Big Picture

OK – so regularity is not Black Swan’s core strength.

Bit of festive season lethargy overlaid with rapid time slippage.

But the garden has never looked better – rather weed than write.

So what is ahead?

A bit like the reason that the NRL and AFL have not had any player/coaches for years, I reckon it is sometimes better to get the drone in the air for a distant view of the markets rather than be knee deep in trying to eek a living out of it.

So am I bullish or bearish?

Short answer remains – BOTH !

Big picture is that I flagged back in 2020 that global virtual “free” money would be inflationary. It was always just a matter of timing.

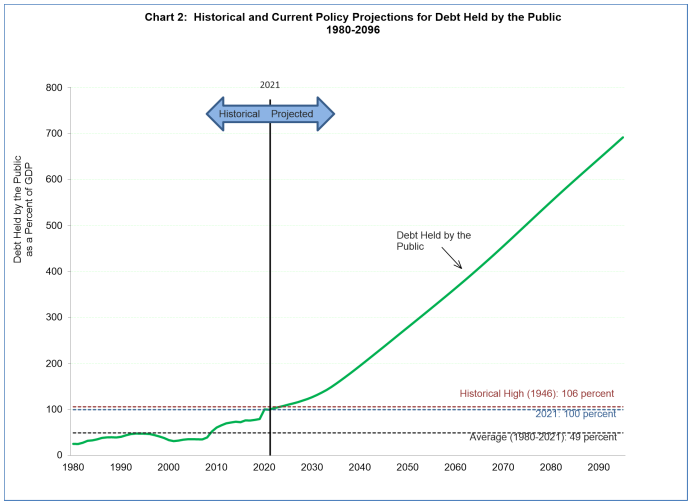

This scary chart is actually a public document released by US Treasury. Why are the cries of WTF!

So why am I currently so sanguine?

Now inflation is here, how much pain do Central Bankers want to give us to kill it? The answer seems not much. Soft landings and “pivots” are all the rage. We can manage this so no one gets hurt….

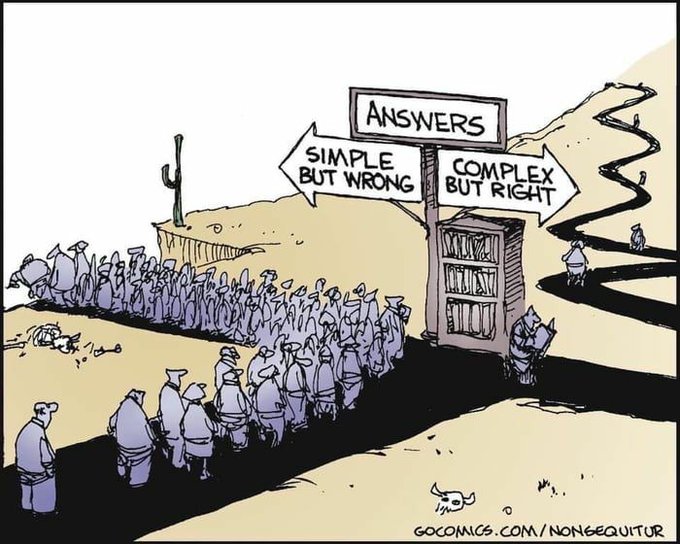

But first a quick check in on what the “experts” are predicting for 2023:

- Goldman’s: Global growth 1.8%. Issues with China reopening and European recession

- Morgan’s : Global weakness in economies but markets “ok”. Housing to recover via supply shortages

- Blackrock : Down markets and increased volatility. Sticky high inflation

- Deutsche : Opposite to Blackrock. Inflation tamed, markets up.

- HSBC : Good 2023 for Bonds (yields falling), slight fall in equities. Strong real estate.

While words from economic experts, or even Central Bankers are not enough for me to be a believer, I usually default to bond market pricing (rather than equities) for a sense of the future. Remember the Aussie bond market priced the RBA hikes in well before economic experts could see them coming.

The USA is a shambles still, but like a wounded junkyard dog, don’t under-estimate it. The Twitter castle has been reduced to a tin shed, but one chap I follow closely still is Alf from Macro Compass.

He did a report last week concentrating on the US bond market. The US is expecting their cash rate to peak at 5% by mid year. Thereafter it is pricing 200 bps of cuts by Dec 2024.

That would lead you to believe that a US (and Global?) recession is a done deal. Except that history again tells us that the FOMC cuts by at least by 350 bps in a recession.

Having said earlier that I back the bond market to be the ultimate gurus, the curve is saying the bond market believes in immaculate disinflation – a jumbo jet soft landing on 100 metres of spiked runway.

High yield credit (the junk stuff) traded at 20,000 bps in the GFC and 10,000 bps at the start of Covid. It is currently offered at 424 bps …a full 1% below the 20 year long run average.

If the shit was about to get real, you would expect this would be the canary in the coal mine.

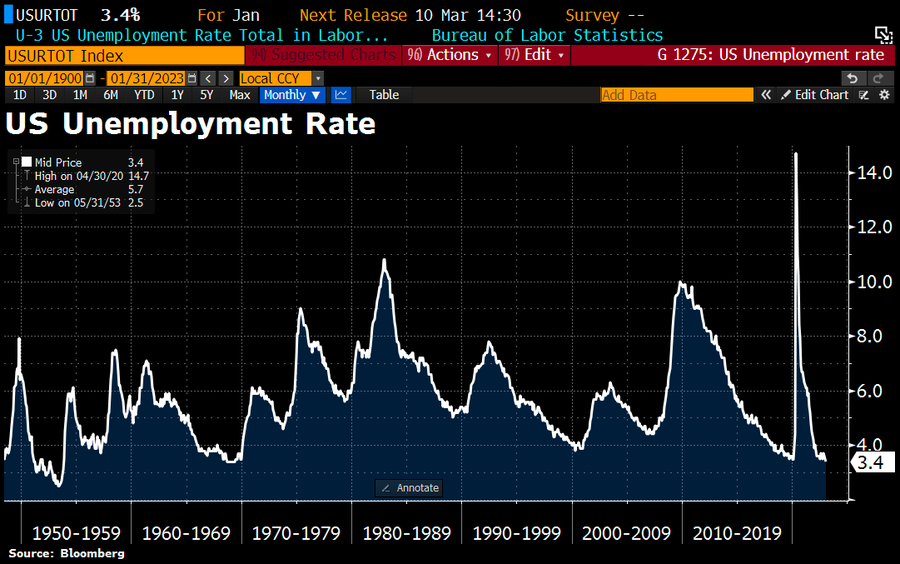

US unemployment data release last week was very strong – lowest unemployment since the 1950’s.

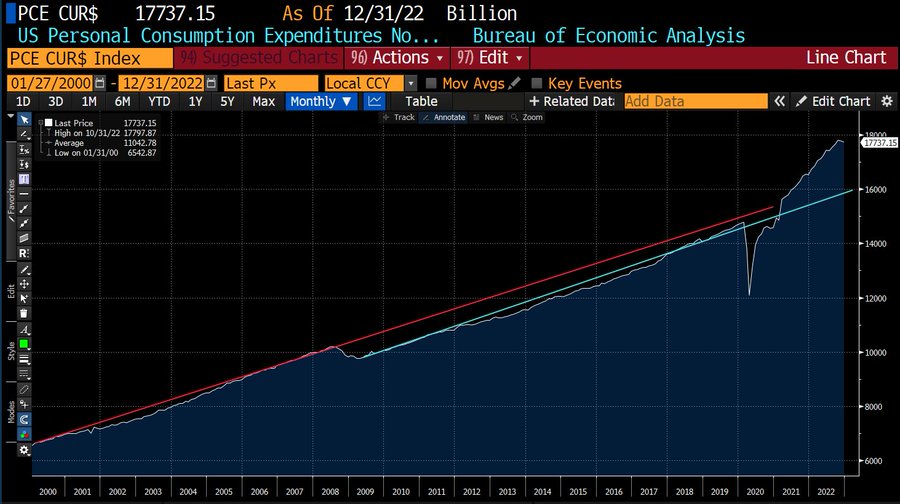

US spending is well above pre Covid levels.

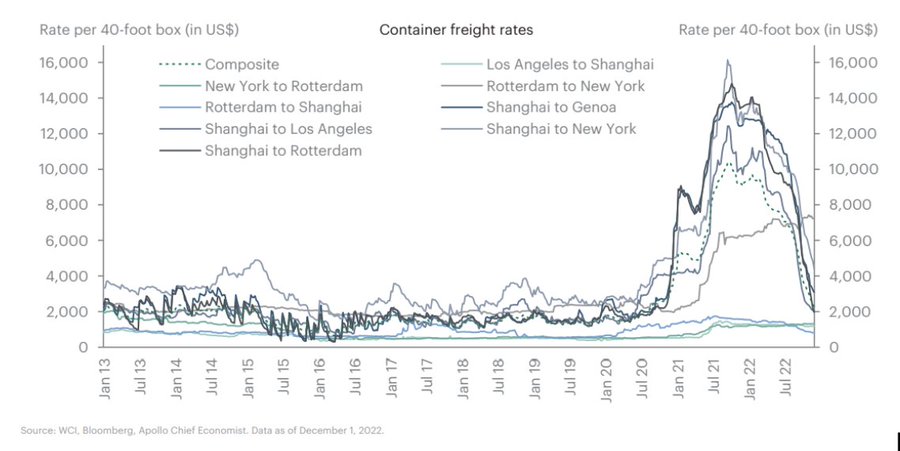

Supply bottle necks are opening rapidly – and costs are falling.

Sticking with last years Titanic theme:

For those that what to be scared though – there is plenty of fodder to feed them.

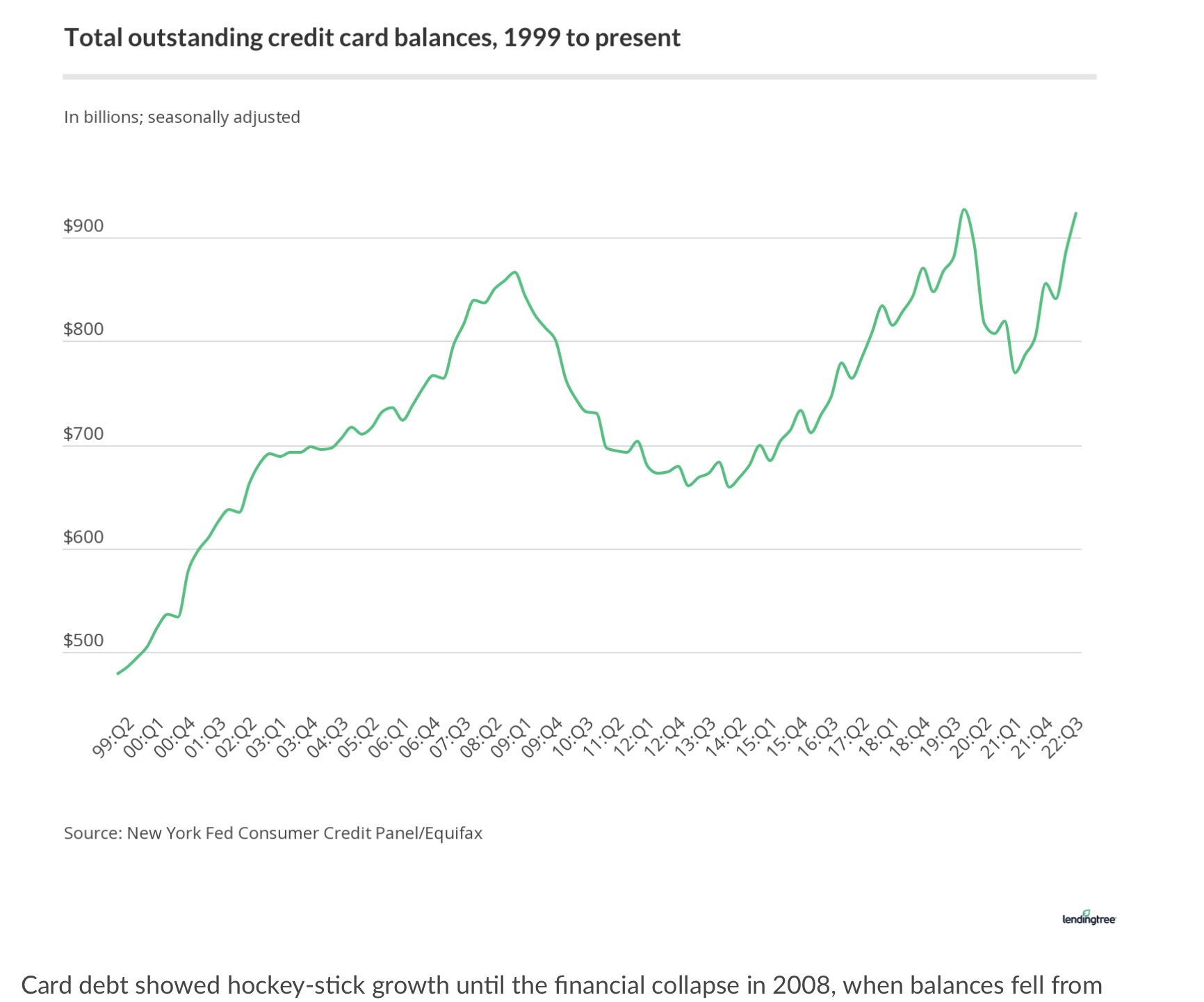

Those spending figures seem propped up by dipping into personal credit debt via the plastic fantastic.

The disinflation of the supply side might be well offset by new factors. I have a share-broker mate (retired) that believes you always need to watch copper prices to get the vibe of the world. Certainly the chart below links very closely the direction of inflation (blue) to copper prices (white). Copper does seem to “lead” in the charts. If that is the case, then either copper prices crap out very soon, or US CPI is likely to rise.

So the very resilience that gives the equity market hope (good employment, spending holding up) may be the architects of disaster. The FOMC wants to crush inflation and like the RBA it wants spending to slow and employment to be weaker. If it refuses to oblige then the FOMC may be forced to hike higher for longer and that miracle soft landing becomes a crash.

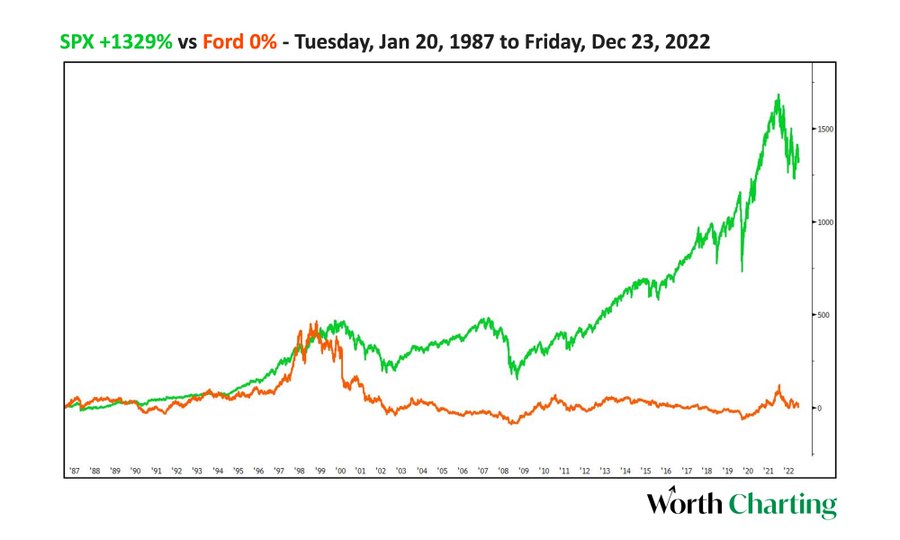

As an aside, not all US equity investments have reaped handsome returns over the last few decades: And if you follow Jim Cramer…don’t.

Domestic Duties

RBA hiked cash rates to 3.35% as expected – but some late money to “even it up” to 3.50% was out and about. I think RBA had no choice really, but there statement made it very clear that more pain ahead should be expected ” The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary.”

So maybe they should have gone whack to 3.50% with a pause ahead. Then again, I always think RBA default to the road of least resistance, where they get abused the least.

It has been said before, but economies can adapt to higher cash rates – but the pace of hikes almost always sets the scene. We have never increased rates this quickly. Bill futures are now showing peak cash rate of 4%.

See what I have done in my portfolio below to get a sense of what I’m up to.

Not advice for you, but this is what I have been doing over the last few months on my portfolio:

- Added a small amount more to my Strong Bear Fund investment (doomsday insurance) by way of dollar cost averaging down.

- Added a bit of REIT (smalls) on belief that Aussie real estate will be strong over the medium term and buying in a dip

- Added further smalls to my Lithium and Gold miners – just diversifying companies a little.

- Haven’t sold anything…except

- Sold down half chunk of a domestic and international fund I was holding – used to be circa 20% of my portfolio. Sitting in cash awaiting opportunities ahead.

Best guess it would look something like this:

- Defensive, fixed interest and cash 25%

- Aussie equities 50%

- Managed Overseas 25%

For me that feels about right.

I am thinking about putting some of that offshore sell down (in cash) back into the market, but via a different manager.

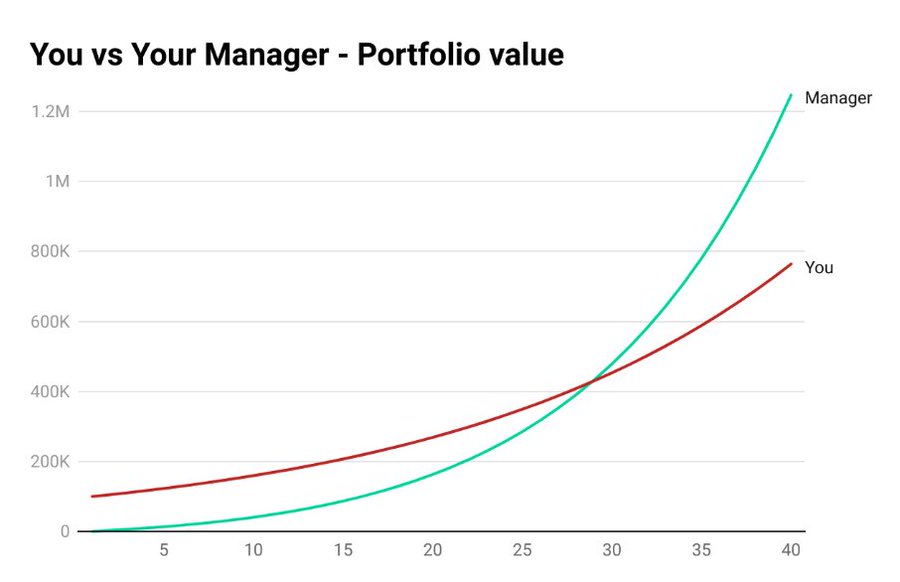

Interestingly though I read an article this week that made me think fund managers get all the joy without any real risk of pain.

The chart below assumes you, at age 25, invest $100k into a fund manager for your happy retirement days sitting on a beach.

The manager does a bloody good job and returns you an annual return of 8%.

But they take a pretty normal 1.5% management fee and a not unusual 20% performance fee.

At 65, you will have a tasty $764K to walk that beach.

But the manager will have $1.24M courtesy of your money.

Maybe instead I’ll back myself in and absorb a few losses along the way.

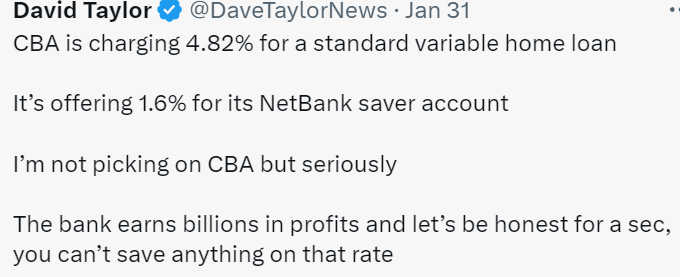

CBA data:

Banks

Lets have a quick look

Banks ticking along ok.

Stories I hear is that financial metrics are holding above budget. Macquarie Banks third quarter result was solid. Whilst cautious, bad debts remain low across all banks. This should remain the case whilst employment holds strong.

NIM’s (interest margins) are improving. This tweet covers why…

The Aussie Dollar and Commodities

Maybe sticking to the big picture. We have a belief that China “need us” and that current trade issues will blow over, and when it does the AUD will fly.

Lets check on that:

- Australia’s exports to China is 48% of our total but only 6% as a proportion of their imports.

- Australia’s imports from China is 29% of our total, but only 2% of their total exports.

Yep, they like our iron and coal, but we sometimes kid ourselves on just how much.

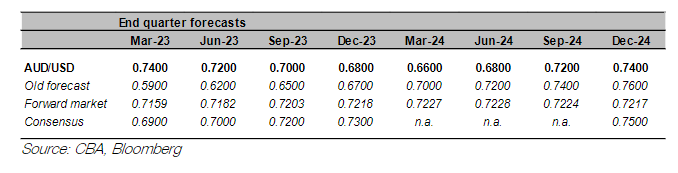

On the flip side, current smart thinking is that when (not if) the US Fed Reserve pivot and start cutting mid 2023, then the USD will tank. Thus the AUD will benefit in relativity and climb higher.

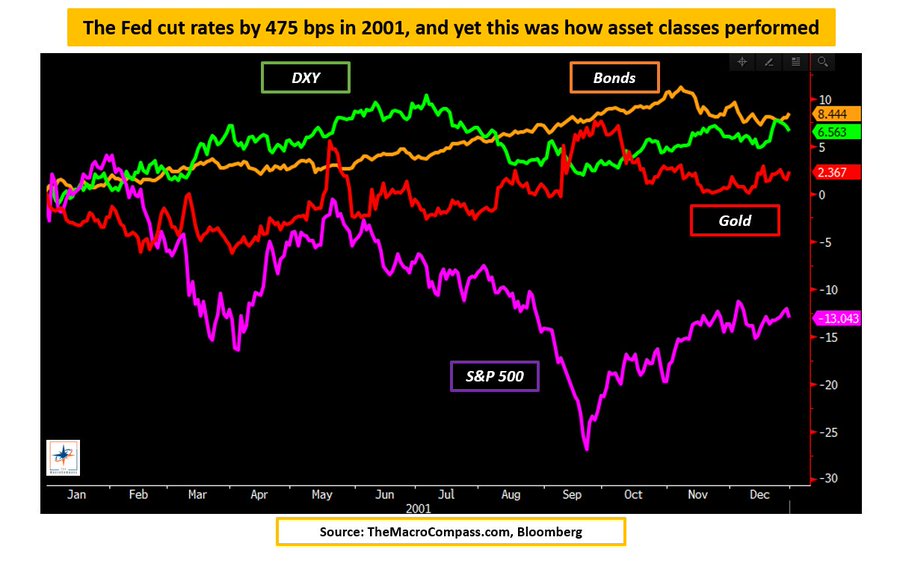

People miss history lessons though. In 2001 the FOMC cut by a whopping 475 bps, yet the USD went 8% higher over the year. Always look for the twist.

My pre Christmas call for a higher AUD was a winner. We tested into the 70 cents before a retreat back in the 69’s.

CBA updated their predictions for the AUD against the USD and the crosses. Broadly speaking they expect the Aussie higher across the board in the next few months before suffering from global slowdowns that will drag it back lower again.

A warmer European winter has been broadly good for citizens (especially Ukrainians) but has also seen oil and gas prices tumble.

Commodity markets still trying to digest if China re-opening is brilliant for prices …or not..

Politics

The US remains a squalid cesspit of lunacy. Where do you start and finish there? Human rights, increased mass shootings or civil disobedience? Trump’s legal challenges keep mounting and Biden forgot he had a garage…let alone confidential documents in it.

When the Trump NFT came out, I was certain that was a joke, but no. Sold out.

Here in Oz, you may distantly remember that late last year the worst Prime Minister in my living memory was censured for his secret Ministry affair.

A true response from him:

The biggest political football of 2023 will be The Voice. The problem however is it should not be political at all. Spud Dutton is taking the approach that confusion and muddying of the waters will help his cause. Sky News report that it has been successful and he is closing the gap as preferred PM.

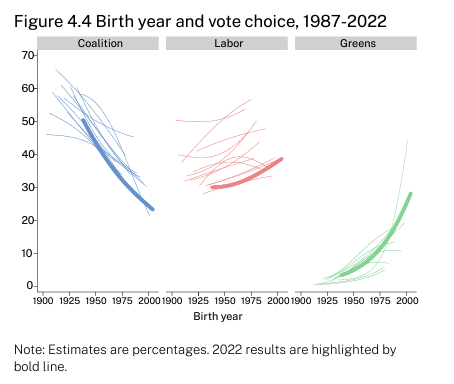

Other studies show that the voters that can make a difference aren’t the ones watching Sky News though. A recent study revealed that (not surprisingly) younger voters were trending strongly to the Greens and Labor. The Coalition base is literally dying off.

If you study the chart below it becomes unclear just how or when the Coalition can regain power. Swinging to the right like “Trump Lite” seems a doomed strategy.

The risk of course is that good government relies on good Opposition, and Labor could end up as fat and lazy as their previous incumbents.

Housing

A bit scattergun, but I wanted to cover a few really interesting charts I’ve seen recently.

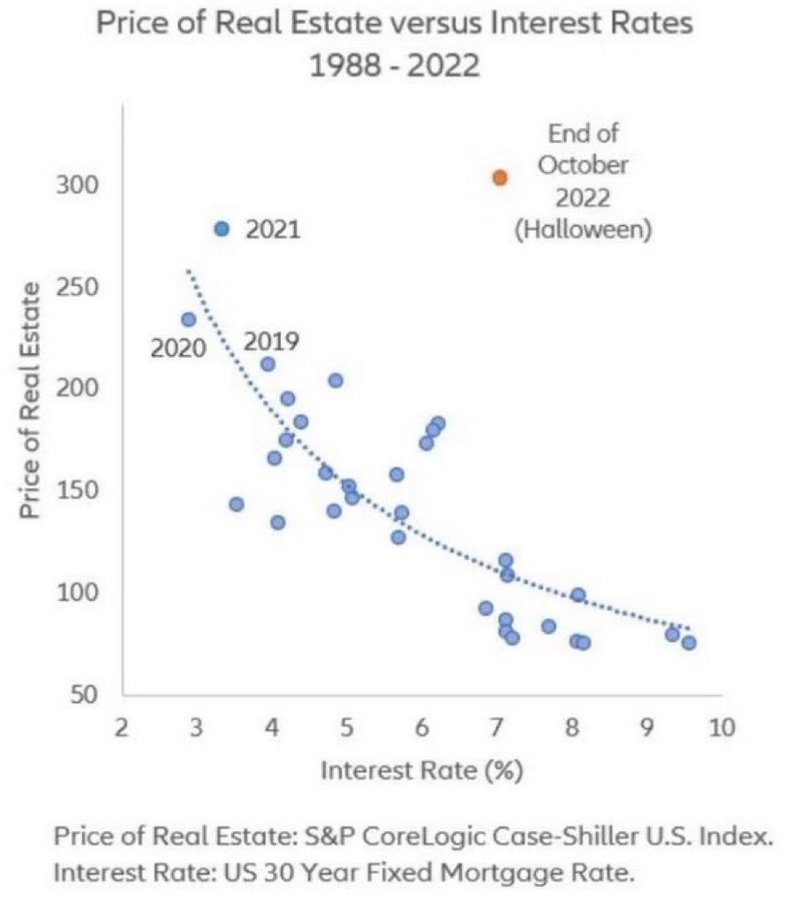

US chart on housing affordability below. Rest assured we would not be a lot different.

Housing demand is purely a function of cost, of which interest rates are THE determinate.

The US is out of whack by a long, long way. Rates, or prices need to fall quickly.

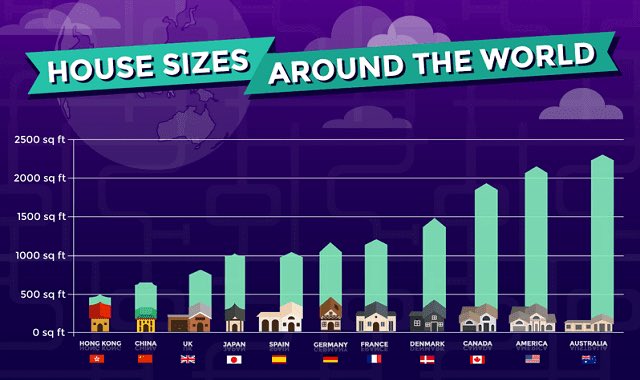

Size isn’t everything of course, but this one below shows structurally we are different. Average house size is nearly 5 times larger in Oz that HK.

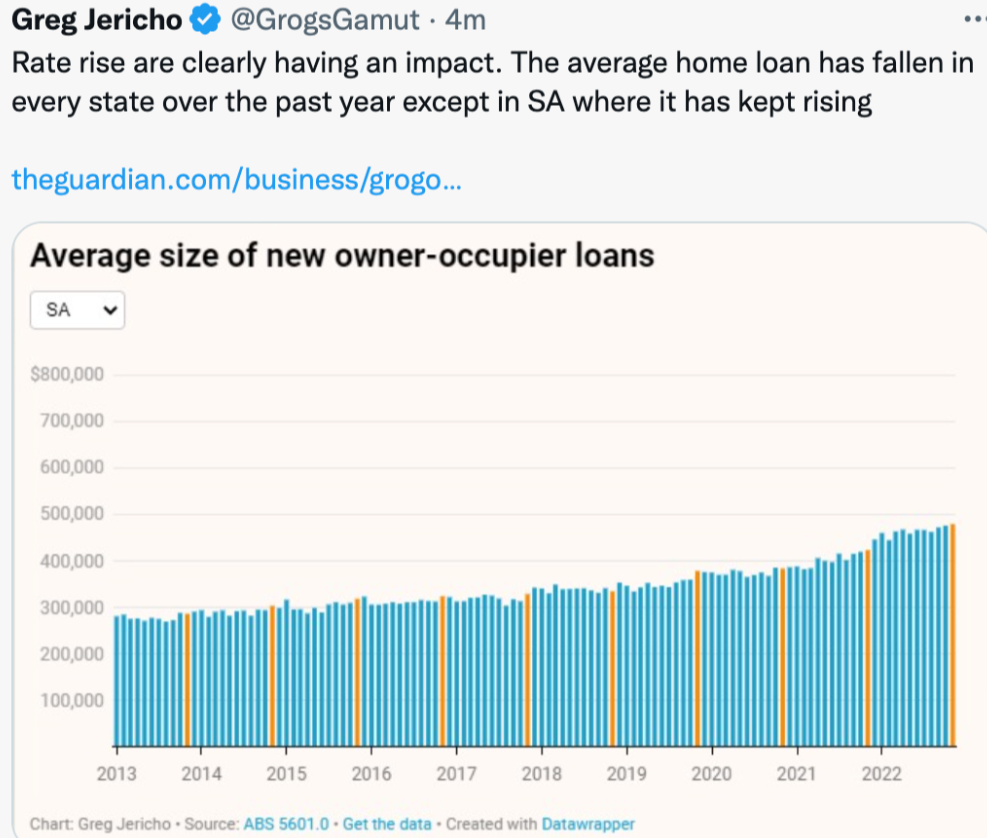

Speaking of size, Aussie house prices are falling (but still much higher than pre Covid) and the last bastions holding out against the fall were Adelaide and Darwin. Even they are now adjusting, albeit more slowly than the eastern seaboard. SA loan sizes are still moving higher which is against the grain too. I struggle to see why affordability is so massively different than in other States. Maybe gearing levels and outright housing prices are lower.

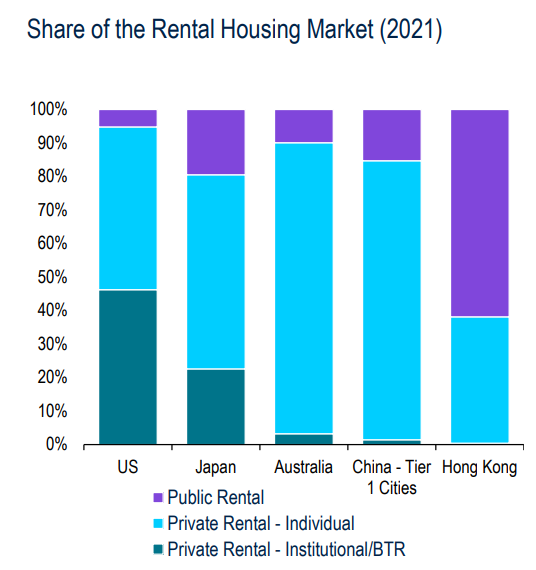

Onto the rental market, and sticking with structural differences, you can see below just how different our housing rental market is compared to overseas. We leave the bulk of the heavy lifting to be done by private investors (with attractive tax breaks) whilst others either give the big institutional players a big slice of the pie, or have government social housing as a priority. You can have your own opinion as to which model makes the most sense.

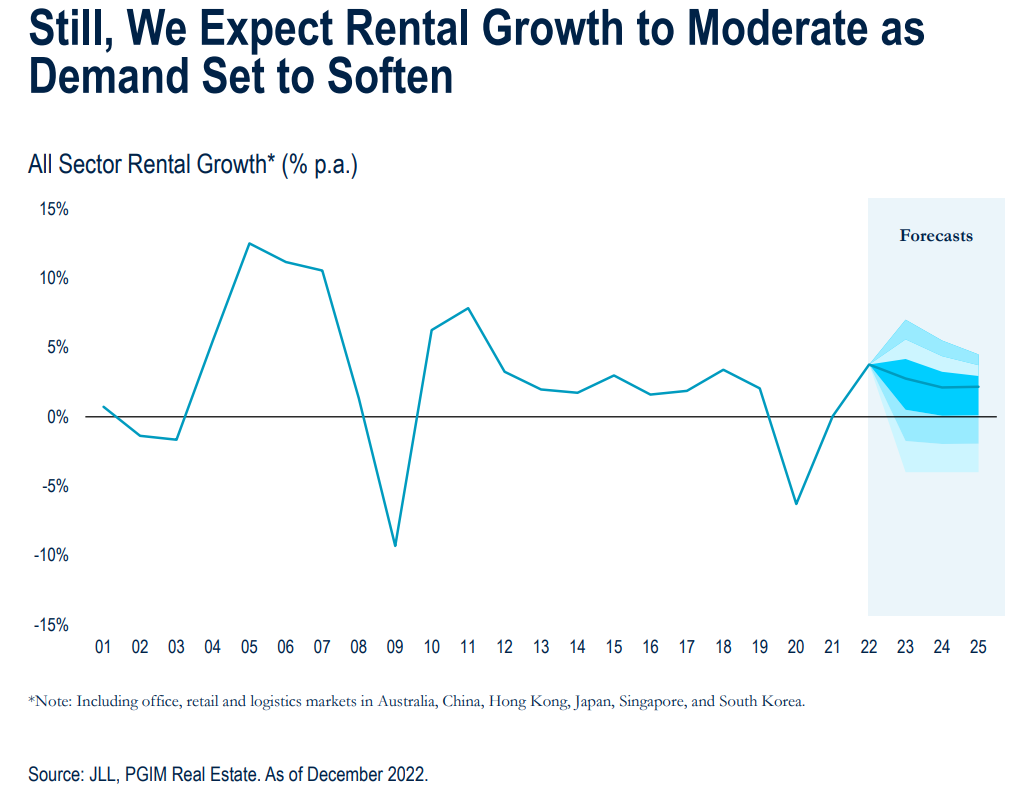

Finally an offshore report from PGIM sees the likelihood of rental price increases plateauing in late 2023 and even falling in 2024+

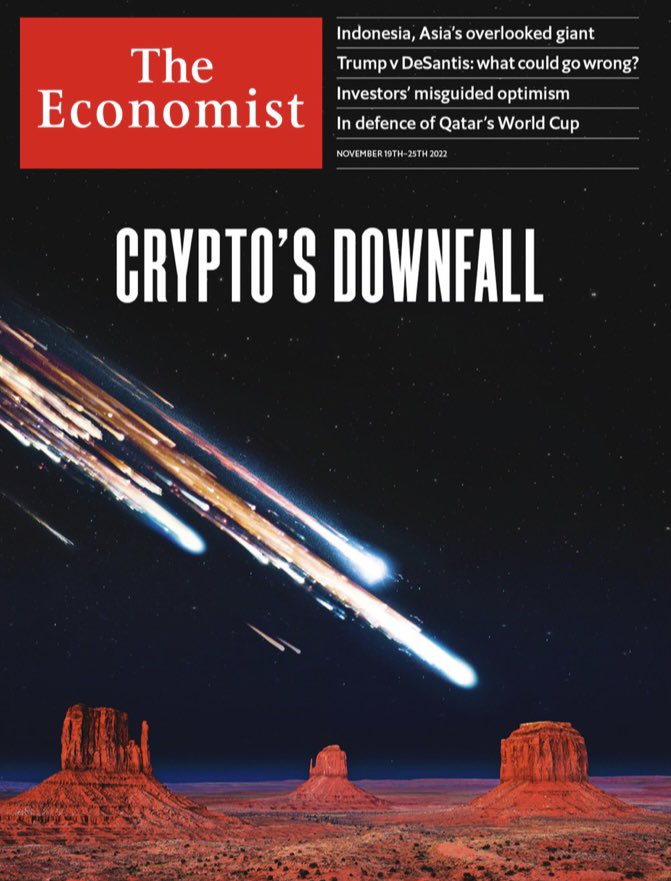

Crypto and Gold Land

Always too little too late. The Economist called the end of crypto in their November edition. A number of pundits were ready to jump on its grave.

Bitcoin is up 40% in 2023 – a tasty return for the brave.

So off to the moon again? It does seem more resilient than I had given it credit for. But I remain confused why it is pitched as a dislocator asset and a fight back against dodgy fiat currency. Especially given it’s daily movement seems to often track very closely to mainstream indicators like interest rates or equity markets.

The full impact of the FTX blow up may not yet be revealed either. The world’s largest crypto exchange Binance has announced it is suspending deposits and withdrawals of US dollars. It appears to be a result of a stoush with Binance’s banking partner Signature. Maybe nothing to see here, their token BNB is trading higher this week too.

I’m still sitting on my initial XRP investment, down 60%.

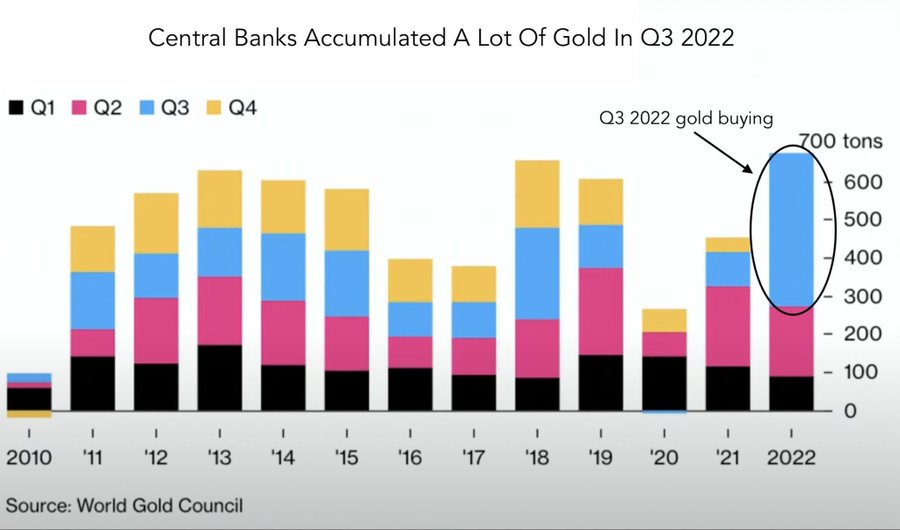

Gold has been on a flyer, and the forgotten asset seems to be somewhat reborn. If you look at the very first chart of this edition, and believe that gold is a store of wealth it makes good sense. Perhaps a case of quasi insider trading, but maybe Central Banks know that too. They have been buying gold at record levels.

Gold price went over $1,900 USD but is sitting under that this morning. Expect another kick higher if indeed the USD weakens mid year.

ESG and Carbon

I’ll finish the serious stuff with another gaggle of charts that I hope you will be modestly interested in.

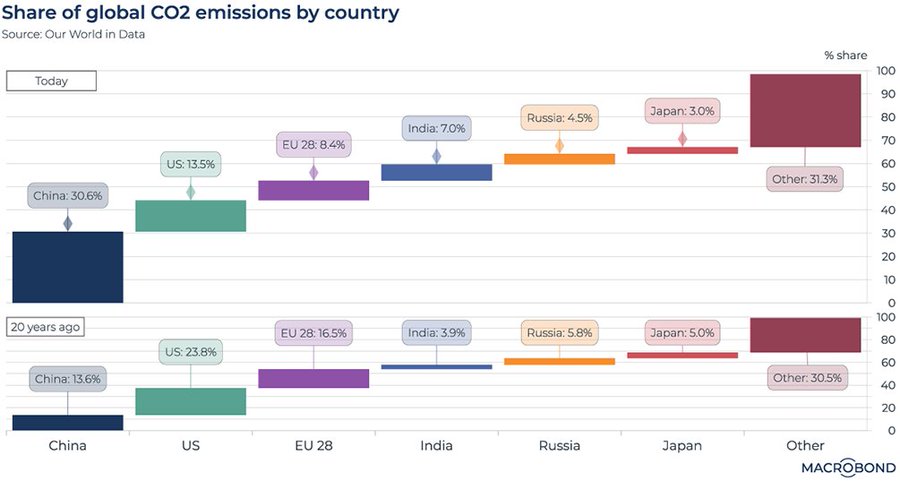

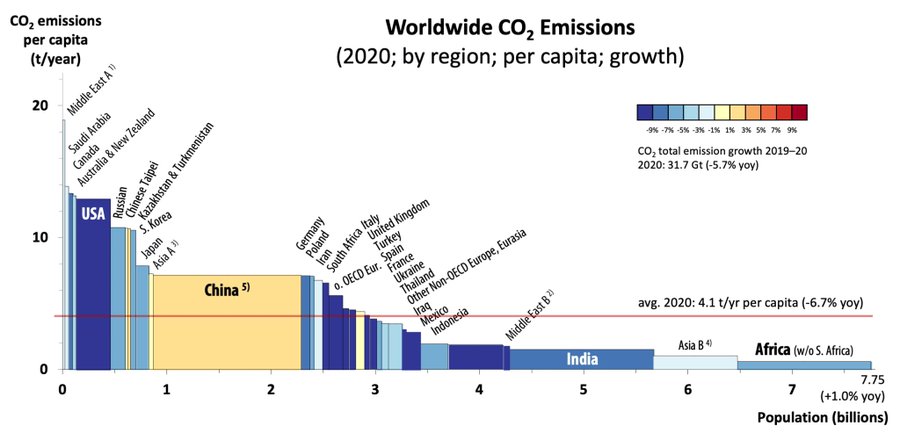

I kick off with the oft used argument that I hear for no action, namely “China pumps more CO2 into the air than the US,EU and India combined. What little old Australia does makes no difference…”

The chart above confirms that, but when you break it down to a per capita basis Australia is well in medal contention.

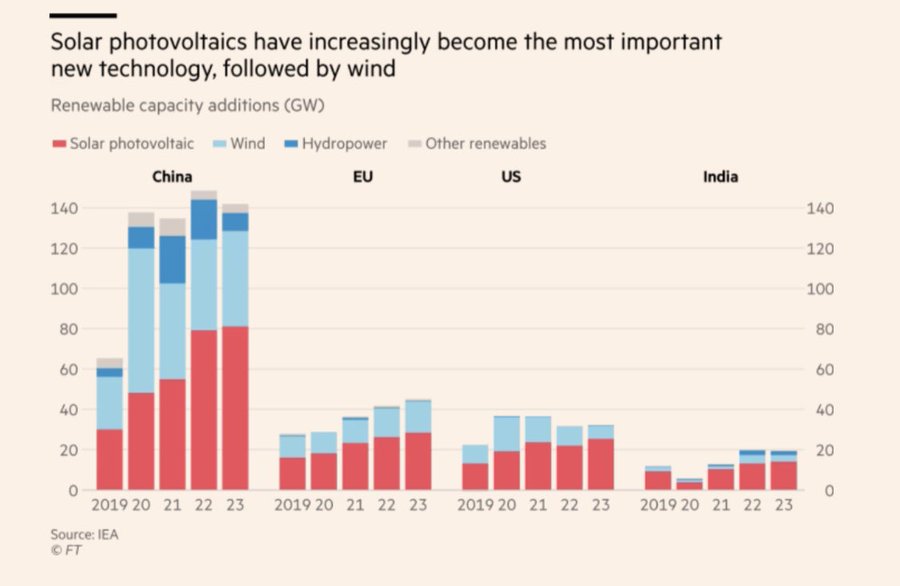

Then you need to look at what China is actually doing (rather than saying). They are not just floating balloons around the world.

To help frame the chart below, a gigawatt is enough to power three quarter of a million Western homes.

They are adding enough renewables this year to power Australia 4 times over.

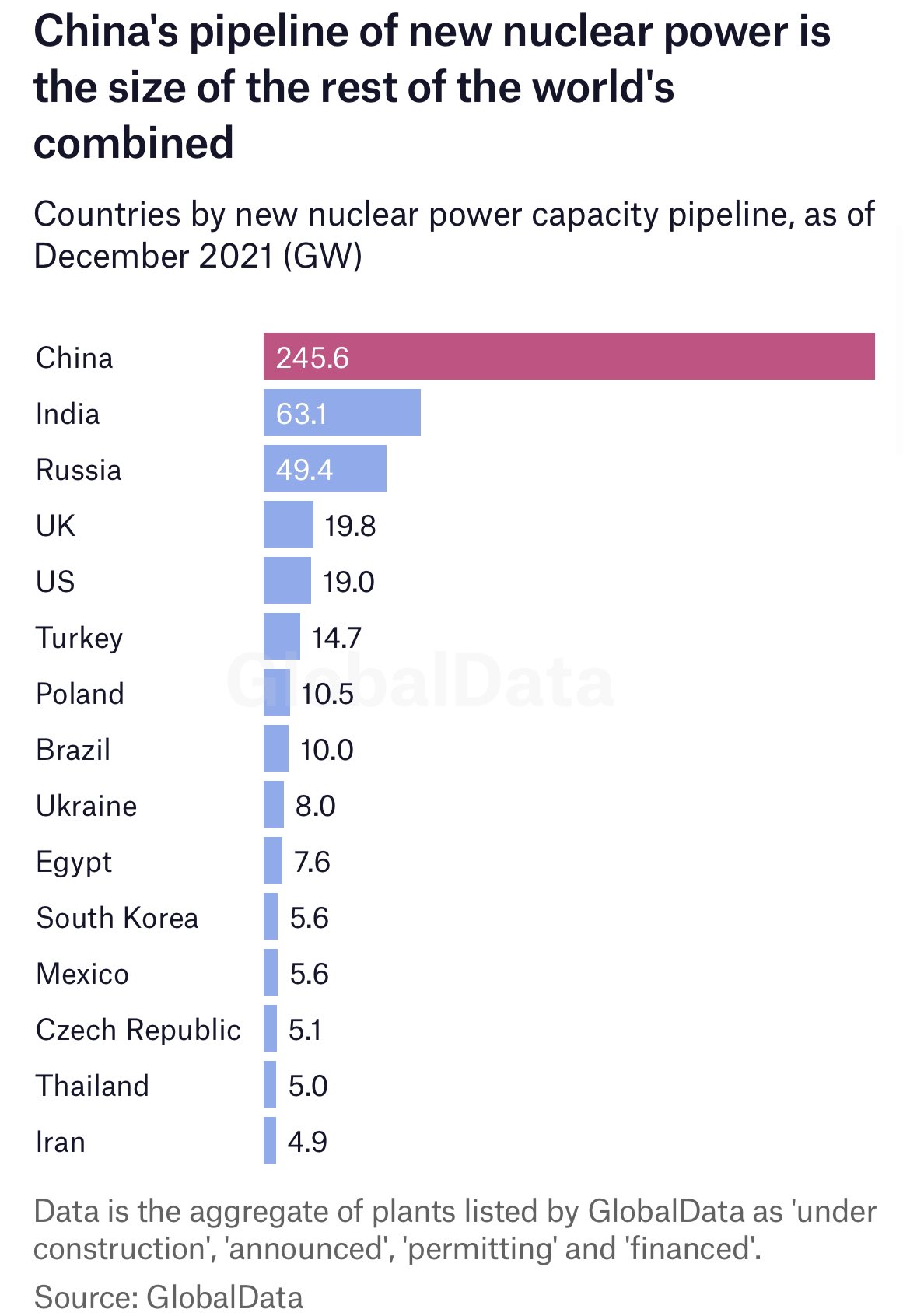

Then you add China’s nuclear power programme into the mix, which nearly doubles that again. I’ll leave the nuclear thing to you to decide.

Late last year saw COP 27 come and go. Remember? I suspect not.

As the leading body to tackle climate change it seems to be losing impetus and focus.

COP28 later this year is “hosted” by UAE – a country that earns 30% of its GDP from oil. Sultan Ahmed Al Jaber is the CEO of the UAE climate envoy. Only as pure coincidence, he is also CEO of Abu Dhabi National Oil Company. Other than being a red desert, does anyone else smells green washing here?

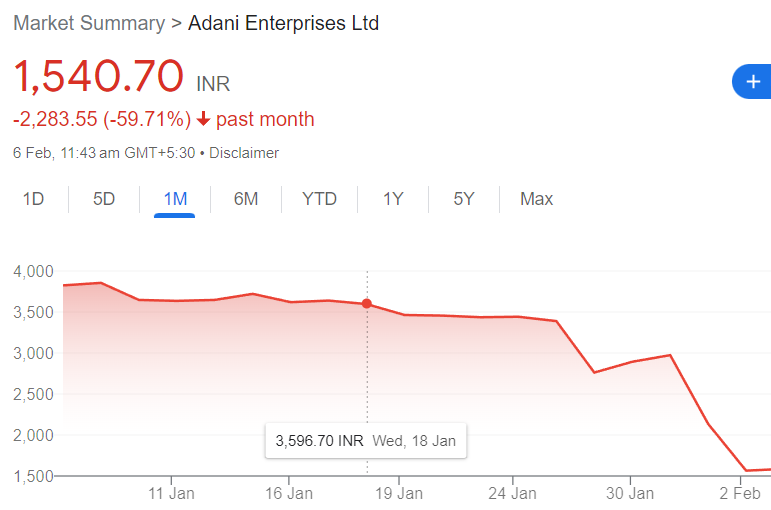

Lastly a great story of short selling being a profitable business (maybe more to come next issue), Adani is getting smashed after suggestions of corporate impropriety.

Adarni Enterprises, the owner of our own Carmichael coal venture, is down 60%.

I couldn’t do any better justice to the issue than The Betoota

S

Drinking favourite…

Black Swan’s dog is Italian but he went German beer for Christmas. He tells me it was a clean and crisp lager.

Black Swan is also doing a version of dry February. I’m finding it much harder than I suspected it would be.

The pick of my Christmas drinks though was a 1996 WA cabernet sauvignon.

I had to share it with a multitude on in-laws, so I was half hoping the 26 year old was cooked.

Unfortunately (of sorts) it was still very much lively and a reminder that aged wine has a place for our palates and we drink our wines too young. I can’t find any reviews for it, but take my word – sublime.

9.9/10

Listening to…

Stumbled across this in my Spotify. Nice beat.

Belated Happy New Year to all.

That big announcement is coming still – stay tuned…..

Feedback always appreciated…

If you want to write a piece – long or short, drop us a DM.

(written down by Black Swan)

Cheers, BS