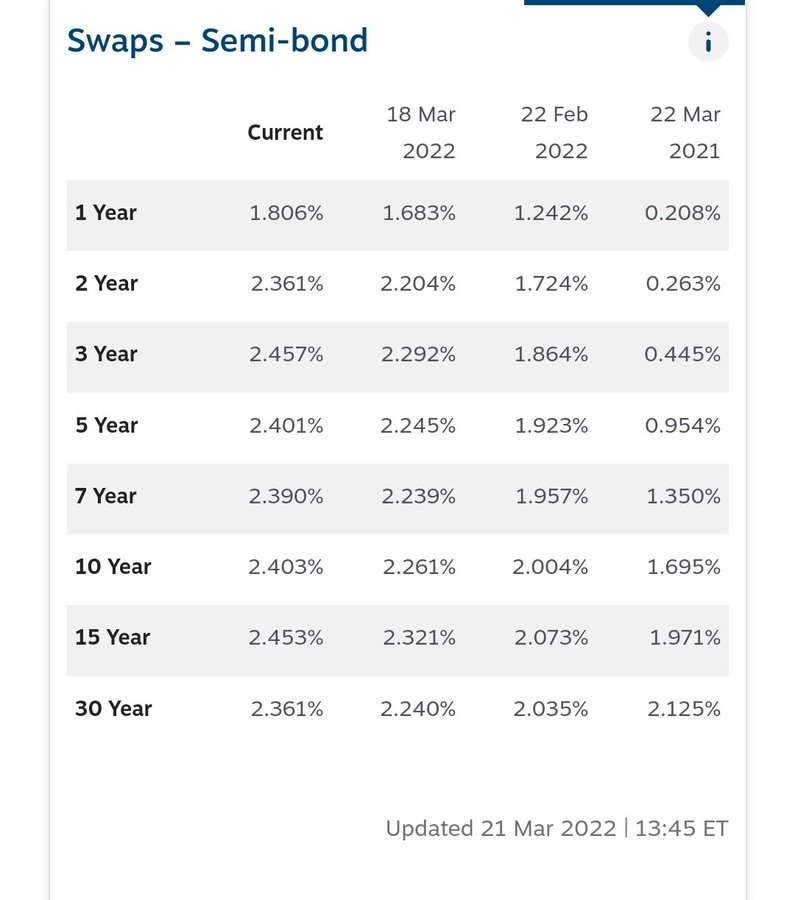

Inverse curves are often seen as a more accurate predictor of any likely brick walls ahead.

Swap curves are also seen as more legitimate than treasury curves (that can get corrupted by QT/QE).

Look at two things in the chart below (US swaps).

One is just how much they have risen in the last year – especially 1-5 year rates.

Second is just how close 2 year, 5 year and 10 year rates are.

Right on the cusp of “oh shite”.

For what it’s worth, my view is the 1 and 2 year rates in the chart do not reflect the risk that inflation stays at, or above, 4% for some time and that if so, the FOMC will hike higher.

But while I’m nervous still, I have not yet tipped equities out and headed to all cash. There is a strong argument that could be mounted to see this house of cards being strong enough to hold another level yet.

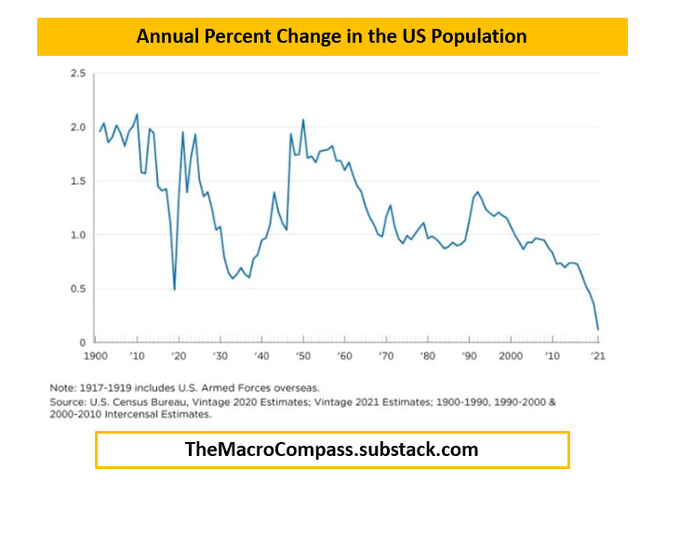

One side issue that has had little investigation is US population growth. We here in Oz know perfectly well what a growing population does (ours via immigration). But the US population growth has stopped:

US domestic demand, you would think, may be dented in the next few years, even with the fact that not inconsiderable cash is held in household bank accounts.

US domestic demand, you would think, may be dented in the next few years, even with the fact that not inconsiderable cash is held in household bank accounts.

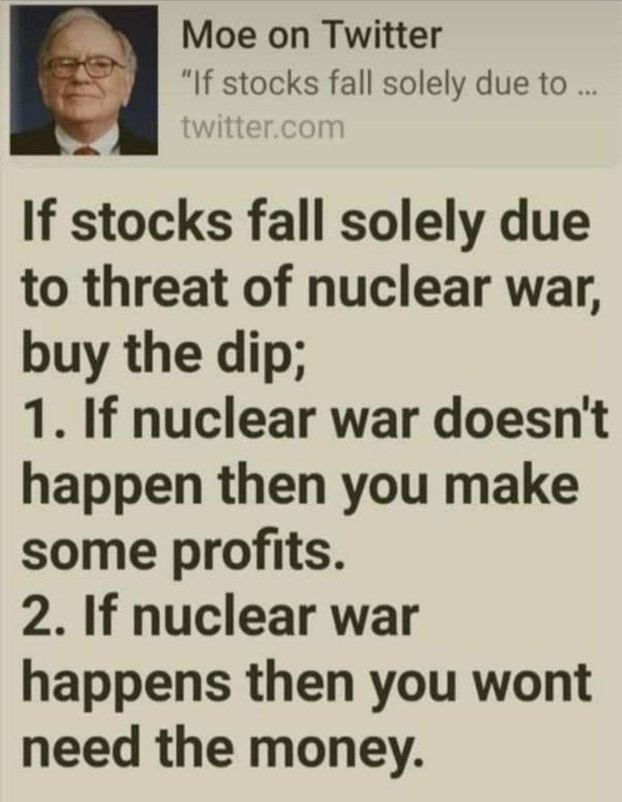

Geopolitical issues continue. I do like Moe’s advice:

Ukrainian conflict looks terrible via TV and socials. Credit to the citizens of Ukraine, they seem a tough bunch. I’m surprised that Putin seems to have so underestimated their commitment and strength of character. Perhaps Putin paid Bain’s or McKinsey Research for a white paper on how to invade and they just used an old paper from 1939.

Biden seems a wishy washy on the issue, but of course there is considerable risks in getting involved further. Arnie the Terminator’s speech is worth tracking down if you missed it. Otherwise:

I did see a chart that indicated Russian current account has never been ‘healthier’. No doubt aided by the fact that no one is sending anything to Russia, but largely because they are still selling oil and gas (at very high prices) to Europe and beyond. China is also niggling at the side as a food importer.

Sanctions appear to be hurting somewhat, but does the Western world have the kahunas and ability to ban Russian oil and gas? Apparently Germany may be ready.

US car drivers are squealing about petrol prices. By my last calculation they are paying approx. $1.60 AUD a litre compared to our $2.20+.

You need the right precautions.

Bloomberg got a ton of negative feedback for this piece:

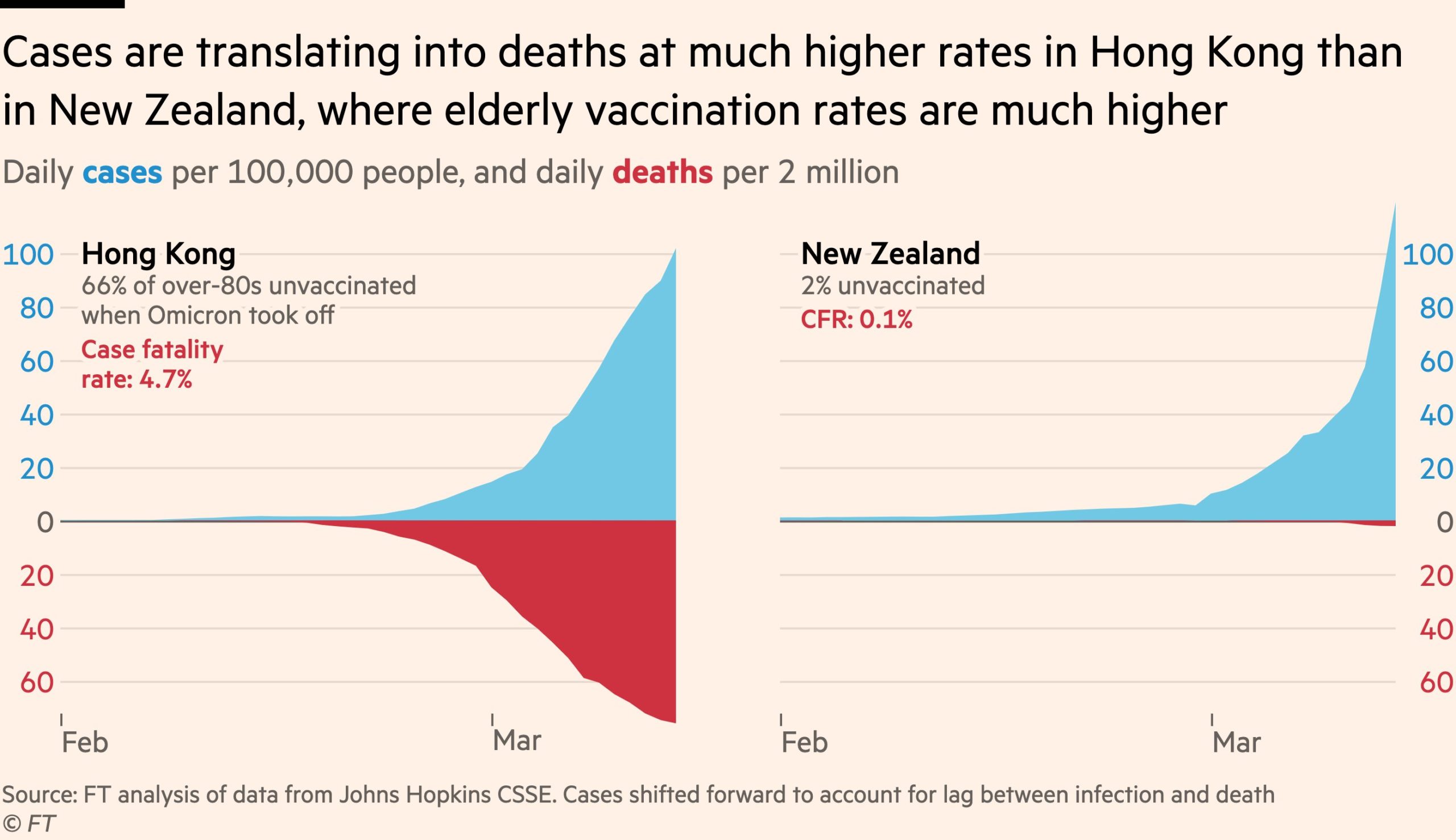

Finally, nobody wants to see or hear anything about pandemics anymore. But unfortunately, it still exists. China have gone for a zero strategy; locking down millions of citizens in an attempt to stamp out Omnicom. 17 million Shenzhen inhabitants alone. To date unsuccessfully – especially in HK.

Some global economic risks if they continue on this path. Hard to get 6% GDP in China if everyone is locked up or dead.

Domestic Duties

Last weeks employment data was without doubt strong.

77k new jobs, hours worked up, participation up, and unemployment to 4.0%.

Higher wages not evident yet, but starting to get the vibe they are coming.

Will be hard for the RBA to sit back too much longer, you would think. First cash rate hike in August?

Westpac Consumer Confidence has fallen dramatically. No wonder with fires, floods, wars and inflation fears. May be temporary.

CBA data:

Banks

Banks share prices remain elevated.

I read the majors will increase their net income margin by 3 bps each time the RBA hike rates – not insignificant. This is mainly a result of the increase margins they will collect on their deposits.

Some of this will be offset by increased risk of borrower defaults. Macquarie also estimate that a 1% rise in rates could lower credit availability (I presume consumer and commercial) by a whopping 10%.

NAB doing particularly well even given current investigation into Star Casino shows NAB somewhat implicit in possible money laundering by concealing gambling as hotel expenses. One Chinese high roller claimed to have spent $2.5M in hotel expenses in 3 days.

Who hasn’t had a blow out weekend every now or then. But I struggle to find ways to spend $52,000 an hour (allowing for my 8 hours nightly kip).

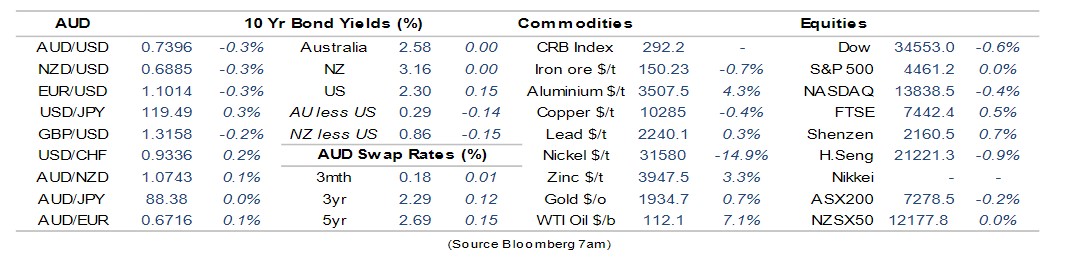

The Aussie Dollar and Commodities

The Aussie dollar hit 73 cents last week, and I mentioned if I was an importer, I would be tempted to take some cover at those levels.

Well, it is now 74 cents, so the same deal applies. I did say 75 cents is unlikely, so I will stick to that.

A key reason for the strength of our dollar is commodities. The price continues to rise wheat, meat and metals.

I had a story to tell about nickel. There is a lot of talk that the rush towards renewables will be stalled because of Russia. They supply about 20% of the global nickel needed for stainless steel production, but also batteries (including EV’s) and solar panels.

Prices were already rising, then on March the 8th, Putin banned nickel exports. Prices went Barney Bananas, and the biggest exchange (LME) suspended trade in nickel for the first time since 1985.

The chart below shows the huge price rise. They estimate that this alone could add another $1k per electric car.

Russia has 20% of global nickel. We have 24%. Suck that Putin.

Politics

Somewhat surprising landslide win for Labor in the SA elections.

For once I agree with SloMo – the new Premier is not Albanese. Not sure what Federal implications there is for the upcoming election.

There are some similarities though: both Coalition parties at State and Federal have a recent history of scandals and questions about integrity.

Labor had their own issues with the ‘mean girls’. I would have thought Albanese would have no problems letting the Prime Minister’s Office investigate the issue. No results of any investigations ever see the light from the PMO.

The Federal Budget next week will be the last chance for a Government cash splash to try to keep power.

Hard to do and hold any semblance of fiscal responsibility.

They are still running with ‘fear’ high on the list.

China remains the bogey (albeit we are happy to keep sending iron ore and coal there).

Not only in the South Seas it seems. Dutton wants to set up an Australian Space Command to counter the risks from Russia and China.

I don’t know about you, but it would be a real cynic that said this was a distraction announcement and not money very well spent. Knob.

Meanwhile, a number of Libs seem to be campaigning in an unusual way.

Sharma does not even want to acknowledge what party he belongs to, and has moved away from Lib colours to a teal… in line with his key Independent challengers.

Josh Frydenberg has similar colours I believe.

Then you have Australia First party – aka The Numpties.

If we had Confederate Flags, that would be their thing. Put Australia First, but let’s get our signs made in China to save a few lobsters.

Cost of living and real wages getting a lot of media focus. Let’s see what the Budget brings.

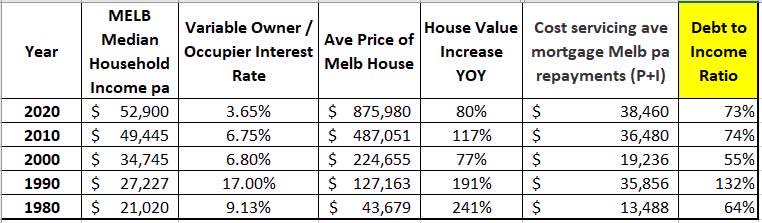

Housing

The value of Australian housing surpassed $10 trillion after the 23% rise in prices in 2021.

Last month’s increase of 0.6% were more in line with longer term ‘norms’.

Prices need to stabilise (or fall).

I asked Mrs Swan where she thought little old Radelaide sat in global house price terms.

She was about 200 places away. It sits 14th globally in (un)affordability and well above New York. London is there for the taking.

Counter argument on affordability (and lack of wage growth) is in this chart.

Of course all reliant on mortgage rates not going higher – stand by

I did read a Morgan Stanley report that reminded me that Retail and Commercial property returns have a closer correlation to long end rates than RBA cash rates. These guys do have a longer dated hedge book so I would not expect to see a huge pullback in that space as short end rates rise. Of course that assumes my view (that long end rates may not rise much from current levels) is right.

Crypto and Gold Land

Gold holding okay price wise. Not helped by a strong USD, but still holding some ‘safe haven’ values.

Not sure the same could be said for crypto that seems to follow equity markets more than it should.

XRP Ripple price up on belief that their law suit against the US SEC is progressing well (but slowly). At AUD $1.13 I’m only down circa 30% now.

Bitcoin at $42k USD is largely range bound for now.

The ‘weaponisation’ of cash payment platforms, Swift in particular, post the Russian invasion may see fringe countries join in support for crypto.

I’m not sure Australia is a fringe player, but our Federal Government is looking to create some crypto reforms via a new “Digital Services Act” and Frydenberg is hunting industry feedback on possible new crypto licensing and custody rules.

I saw a report that some Indigenous artists from remote East Arnhem Land are selling their art as NFT’s. Good on them and I hope it works. Shows the reach of this stuff.

ESG and Carbon

We have covered carbon credits extensively. Most people roll their eyes and start to yawn. Lefty, Greeny stuff aside, there is a shit-tonne of money to be made and lost in this space.

Short story is that the Government bought carbon credits from farmers at a fixed price of $12 a tonne. Market price has more than quadrupled to $55, as polluters look to offset their emissions.

Without notice or fan-fare, Angus Taylor announced this week he will tear up those $12 fixed priced agreements and let the farmers go to the bigger market.

It is like Banks saying anyone with a fixed loan that they didn’t like could walk away from it. Estimates is that the dollars in question is circa $3.5 Billion.

This change appears to have come via a review of the Emission Reduction Fund body in 2020 led by a former head of the Business Council of Australia and Chair of a company called Green Collar.

First response was a 30% fall in market prices – working as an immediate disincentive for polluters to change.

Next problem is that most farmers have sold their carbon to the Government via an intermediary.

What is one of the largest intermediaries in Australia you may ask? Green Collar is the answer.

Whilst I am sure all is above board… looks bad…

The ABC’s version is below:

Drinking favourite…

Controversy this week.

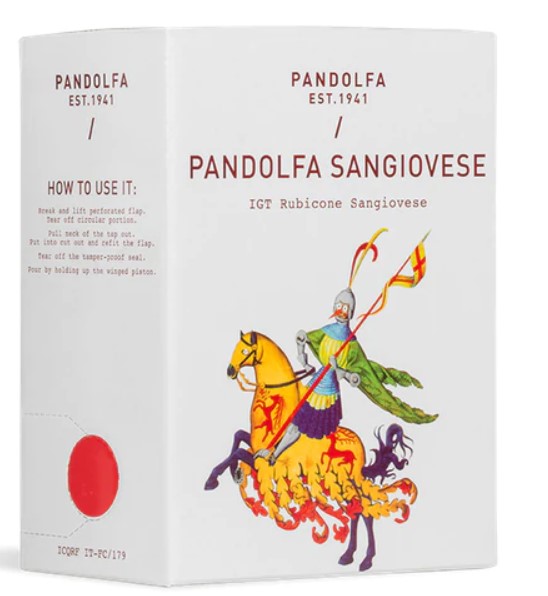

Yes – Black Swan has gone the goon.

Took this 3 litre puppy into my cave. Tuscan sangiovese (they called it 2019 vintage but not sure how they know).

The producer says: “The aim here is to make a pure expression of Sangiovese as it is known in Emilia Romagna. Highly aromatic, cherry, raspberry liquorice and subtle spice, Mostly aged in stainless steel for 12 months, with the remainder aged in large oak casks owing to its softer character and drinkability. You would make quick work of this wine with a bowl of pasta or pizza.”

My young cygnets at home refuse to drink it – added bonus and protects my cellar stocks.

Fellow cave dwellers were mortified.

Stuff em. At $35 it is good wine at an excellent price.

Load up.

7.5/10

Listening to…

This song was released in 2017 – but is ageless… other than it is about an age.

Strong drumming and guitar. The band is described as ‘stoner rock’. Seems legit.

From Brooklyn, they are touring Melbourne and Sydney next month. Reckon they would be a crackin’ live band.

I loved the line in this song, “I was kite-less”.

Easter approaches. As Marlon Brando said in Apocalypse Now: “The horror….the horror….”

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS