Big Picture

Rock bottom? I’m not sure, but no razor blades are out for me.

Some degree of near panic as asset prices in property, equities and bonds are all pretty volatile.

Just when you see the smidgeon of calm and a rally, the rug gets pulled again. Central Banks have gone full attack mode on inflation.

Of course before we dig deep (ish) into the markets, just how stuffed is the entire fabric of the USA? No-one saw the shit storm coming that is the Supreme Court. How nuts are they? Abortion ruling aside, they have made gun control more difficult, over-ruled government environmental agencies and seem like they have a lot more on their agenda. Meanwhile, the whole USA democratic process is under review with the Jan 6th committee. I am not sure that Trump will ever actually see the inside of a jail cell, but you heard it here first… he will be charged with sedition in 2022.

While none of this should be affecting the “markets” it must just add to the uncertainty of investors.

Just when you think inflation may have peaked in the States, they get some data that puts it at doubt.

It has been so long since most Western economies have seen a hiking cycle I fear some have missed the whole idea of what it is intended to do.

A hiking cycle is intended to give PAIN. It looks to slow demand (and if supply stays equal or increases then prices should fall). It looks to see unemployment go higher. It looks for house prices to fall.

Of course nobody wants to actually say that – especially central bankers or politicians. Everyone believes we can land the economies soft and gentle like a summer shower. Possible but not guaranteed. Maybe more like Oman this month..;

The US labour market is in the same situation as we are. Unemployment very low and lots of vacancies. But mounting evidence that vacancies are shrinking and lots of big employers (eg Tesla) have market notifications of large staff retrenchments.

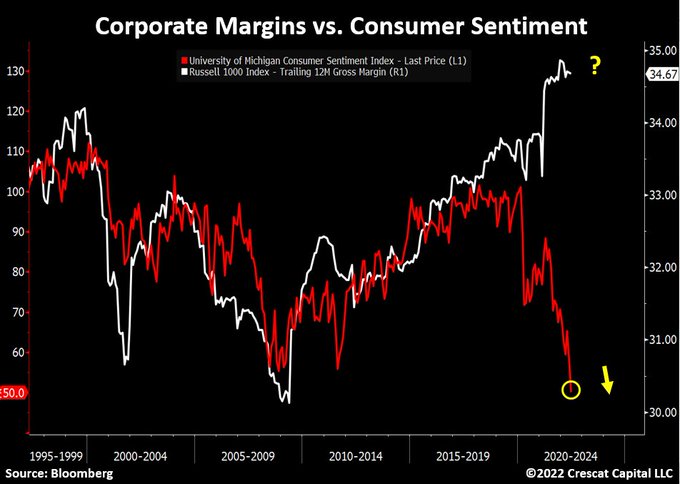

The red line above is US consumer confidence and the white is company profits. Big divergence. The inference is that profits will very quickly trend down. US consumer spending is also falling quickly (unlike here in Oz).

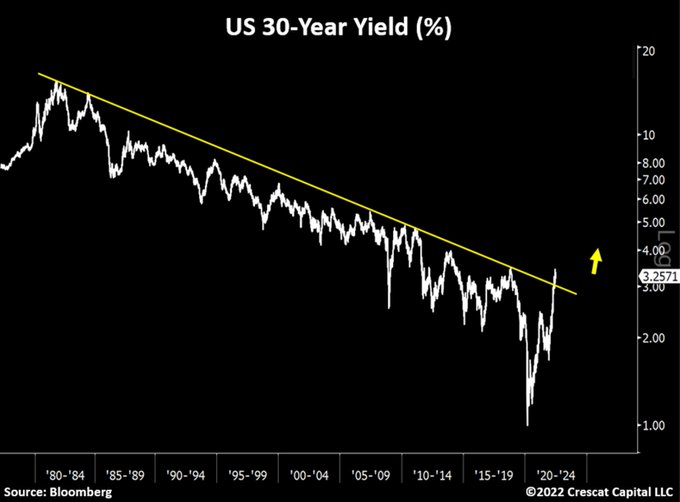

Members of the US Fed Reserve are talking a cash rate above 4%. The bond market believes they are serious this time. One of the biggest breakouts of chart trends that I have ever seen:

All this pain to kill inflation. Like the dingo or the wedgetail, I am not 100% certain it is actually the killer that many think it is.

Expected future inflation in the USA at least is not that bad. Yep. High now but most see it heading lower in late 2022 or 2023 at the latest.

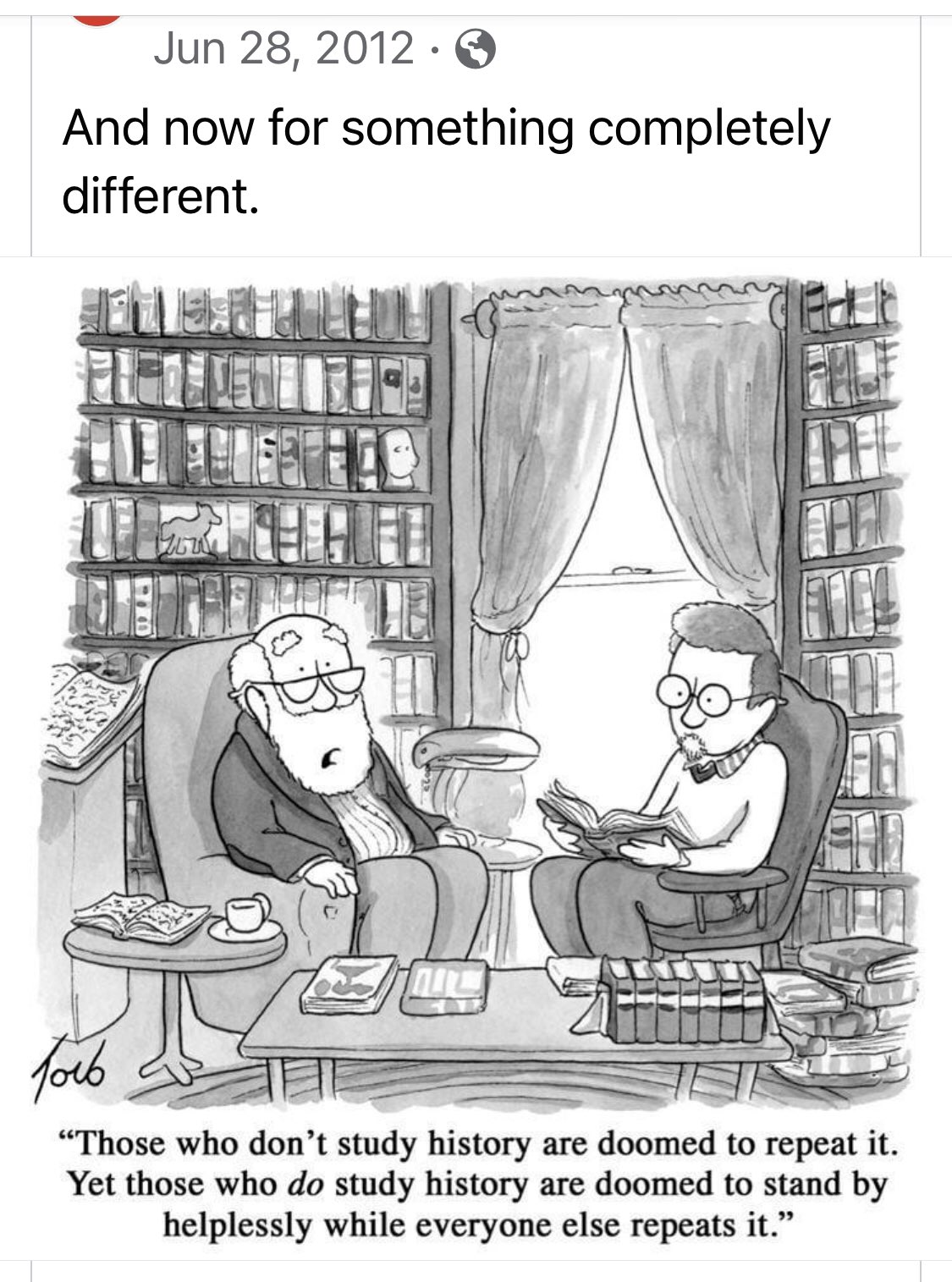

In a recent edition here, we stated that markets can withstand hiking cycles pretty well – provided they are slow and measured. Both in the USA and here, the exact opposite is true. Go hard then go home is the theme. “This time is different” you say? An old cartoon – but still relevant:

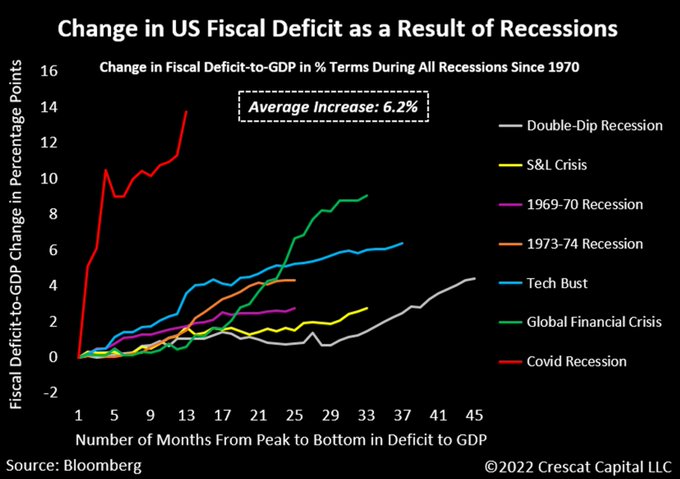

Yep different, but worse. The Fed have shot all their bullets early. No ammunition in the gun (*not NRA sponsored). The red line below shows that outside of monetary policy, there is no fiscal power left.

Thus the market has some kind of consensus at the moment, expecting a short, sharp recession in mid 2023.

Fair enough – but what do we DO now, until then? Sell, hold or look for that dead cat bounce?

For me it is be conservative but hold.

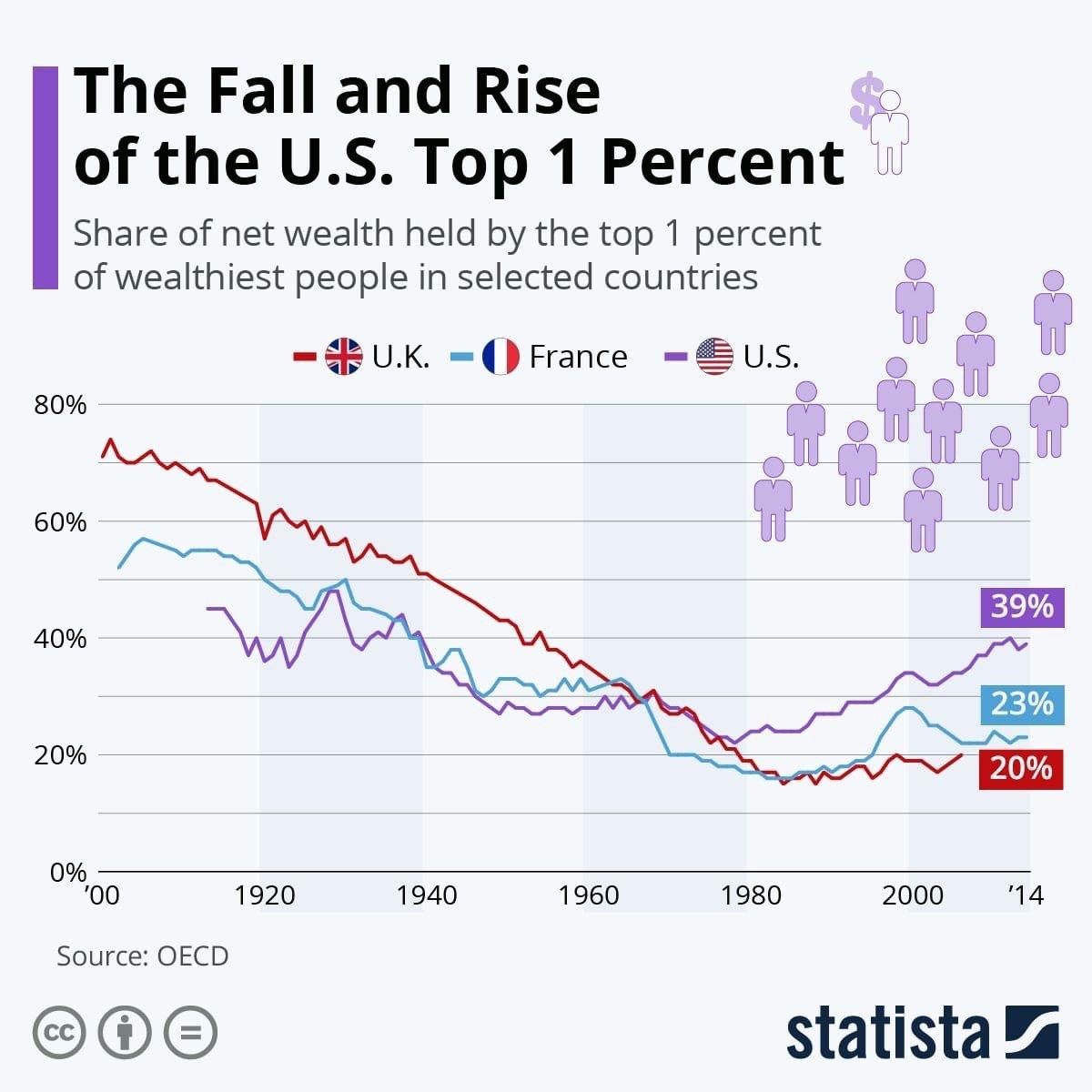

Somewhat aged chart below, but I found it intriguing. It shows the share of net wealth held by the 1% elite of the UK, France and the USA.

No surprise that the concentration of wealth is particularly high (39%) in the USA – and probably higher in 2022.

For me was the incredibly high starting point for the UK. Pre Industrialisation, some 80% of UK wealth was held by just 1%. That staggers me. That they transformed without serious civil unrest is very impressive.

Australians can take to the streets to march against vaccines, or for civil liberties. Or for even more important reasons.

I’ll finish this section with the broadest of macro-economics. In footy parlance, who is climbing the ladder, and who is heading for relegation?

I’m not convinced of the input data, but under World Bank predictions, China wins the premiership in 2031.

We currently sit 13th but should bump South Korea off in the next finals… before dropping to 14th in 2036.

Perhaps this assumes our “lucky country” status will be tested in a net zero carbon world…?

It really is a wheel of fortune game…

Domestic Duties

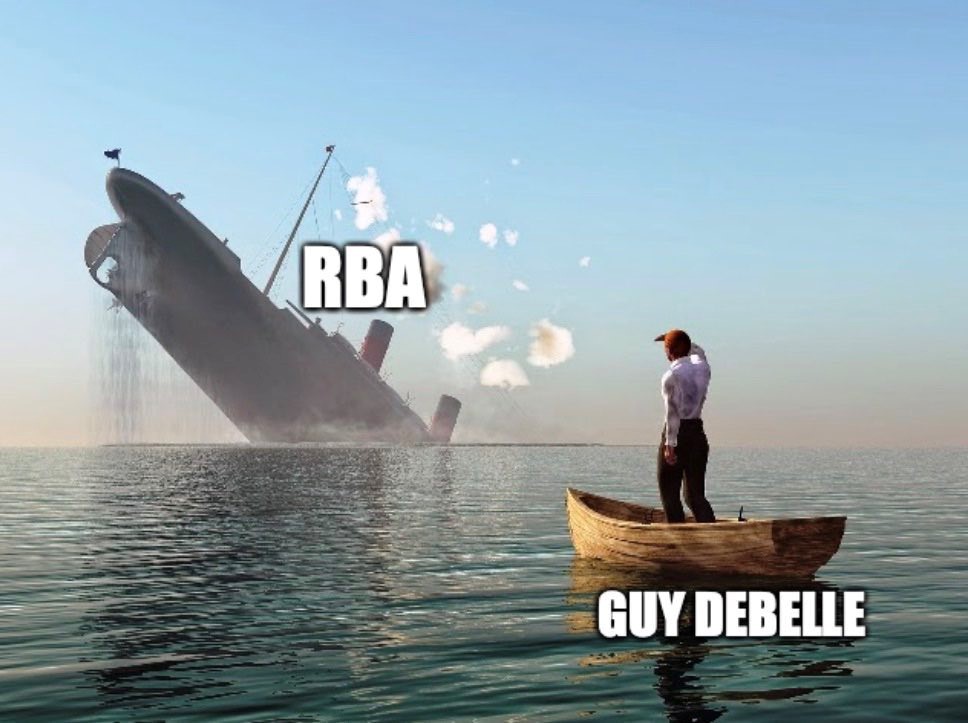

We will find out soon enough how much pain (and how quickly) the RBA want to kill inflation this week.

I reckon 50 points is the go. Enough to hurt, but 75 bps would perhaps spook the horses too much.

Guy DeBelle definitely got out of the RBA just before it hit the iceberg.

Whilst we will always follow “Big Dog” USA, we remain at a very different stage of our economic cycle.

To me their economic clock may already be tipped past midnight. We are still at the party – just trying to figure out who is designated driver.

Retail sales remain pretty resilient;

The vibe is changing though. As one senior banker said on the weekend: “buyers are now sellers”.

With an RBA hike imminent, it is a good time to remind readers that the Central Bank cash rate is only one input into funding costs.

Recent “averages” see Aussie banks funding themselves in thirds:

- 1/3 coming from deposits

- 1/3 coming from short/medium term domestic market

- 1/3 coming from longer term offshore wholesale market

Bank deposits hold the largest chunk currently with households and businesses still holding significantly more savings than usual. But this is reducing now. This portion is closely linked to RBA cash rates (and banks enjoy when that cash rate is on the up).

Longer term offshore funding is getting more expensive as European and USA rates rise – as well as our AUD falling.

Domestic term funding is rising quicker than RBA and government bond rates. As powerful as Aussie banks are, there are not “sovereign” risk. They need to pay a premium over government bond rates. This is measured as a swap spread. Spreads are rising.

The chart below gives an idea of just that;

I mention this to explain, in part at least, why CBA hiked fixed rates for 1-5 years by a whopping 140 bps last week… whilst at the same time dropping floating/variable rates.

ANZ data:

Banks

Still believe Aussie banks have been oversold.

I’m holding.

A reminder, if any was needed, that the Big Four Aussie banks operate as an oligarchy, shown when a new bank surrendered last week.

Volt Bank started in 2018 and gathered about $113m in deposits which it is now giving back to customers as it ends its attempt to grow a mortgage book. With regulation costs, you would certainly need scale to make a dollar.

Whilst I have earlier called Judo Bank as a challenger worth watching, it’s share price is getting crunched even more than the big boys.

Rumours remain that Suncorp are also keen to sell off their banking arm (to Adelaide Bendigo?) to concentrate on the more profitable insurance game.

The Aussie Dollar and Commodities

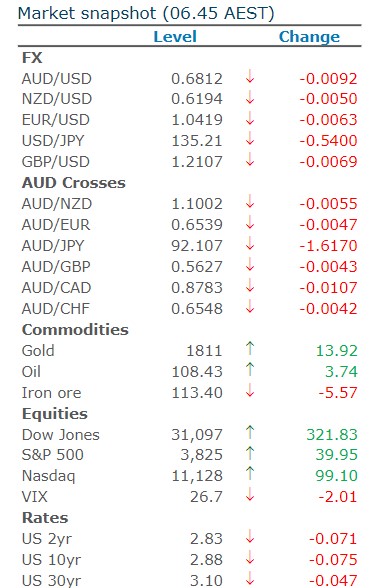

Commodities prices remain volatile – but remain high. The Aussie dollar could… or should be higher… but it is not. Why?

Well the reason is our currency is stronger – against most countries. Good time to travel to NZ, if you can get through an airport and have carry-on luggage only. But the AUD is lower when measured against the USD.

Everyone seems to want the greenback for now. The Federal Reserve is expected to hike its rates by more than us. So why hold the AUD when you could hold USD and get a better return?

So we are struggling to hold on to 68 cents at the moment. A look into 67 cents looks inevitable.

LNG prices off a bit.

A cynic would say that perhaps the OPEC oil producers are making the most of the current supply disruption to maximise profits.

They could pump 3m more barrels of oil a day to help lower prices, but seem comfortable not to do so.

Genius or bastards?

US petrol at $7 a gallon. Wonderful synergy:

Politics

Where would you start in the USA? What a complete balls up.

It may well be easy to target Labor in coming months, but so far it seems to be an offshore tour of apologies.

I remember years ago when I suggested Tony Abbot may have been the worst PM in my living memory, most told me he was “ok”, and I was being harsh. Indeed I was not knowing what was ahead. The worst PM was two away.

Recently many re-suggested I may have been too harsh on Morrison. Yet once he was rissoled so spectacularly, most now suddenly seem to agree he was crap. Even Rowan Dean, our version of Fox’s Tucker Carlson, has suggested Morrison’s legacy is a joke.

He certainly did not have that view back in 2019….or in the lead up to the 2022 election.

How much longer can the Federal Labor party live off “it is the other mob’s fault” is yet to be determined.

Also off to a rocky start with most Independents.

Housing

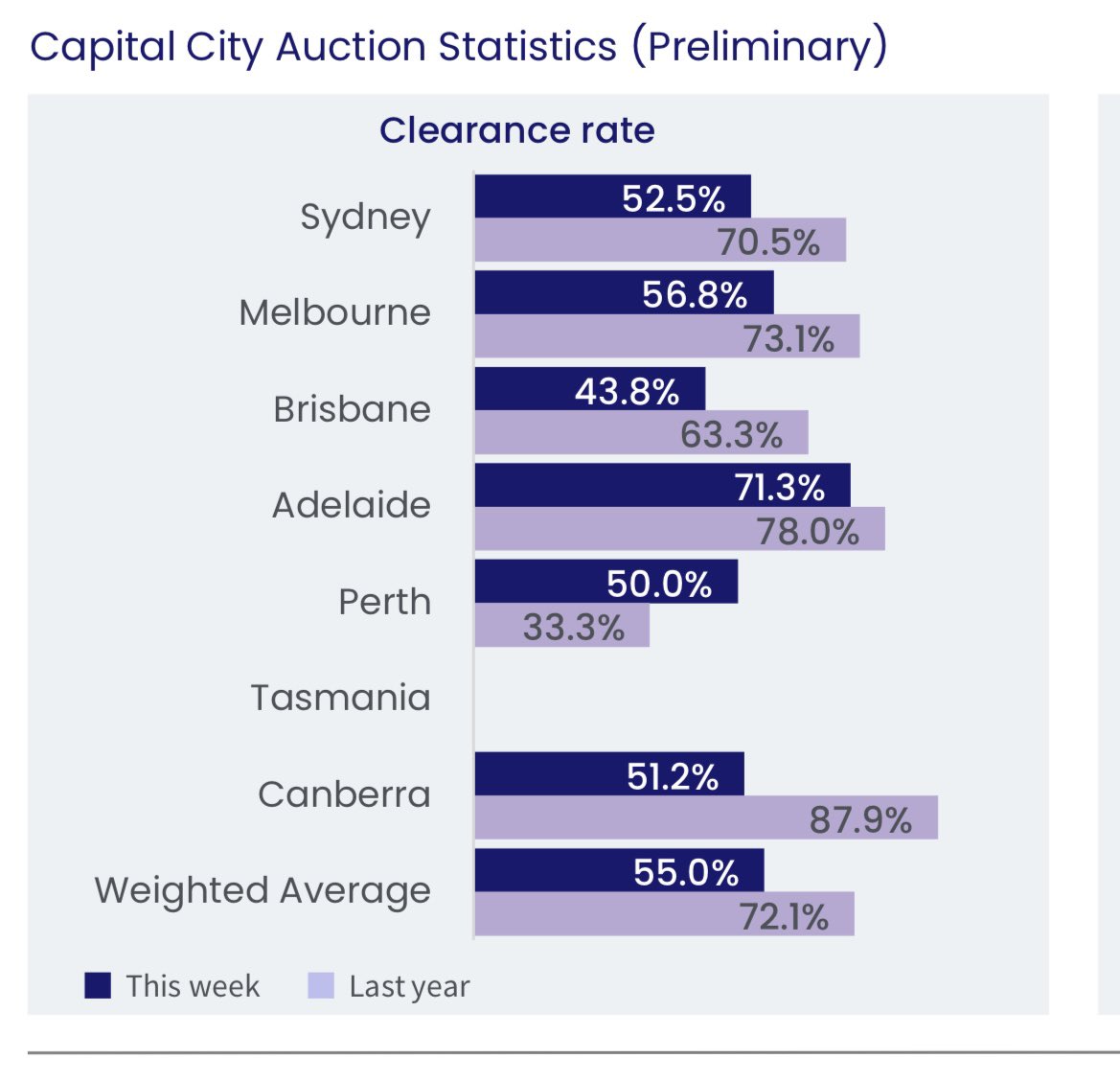

Clearance rates are falling quickly. Most sell under auction when the market is hot, and by private treaty when things are cooling;

Clearance rates falling doesn’t always mean prices are falling. But they are in most Capital cities.

Interesting chart from Morgan’s below.

The bottom quartile of housing rose by less than half of the top quartile in percentage terms. The catch up is now though, where the fibro dump is holding its value a lot more than the Chateau.

As much chance of a quick change in prices are the same as Australia’s World Cup hopes.

Crypto and Gold Land

Unlike most in the Twittersphere, I am not jumping on crypto’s grave with glee.

As a small holder, I am open to the glorious bounce back.

I just struggle to see it coming any time soon.

BTC at $2ok USD looked pretty strong support, but having broken through that, I am not sure where to next.

As you know I like correlation charts, and this one suggests some upside for BTC if Hass Avocados hold their price in the USA.

It is BTC after all – so why is that so crazy?

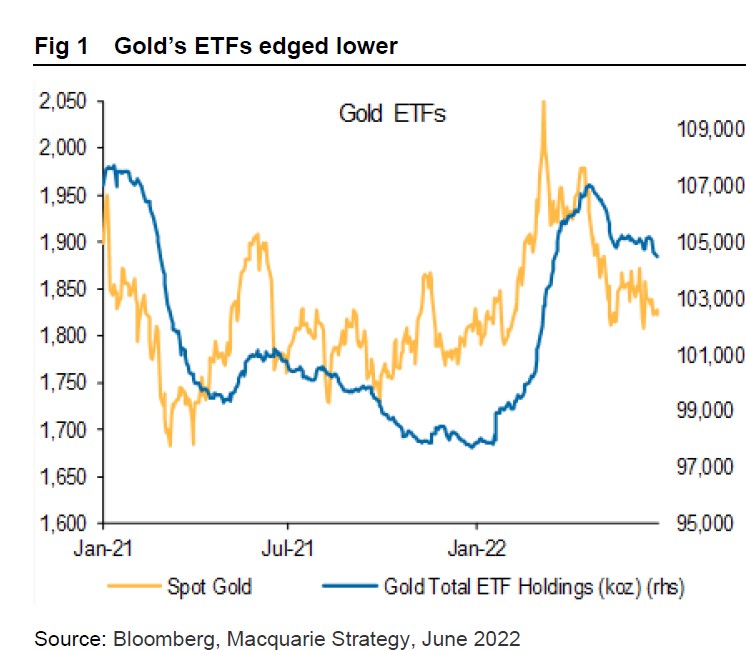

Gold is not doing well either.

A lot of selling from gold EFT’s (like I am holding).

One theory for the fall is that gold is a non yielding asset. You buy it for capital gain or comfort. As interest rates rise, the opportunity cost to hold gold goes higher. Makes some sense.

Bigger picture is maybe punters believe the US Fed will actually crush inflation quickly.

ESG and Carbon

The new Federal Government has so far acted in good faith to their carbon promise – which hopefully will give private sector players the confidence to invest in new technology and infrastructure.

More flooding in the Eastern states may also raise a bit more conversation about action or the cost of inaction.

Matt Cosplay Canavan believes that all this “woke” virtue signalling will disappear when voters realise it is costing them more in dollars from their pockets.

It is well known I think he is either a tool or a cunning liar, but he actually has some validation on this point.

A recent international research paper highlights that climate and ESG matters have fallen dramatically when other external shocks hit.

Apparently we can only save the planet when everything else is honky dory. What a strange breed we are.

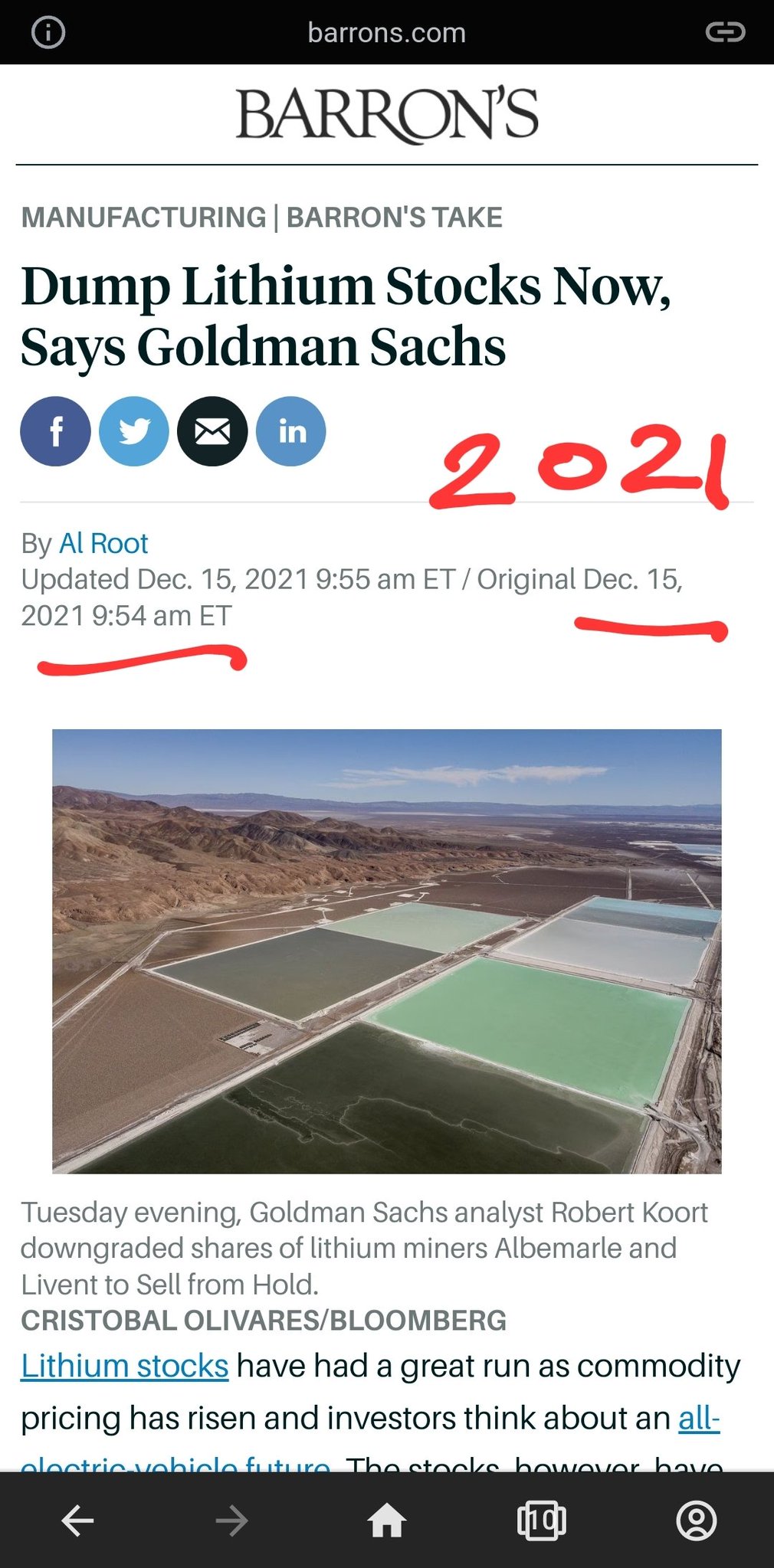

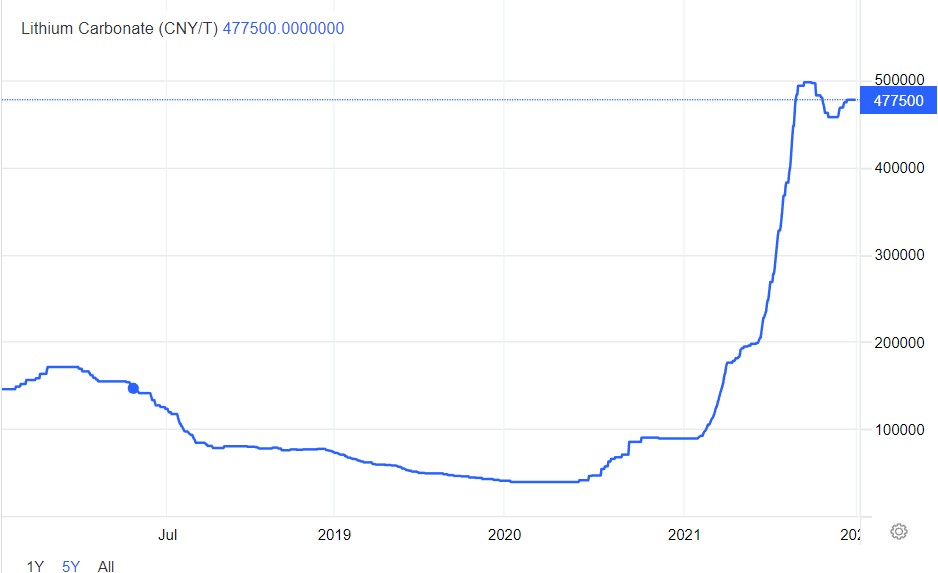

Lithium prices have been bouncing around considerably lately.

A number of research houses claim that lithium is an abundant commodity and supply will surpass demand pretty quickly… thus killing off the price rally.

I would never suggest it, but it was highlighted that the main player to make this claim also did the same in late 2021. The price of lithium has doubled since that claim.

So why would they say that? Perhaps they had not so much a “house view” as a “house position”?

Surely though, those shenanigans don’t happen in 2022…

Personal view is that demand will outstrip supply for some considerable time still. I have backed that view with additional lithium share buys.

Mind you – look up the float of Lake Resources if you want to see how NOT to float a company.

Drinking favourite…

I could be having an old age moment – have I already featured this?

I have been on McLaren Vale grenache before it became all popular.

Had the 2016 version at the local last week. Such a magnificent example of grenache – body, flavour and texture without the over powering tannins of heavier varieties.

I looked it up online and believe it or not, Dan Murphy’s are selling a carton of 6 (2017) for $150.

Forget lithium – get onto this.

9.75/10

Listening to…

This one came across my desk…:

So I had to run with it.

As a side thought I could have used the picture of Tim Smith (MP) who drunkenly drove his car into a fence in Melbourne.

Bizarrely there is also a Tim Smith Driving School…

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS